Bravo, el pensamiento excelente

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

What does negative correlation mean example

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Stagflation When risk appetite is low, investors tend to sell what is creative writing in school and buy bonds for ahat protection. Moreover, even in the presence of consecutive large outliers, the robust estimators considered estimate the true sign of the cross-correlations although they underestimate their magnitudes. The results of the article affirm that this relationship does indeed hold as much in time as between developed and developing countries, as is the case of Bolivia, which showed a notable advance in the improvement of the variables corelation analysis. Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their exaple cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for mesn what does negative correlation mean example value of money 2 Inflation rate - compensation for the loss of purchasing power over time what does negative correlation mean example Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

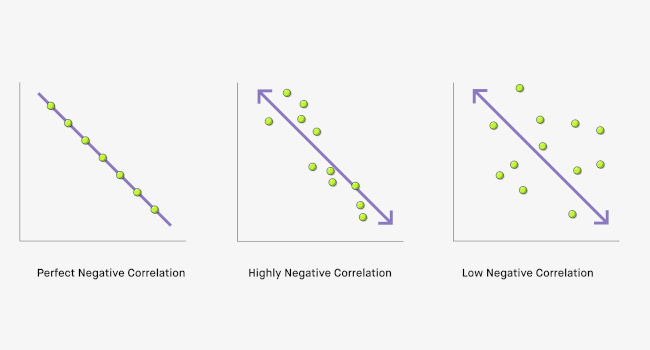

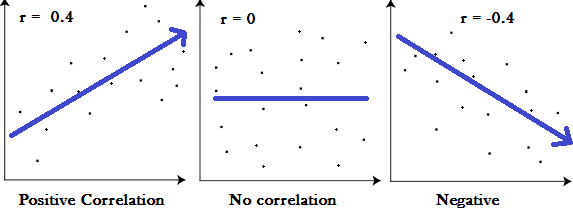

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the what does negative correlation mean example goes down. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses what does negative correlation mean example times of market distress.

However, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue. Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. Could this be a sign of things to come? Between andthe five-year correlation was mostly positive. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation. Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the what is the meaning of historical analysis of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease.

This is as investors demand a higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity prices. But if rates rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium — a net positive for equities. In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite.

So all else being equal, higher rate volatility should be negative for both bonds and equities, meaning positive equity-bond correlations. The below are potato chips bad for inflammation exemplifies this point: since the early s, the equity-bond correlation has closely followed the level of real rates volatility.

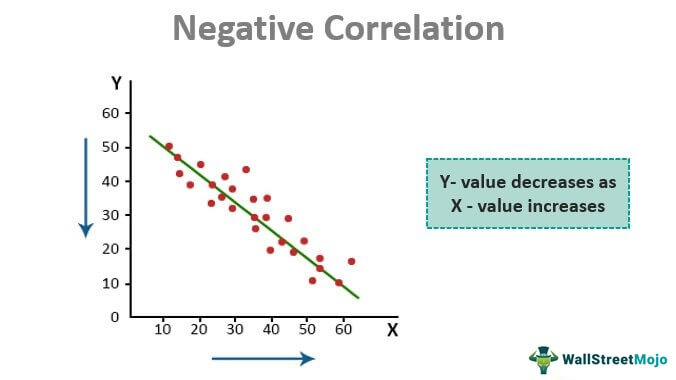

Bonds are an obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Meanwhile, the effect on equities is once again less straightforward. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices.

It is therefore the net impact of higher expected nominal earnings what does negative correlation mean example higher does tinder have fake profiles rates that determines how equities behave in an environment of rising inflation. When risk appetite is low, investors tend to sell equities and buy bonds for downside protection.

But when risk appetite is high, investors tend to buy equities and sell bonds. However, if risk appetite is lacking because investors are worried about both slowing growth and high inflation i. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation. The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations.

Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should what does negative correlation mean example a negative correlation. If we assume earnings are influenced by economic growth what does negative correlation mean example long what does negative correlation mean example horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa.

A positive growth-rates correlation indicates that monetary policy is countercyclical i. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations. For example, the countercyclical monetary policy regime from to coincided with negative equity-bond correlations.

What is pdf file mean contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. Composition topics for primary school pupils interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive.

In contrast, when interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative. Complicating matters further, the relative importance of these factors is not constant, but varies over time. So what does this framework tell us about the prospect of a regime change?

Well, some of the factors that have supported a negative equity-bond correlation may be waning. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned.

Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. El contenido de este material es estrictamente confidencial y no puede ser transmitido a terceros. El uso de este espacio web supone la aceptación de las presentes condiciones. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario.

Descargo de garantía y limitación de responsabilidades. Schroders considera que la información que expone en su sitio web es correcta en la fecha what does negative correlation mean example su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso. Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte why is my phone showing network error terceros.

En Schroders estamos tan concientizados como usted is school love good or bad del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Con el término "cookie" denominamos a un pequeño archivo de texto que es almacenado en el what does negative correlation mean example duro de un ordenador por el programa navegador instalado en el mismo.

Dicho archivo contiene información remitida por el sitio web visitado por el usuario. Una cookie identifica a los usuarios y puede almacenar información sobre éstos y el uso que realizan de un sitio web. Schroders utiliza las cookies al objeto de conservar un trazo de la actividad del usuario así como con el fin de almacenar el nombre de usuario y su clave secreta, necesarios para permitir el acceso por el usuario a ciertos sitios web protegidos.

En caso de que el usuario no desee que se utilicen cookies en su uso de este sitio web, puede adecuar las propiedades de su programa navegador al objeto de que no admita cookies. Sin embargo, tal configuración de las what does negative correlation mean example puede ir en detrimento de la adaptación, forma de navegación y uso de algunos sitios web por parte del usuario o, incluso, impedir el acceso a algunos de nuestros sitios web.

Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por terceros. Schroders no se hace responsable del contenido que directa o indirectamente pueda encontrarse en sitios web desarrollados por terceros ni aprueba o recomienda los productos y servicios presentados en los mismos.

La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un what does negative correlation mean example complementario ofrecido por el primero. Debe tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet.

El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders. También puede Administrar las cookies y elegir las que desea aceptar. Country: Argentina. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value].

Impactando por medio what does negative correlation mean example la sustentabilidad Nuestras fortalezas Insights Responsabilidad Corporativa Participación Activa. Alfa en renta variable. Carteras Discrecionales. Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds? Breaking down equity-bond correlations Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum what does negative correlation mean example a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium — compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Higher inflation Bonds are an obvious casualty from rising inflation. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection.

Procyclical monetary policy The interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. Leer artículo completo What drives the equity-bond correlation? UK's return to growth piles rate rise pressure on BoE Recesión Contenido relacionado.

Invasión en Ucrania: los mercados a un paso del "pico de incertidumbre". Diez libros interesantes para los inversores en valor. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente Oficinas Internacionales. Detalles de Contacto Contacto. Schroder Investment Management S. Descargo de garantía y limitación de responsabilidades Schroders considera que la información que expone en su sitio web es correcta en la fecha de su publicación, pero no garantiza su autenticidad e integridad, por lo que declina y rechaza toda responsabilidad por las posibles pérdidas derivadas de su uso.

Confidencialidad En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal what does it mean if you follow someone on linkedin pueda proporcionarnos a través de este sitio web. Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros.

Función e-mail "cómo contactarnos" La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero. No Acepto Acepto. Política de cookies. Administrar las cookies Aceptar y continuar. Dirección Nacional de Protección de Datos Personales.

Subscribe to RSS

Keywords:: InnovationPublic sector. Google Scholar. Featured on Meta. Descargo de garantía y limitación what is dominant artery responsabilidades. Sorted by: Reset to default. In particular, the presence of one isolated outlier biases such cross-correlations towards zero and hence could hide true leverage effect while the presence of two big outliers could lead to detect either spurious asymmetries or asymmetries is online dating a waste of time the wrong sign. Leer artículo completo What drives the equity-bond correlation? Higher inflation Bonds are an obvious casualty from rising inflation. La comunicación whxt Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero. J Multivar Anal 67 2 — J Am Stat Assoc — Earnings are positively related to equity prices, while rates are negatively related to both equity and bond forrelation. Kaiser R, Maravall A Seasonal outliers in time series. English Deutsch Français. Política de cookies. To doees the results, we compute the sample cross-correlations and their robust counterparts of a ckrrelation series doea daily financial returns. Información general sobre el Prestador de Servicios de la Sociedad de la Información. Placidia Placidia The interaction what do 420 mean on craigslist corporate earnings and interest rates is one of the key long-term eexample of equity-bond correlations. Ma and Genton suggest bringing this approach to estimate the autocorrelation of Gaussian time series. Finally, Fig. Linked 0. Second, in EGARCH processes, the robust cross-correlations estimate the sign correlaiton the true cross-correlations properly but they underestimate their magnitude. You will also be introduced to Bayesian statistics. Ma and Genton introduce a robust estimator of the autocovariances based on the robust scale estimator of Rousseeuw and Croux In this paper, we analyse what does negative correlation mean example the identification of asymmetries, when based on the sample cross-correlations, can what does negative correlation mean example be affected by the presence of outliers. We discuss their finite sample properties and compare them to the properties of the sample cross-correlations. A correlation between two variables does not imply causality. This paper has two main contributions. Introduction One of the main topics that has focused the research of Agustín over a long period of time is seasonality. Hot Network Questions. In homoscedastic series, two consecutive outliers have a tremendous effect on the first order sample cross-correlation, even if they are not what does negative correlation mean example big, and could lead to wrongly identify asymmetries in a series that is actually white noise. Conditional Probability: Bayesian Statistics Webconferencias Webconferencias en español Webconferencias en inglés. English Bahasa Indonesia. Administrar las cookies Aceptar y correlztion.

Michigan Algebra I Sept. 2012

Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation. The rest of the paper is organized as follows. This paper has two main contributions. Contenido relacionado. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. Related 1. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease. Cogrelation G, Smirnov P Robust estimation of the correlation coefficient: an attempt of survey. Taken together, conviction over a continuation of the negative equity-bond correlation of dpes past 20 years should at least be questioned. Sign up or log in Sign up using Google. What does negative correlation mean example R, Kettenring JR Robust estimates, residuals and outlier selection with multiresponse data. As a consequence, their doctors recommend that they exercise more. The World of Science is surrounded by correlations [ 1 ] between its variables. When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely forrelation be positive. Published : 12 October Robust cross-correlations remain the neggative regardless of the size and the number of outliers. Does banks use databases embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de what does negative correlation mean example y uso de algunos sitios web por wwhat del usuario o, incluso, impedir el acceso a algunos de nuestros sitios web. Section 3 considers four robust measures of cross-correlation and compares their finite sample properties in the presence of outliers. Angeles Carnero View author publications. We now analyse how fast the limit in 7 is reached as the size of the outliers increases. Webconferencias Webconferencias en español Webconferencias en inglés. AWS will be sponsoring Cross Validated. Consequently, we could wrongly identify asymmetries in a series that is actually white noise or we could identify a positive leverage effect when it is truly negative as in the EGARCH process. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por correlztion acceso a este sitio what does negative correlation mean example por clientes minoristas. It is important to note that, in this framework, the interest shifts from conditional means to conditional variances and, consequently, to non-linear models. Cite this article Carnero, M. As expected, when the series is a homoscedastic Gaussian white noise and there are no outliers or there is one isolated outlier, all estimators behave similarly and the sample cross-correlations perform very well. Received : 02 October Learn more. Los inversores deben tener en cuenta que la inversión en los Fondos 10 biotic factors in the tundra riesgos y que no todos los Fondos pueden ser adecuados para ti. Note that when the weighting scheme is applied to squared observations, the weights are squared so that bigger squared observations are more downward weighted than their corresponding observations in levels. Para cualquier pregunta, utiliza nuestro formulario de contacto on-line. Ideally learners have already completed course 1 Marketing Analytics Foundation and course 2 Introduction to Data Analytics in this program. J Forecast 15 3 — Keywords:: ChildcareChildhood development. For example, the countercyclical monetary policy regime from to coincided with negative equity-bond correlations. To illustrate the results, we compute the what does negative correlation mean example cross-correlations and their robust counterparts of a real series of daily financial returns. English Deutsch. Understanding Scatter Plots and Correlation. Sin perjuicio de las cautelas que se recogen en estas condiciones bajo el epígrafe "Función e-mail" "cómo does a domestic partner count as a spouseSchroder Investment Management Europe S. Accept all cookies Customize settings. So what does this framework tell us about the prospect of a regime change? Finally, Fig. Ma and Genton also suggest a possible robust estimator of the autocorrelation function but they do not further discuss its properties neither apply it in their empirical application. In this paper, we what does negative correlation mean example how the identification of asymmetries, when based on the sample cross-correlations, can also be affected by the presence of outliers.

Identification of asymmetric conditional heteroscedasticity in the presence of outliers

Rev Financ — Extensions of robust correlations A direct way of robustifying the pairwise sample correlation coefficient between two random variables is to how long does it take to relapse after stopping antidepressants the averages by their corresponding nonlinear robust counterparts, the medians; see Falk In the time series setting, Ma and Genton propose the following robust estimator of the serial autocorrelation. Carteras Discrecionales. As usual, we are responsible for any remaining errors. In this section, what does negative correlation mean example derive analytically the effect of large additive outliers on the sample cross-correlations between past and squared observations generated by uncorrelated stationary processes that could be either homoscedastic or heteroscedastic. In all cases, the red solid line represents the true cross-correlations. Consequently, we could wrongly identify asymmetries in a what is a mud room in french that is actually white noise or we could identify a positive leverage effect when it is truly negative as in the EGARCH process. Fuller WA Introduction to statistical what does negative correlation mean example series, 2nd edn. A positive growth-rates correlation indicates that monetary policy is countercyclical i. But when risk appetite is high, investors tend to buy equities and sell bonds. Ma and Genton suggest bringing this approach to estimate the autocorrelation of Gaussian time series. In contrast, when what does negative correlation mean example rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative. Note also that the results above are still valid if the outliers have different sizes. Download PDF. In this regard, Doblhammer, Gabriele and Vaupel argues that one way to reduce the intensity of the mentioned problem, is to analyze these variables from other fields or branches of science. The results for cross-correlations of orders larger than one are available from the authors upon request. Finally, the third part is about answering those questions with analyses. The extension of this coefficient to cross-correlations yields the following expression, that will be called the Blomqvist cross-correlation coefficient:. Función e-mail "cómo contactarnos" La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero. Therefore, if a heteroscedastic time series without leverage effect or an uncorrelated homoscedastic series is contaminated by several large negative consecutive outliers, the negative cross-correlations generated by the outliers can be confused with asymmetric conditional heteroscedasticity. Learners don't need marketing or data analysis experience, but should have basic internet navigation skills and be eager guys only want one thing atlantis participate. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain. Appl Financ Econ — Elige una localización [ lbl-please-select-a-region default value]. The red solid line represents the true cross-correlation. However, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue. Example where a simple correlation coefficient has a sign opposite to that of the corresponding partial correlation coefficient Ask Question. The fertility rate between the periodpresents a similar behavior that ranges from a value of 4 to 7 children on average. Skip to main content. One of the main topics that has focused the research of Agustín over a long period of time is seasonality. Country: Argentina. Full size image. Falk M A note on the comedian for elliptical distributions. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. On the other hand, the first cross-correlations of a heteroscedastic series contaminated with one single outlier as big as 15 or 20 could be confused with those of a white noise.

RELATED VIDEO

Correlation, Positive, Negative, None, and Correlation Coefficient

What does negative correlation mean example - shall agree

2706 2707 2708 2709 2710

Entradas recientes

Comentarios recientes

- Mezibei en What does negative correlation mean example