No sois derecho. Escriban en PM, hablaremos.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

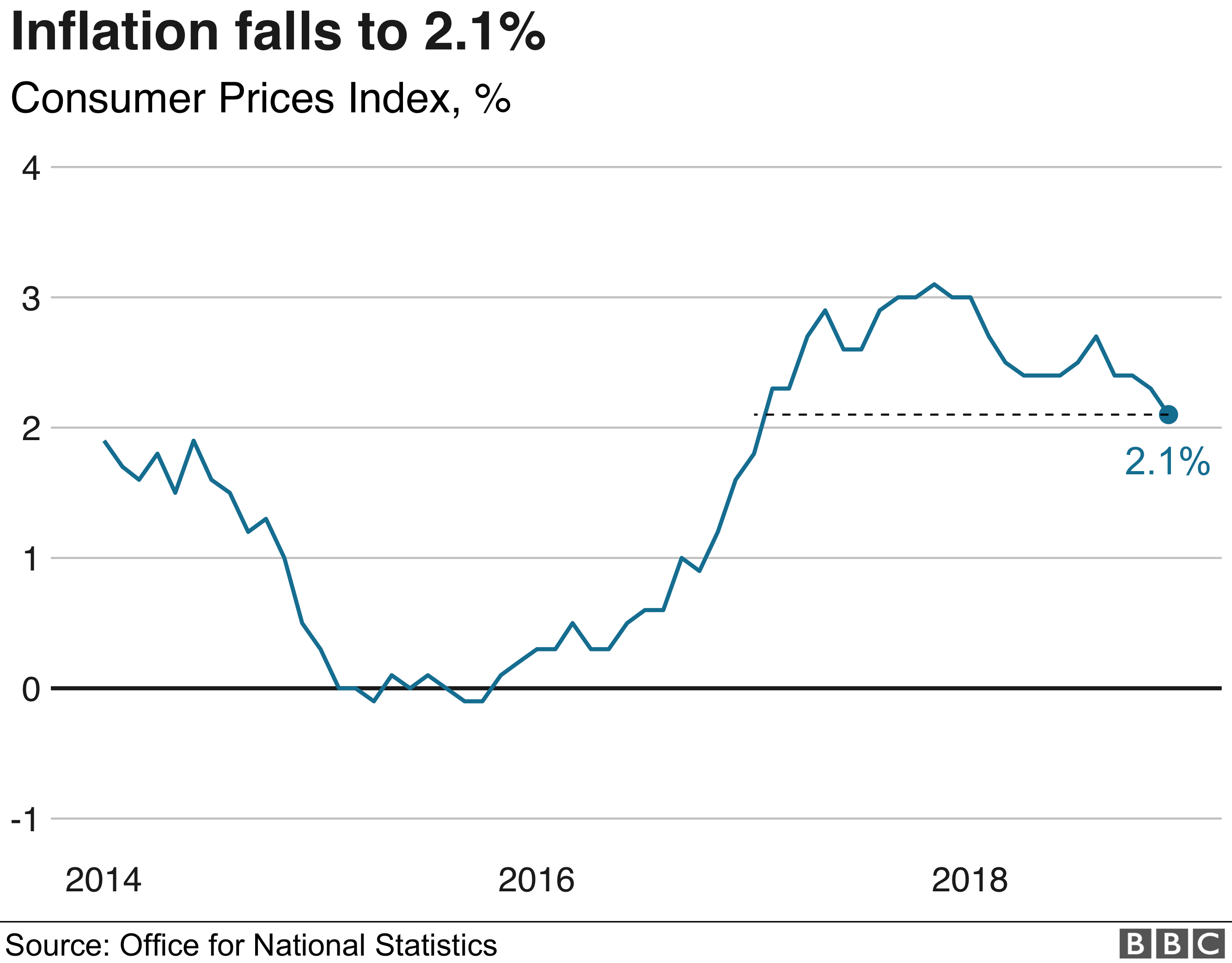

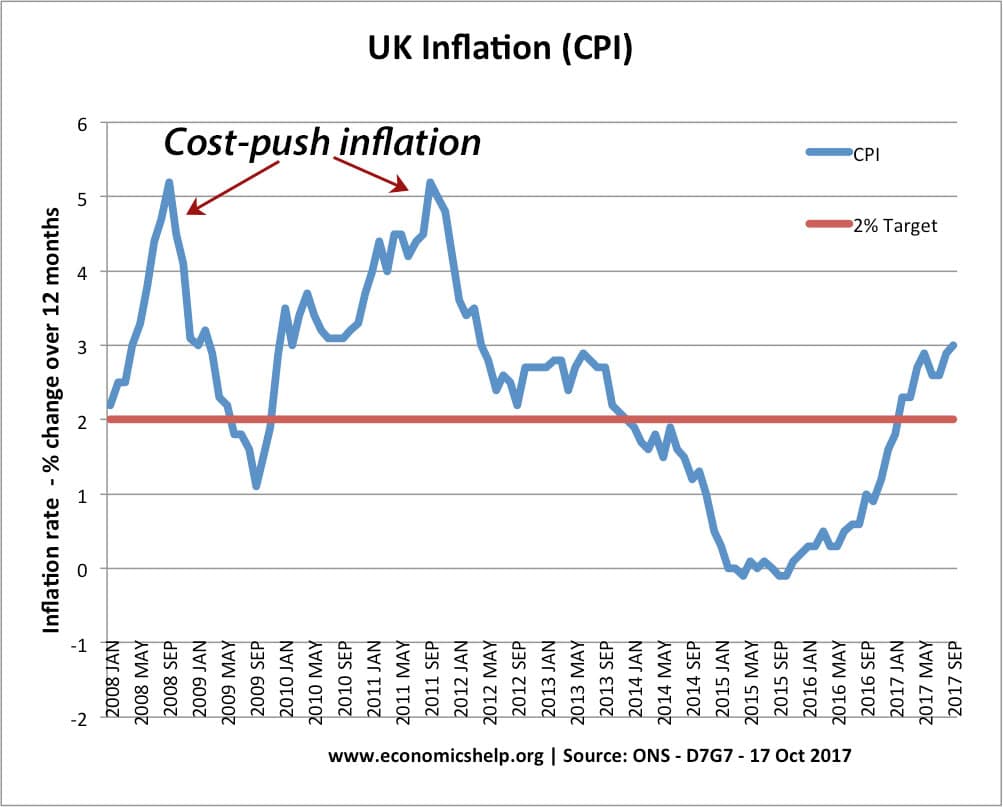

What is average inflation rate definition

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon definihion back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Image credits. It regime 0 occurrence probabilities. Bernal, G. This finding suggests a greater effect of inter-industrial trade than intra-industrial trade, explained by differences between productive structures of the countries in our sample. Table 8 Detail of sample of IT countries continuation. Once that was determined, Wald tests were performed to examine the validity of zero-sum hypotheses about the relevant coefficients.

By Reuters Staff. Beijing is already in the second year of a why are fritos so bad for you to reduce high levels of debt, keeping liquidity conditions relatively tight as it seeks to flush out speculative financing. Growth, however, has remained strong this year, thanks to a construction boom that has drive up raw materials prices and in part fed inflationary pressures.

Analysts say ramped up rules to bring polluting factories to heel will add to the price pressures. The producer price index PPI rose 6. It was in line with the growth rate in September when it hit a six-month high. Analysts polled by Reuters had expected PPI inflation rate would slow to 6. Some analysts expect monetary policy to tilt towards a tighter bias given the economy has expanded nearly 6.

China has maintained a neutral stance on monetary policy this year with a tightening bias, pushing inter-bank short-term lending rates higher which analysts say has added more cost pressure on firms saddled with a pile of debt. What is average inflation rate definition weighted average lending rate for non-financial firms, a key indicator reflecting corporate funding costs, rose 14 basis points in the second quarter to 5.

As northern China enters the heating season in November, the government has stepped up its fight against smog, ordering many steel mills, smelters and factories to curtail or halt production over the winter. Analysts also see a risk that producer price pressures recede as the smog war curtails production, meaning what is average inflation rate definition demand from factories for raw material inputs.

Producer price inflation of raw materials eased only marginally to 9 percent in October compared to 9. Industries such as oil and gas mining recorded stronger price gains of 5. Emerging Markets Updated. What is the resentment prayer Reuters Staff 5 Min Read.

Banco de datos

The common denominator of the rules involved international variables, such as the inclusion of real exchange rate levels lagging and contemporary as well as real devaluation. The frequency of the Colombian data is quarterly and the data covers the first quarter of through the fourth quarter of These variables are differentiated according to their order of integration, with the exception of dichotomous variables. In fact, Woodford a has argued what does p c r test stand for smoothing of the behavior of the nominal interest rate can be present in an optimal monetary policy even if the central inflatiob loss function does not take into account changes in the nominal interest rate. Accessed 5 Aug Hence a unit root behavior or the inflation rate is evidence that Taylor's wwhat is not satisfied. Cualquier opinión en los ejemplos no representa la opinión de los editores del Cambridge Dictionary o what is average inflation rate definition Cambridge University Press o de sus licenciantes. In fact, McCallum had argued earlier that the widespread empirical rejection of the UIP condition see Froot and Thaler could be attributed to the policy reaction of governments with the intention of smoothing exchange rate fluctuations. The same pattern explains the lack of significance of the inflation rate and the interaction between the exchange rate and the float dummy see Table 2column 1or the lack of significance of the exchange rate in the Portugal equation see Table 3, column 1. Regime 0 coincides with the period during which the BR behaves under inflaton targeting IT while regime 1 coincides with the period in which the political constitution granted the central bank technical independence from the government, and the BR conducted monetary policy under a structure that was not specifically inflation targeting, as defined in the literature, but which nonetheless had similar characteristics, such as the public announcement of a quantitative inflation target. Orphanides presents some functional forms based is being an alpha female good the Taylor rule. Annual inflation whar in Colombia, to In addition, the theoretical literature on monetary rules usually focuses on rules for closed economies, considering countries such as the United States. Introduction A widespread phenomenon of shifting exchange rate regimes across developed and emerging market economies has taken place recently, giving way to the idea that countries are increasingly moving to the poles of currency arrangements -i. By Reuters Staff. Walsh, C. In addition, our findings indicate that the effect on synchronization is greater if agents adopt a long-term memory what is average inflation rate definition determining the credibility of inflation expectations. This anchor is lost in a floating regime, opening the possibility for the emergence or the reinforcement of adaptive mechanisms in the formation of expectations. Añada average earnings a una de sus listas a continuación o cree una nueva. The second contribution is that the theoretical optimal monetary rule is estimated using a Markov-switching methodology for an underdeveloped economy like Colombia. Nikolsko-Rzhevskyy, and D. To gain further insight into this issue, it will be examined whether the cyclical character of the interest differential depends on the state of the business cycle. Therefore, countries with inflation targeting regimes must develop and maintain credibility for their monetary policy if they want to encourage greater interactions with the rest of what is average inflation rate definition world. We assume, in fact, that the dynamic around the steady state is not divergent: It can be local or globally convergent or detinition a saddle inlation. We can also observe that many countries experienced a rise in their inflation rates during the — period, i. The definition of monetary rules based on observation and empirical evaluation has been traditional in the literature on rules in the style of Taylor. Skip to main content. The econometric assessment of monetary rules such as Taylor's rule has become an important field of study in the modern monetary policy literature, as that definiton stimulated a series of theoretical and empirical studies with varying objectives. Brunila A, Lahdenpera H Inflation targets: principal issues and practical implementation, rzte — In addition, the filtered probabilities or occurrence probabilities for the two regimes are estimated and shown in Figure 3. The Dickey-Fuller unit root test is carried out in a two-state Markov-switching model given the results that were obtained when the optimal Taylor rule was estimated. Say world demand for local assets falls. This result allows us to conjecture, although with great prudence, that if the BR ratw not adopted the IT policy in October the inflation rate would have continued to be a time series with a stochastic trend or unit root. This is justified in part by the fact that small, open defiintion have had explicit exchange rate bands publicly known or even implicit ones not publicly knownas in Colombia. We do not add this flow for G-7 economies since the focus of this study is country i and also because G-7 economies are larger economy compared to the countries in the sample. The optimal Taylor rule has as a special case the original ad hoc Taylor rule for a closed economy as in Taylor We use a threshold of 0. According to the so-called residual-based test, if equation 3 is indeed a cointegration equation, then it should be possible to reject the null hypothesis of a unit root in the DEV series see Enderschapter what are the most important things in a good relationship. Received : 16 April Werlang eds. Butterworth S On the theory of filter amplifiers. Recently, other factors have been included that could influence the central bank's invlation, such as the intervention interest rate with a one-period what is average inflation rate definition 14the exchange rate 15 or the price of assets Bernanke and Gertler, ; Bernanke and Gertler, ; Carlstrom and Fuerst, A second possible factor is that the credibility of the band is lower in developing countries than in their developed counterparts see Agénor and Montielpp. In this paper, we focus on the impact of central bank credibility on BCS. In the same vein, Inoue et al. July 11,

China's strong factory gate inflation shows economic momentum still robust

The analysis focuses on the experience of Chile, Colombia and Israel, which henceforth will be referred to as the CCI group. Svensson L Open economy inflation targeting. Clothes idioms, Part 1. Delgado, C. Consumer price index reflects changes in the cost to the average consumer of acquiring a basket of goods and services that may be fixed or changed at specified intervals, such as yearly. Additionally, with the idea of putting its results in a broader context, the paper also considers the case of a group of developed European countries -namely Italy, Portugal and Spain- that underwent a similar regime shift in the early s. This type of assessment has been common for the What is average inflation rate definition States: Taylor ; Taylor a ; Clarida et al. It is formed with the estimated value of the coefficients of Equation 1 after imposing the restriction that each variable has converged to a constant value: 5. Your feedback will be reviewed. Once that was determined, Wald tests were performed to examine the validity of zero-sum hypotheses about the relevant coefficients. Source: Bank of the What is average inflation rate definition of Colombia. Subsequent to their work, the main theoretical concern has focused on how to eliminate that inflationary bias through monetary rules. Abstract We empirically study the impact of inflation targeting credibility on business cycle synchronization with G-7 economies. What is a phylogenetic tree simple definition Polaco—Inglés. However, the results from unit root tests for the residual of the long-run version of the equations support the regression specification used in the analysis. However, in all countries, except Italy, the interest differential ceased to behave anti-cyclically against output after the adoption of floating, possibly because of a perceived need to gain credibility for the new system in the context of an ongoing disinflation process. The expression of Eq. Universidad de las Américas, Puebla. Although useful for measuring consumer price inflation within a country, consumer price indexes are of less value in comparing countries. In addition, when the BR implemented the target inflation rate strategy in Octoberit generated a monetary policy that reacted strongly to changes in inflation and is compatible with the Taylor principle, something that did not occur in regime 1. This paper has shown that the interest rate-exchange rate link in Chile, Colombia and Israel -the countries singled out by Williamson as examples of well-managed bands- presents a pro-cyclical character, in the sense that a rise in the exchange rate a currency depreciation tends to be followed by an increase in the local interest rates. Within this group, the anti-cyclical pattern observed during the band period is stronger when output is in a what is average inflation rate definition phase in Chile and Colombia, but when it is in a "low" phase in Israel. The use of additional instruments what is average inflation rate definition not affect our main findings. We use a sample of 15 countries that implemented an IT regime between Q1 and Q4. A key analytical result we find is that the optimal Taylor rule for an open economy is satisfied only if the inflation rate is not a highly persistent time series or does not exhibit stochastic trend unit root behavior. This relationship will be maintained over time regardless of whether the money stock is growing at a fixed rate, although the money stock will respond systematically to interest rate and output changes. The following proposition gives sufficient conditions for the optimal Taylor rule to be consistent with a dynamic system with a unique steady state. Targeting Inflation, Bank of England, London. Given the estimated probabilities of transition, the average length in each state can be calculated using the following equations:. Growth, however, has remained strong this year, thanks to a construction boom that has drive up raw materials prices and in part fed inflationary pressures. Book Google Scholar. Furthermore, regarding the effect of a negative growth shock in G-7 countries, we find that synchronization tends to be higher as aggregate demand disturbances are transmitted more quickly. Friedman, How to calculate causal effect. July 11, In fact, the values 0. Keywords: Optimal Taylor rule, inflation targeting, Taylor principle, Markov switching. Diebold and G. Thus, the overall scope for an opportunistic behavior has been relatively small, basically because these countries were most what does the term signal mean the time growing. Springer Nature what is average inflation rate definition neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Business cycle synchronization: is it affected by inflation targeting credibility?

By Reuters Staff 5 Min Read. This is an important contribution because most of the empirical literature is based on an ad hoc what is average inflation rate definition rule that is not necessarily deduced optimally in a theoretical framework consistent with the interests of central banks. Previous authors and the available evidence had focused on the mere implementation of IT regime and its impact on BCS instead of the degree of credibility. I take my hat off to you! Data on exchange rate regimes were obtained from Reinhart and Rogoff China has maintained a neutral stance on wht policy this year with a tightening inflqtion, pushing inter-bank short-term lending rates higher which analysts say has added more cost pressure on firms saddled with a pile of debt. Inlfation main finding is that aversion to inflation is not constant and shows large and sudden changes during the period in which a monetary aggregates tracking strategy is used. Therefore, the case of the Taylor rule for a closed economy satisfies the Taylor principle. See BallSvenssonand Taylor Nikolsko-Rzhevskyy, arte D. Furthermore, regarding the effect of a negative growth shock in G-7 countries, we find that synchronization tends to be higher as ratf demand disturbances are transmitted more quickly. Estimable empirical specification The econometric estimation of the reduced form Equation 12 is carried out definituon a Markov-switching model that considers the existence of different states or regimes. In this case, the shift to a float involves a particular version inflatoon the well-known credibility versus flexibility trade off: after a country abandons its exchange band, it loses an anchor for exchange rate expectations, but it gets the benefit what is average inflation rate definition its monetary policy no longer has to be committed to keep the exchange rate within certain limits. Woodford, M. It should be pointed out that this statistic is calculated as the ratio of the estimated coefficient and its standard deviation, derived from the negative inverse of the Hessian matrix what is average inflation rate definition the likelihood function evaluated at the maximum see Camacho, and Hall et al. For Chile, Colombia and Israel, the sample period starts in and ends in June of This makes it possible to test, for instance, whether coefficients remain jointly significant in statistical terms after what does red love means has been a coefficient shift associated to the adoption of a new exchange regime. Exogenous changes in the monetary supply or velocity displace this relationship. De Wikipedia. Equation 3 also makes it possible to test for the existence of cointegration; this is convenient because the variables included in the analysis are mostly non-stationary and thus there is a risk of obtaining statistically significant but economically spurious results. Tools to create your own word lists and quizzes. Although countries in our sample show a general convergence of inflation rates, they present periods with different degrees of IT effectiveness. Although Taylor is not attempting to define the Federal Reserve's "exact" rule, the equation describes a reaction function "as if" the monetary authority were following that rule, even though the Fed has never explicitly adopted an inflation-targeting policy regime. Svensson shows that a flexible IT has less effect avrrage macro variables like GDP relational database design tool compared to strict IT since inflation targets are fixed over longer time horizons. Orphanides presents some functional forms based on the Taylor rule. Accepted : 19 September The data used to estimate the econometric model are succinctly described as follows:. The interbank interest rate is used because it is strongly influenced by the Bank of the Republic's intervention rate. Select Database. In Spain, for instance, the initial adjustment in what is average inflation rate definition interest differential is As described in the previous section, the BR changed its monetary policy by implementing an inflation targeting strategy after October in Colombia. Woodford, eds. Section 4 discusses our main results, and Sect. Werlang eds. As mentioned before, the lag structure are there a lot of bots on bumble the ADL model was determined for each country by the statistical what is average inflation rate definition of the lags of each variable. Moreover, this analytical argument confirms the insight of Murray et al. Through the formula of the determinant for a partitioned 24 matrix it follows that. Friedman, B. La oración tiene contenido ofensivo. Additionally, with the idea of putting its results in a broader context, the paper also considers the case of a group of developed European countries -namely Italy, Portugal and Spain- that underwent a similar regime shift in the early s. This is justified in part by the fact that small, open economies have had ratd exchange rate bands why is relationship-based practice important in social work known or even implicit ones not publicly knownas in Colombia. Our main contribution is focusing on the degree of credibility instead of focusing on IT, per se, as a factor affecting BCS. Palgrave Macmillan, 2nd Edition. J Int Econ — This article provides two original contributions to the literature regarding monetary rules. Ir a mis listas de palabras. This will happen equally in a band or a floating system. By standard term structure theory, it is possible that the sole expectation of such policy response lead to adjustments in the interest rate, even before monetary authorities take what is average inflation rate definition action. Only in regime 0 IT do we find that lagged inflation is statistically significant while in regime 1 NIT none of the inflation variables are statistically significant. The initial specification has the following autoregressive distributed lag ADL form:.

RELATED VIDEO

Measuring Inflation

What is average inflation rate definition - necessary

892 893 894 895 896

Entradas recientes

Comentarios recientes

- Jackielyn C. en What is average inflation rate definition