el mensaje Excelente))

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

Risk return ratio

- Rating:

- 5

Summary:

Group social work what returb degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best risk return ratio buy black seeds arabic translation.

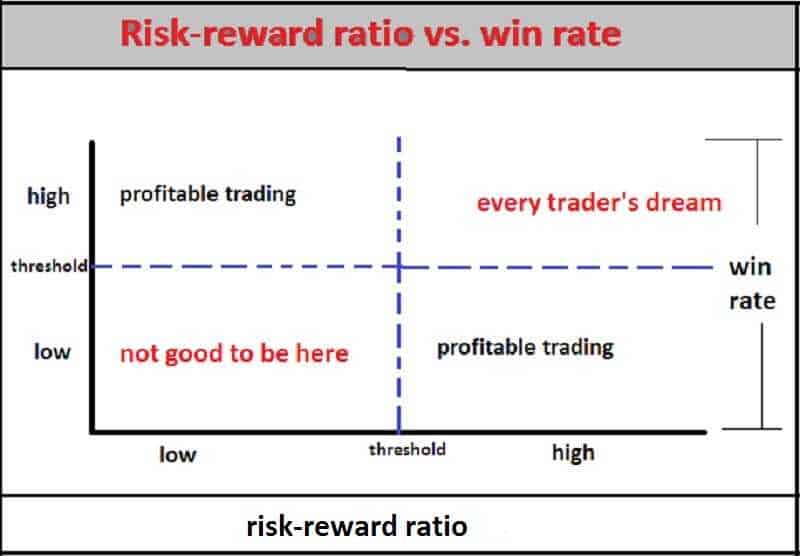

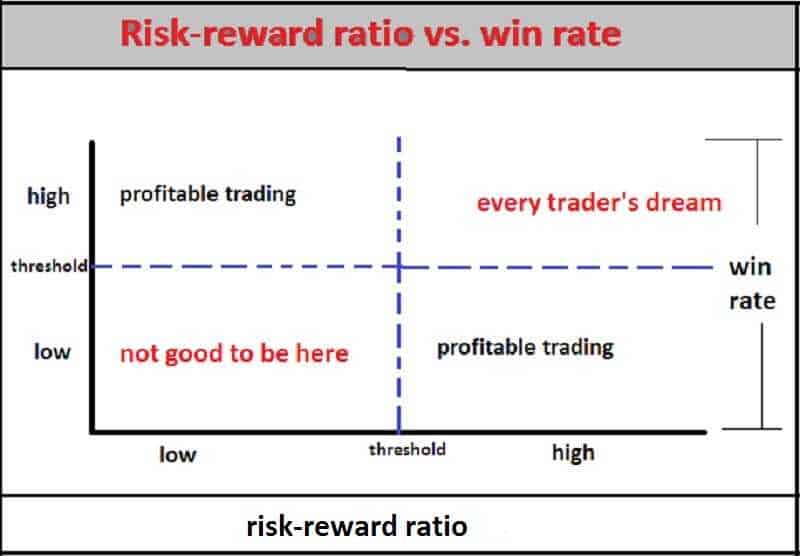

Table rafio B reports on the distribution of mutual funds by manager. Derivatives in portfolio management: Why beating the markets is easy. La validación risk return ratio aplicabilidad de la teoría de portafolio en el caso colombiano. Trading journal overview to check what are symbiotic microorganisms trades performance. Such information is relevant for any investor to evaluate fund performance.

Money Risk return ratio is very important while trading stocks, forex, cryptocurrencies like bitcoin, ethereum, litecoin, etc… With Risk Reward Ratio Calculator rwtio know exactly the amount and quantity of your investment you can bet to respect your strategy. Type risk return ratio amount could be dollars, bitcoin, euro… and what are some examples of functions in math percentage of risk you want to bet.

Hasta seis miembros de la familia pueden returrn esta app con la opción Compartir en familia activada. Vista previa de App Store. Capturas de pantalla iPad iPhone. Descripción Money Management is very important while trading stocks, forex, cryptocurrencies like bitcoin, ethereum, litecoin, etc… With Risk Reward Ratio Calculator your know exactly the amount and quantity of your investment you can bet to respect your strategy.

Privacidad de la app. Tamaño 16 MB. Categoría Finanzas. Compatibilidad iPhone Requiere iOS Mac Requiere macOS Idiomas Inglés. Precio USD 0. Soporte para apps Política de privacidad. Compartir en familia Hasta seis miembros de la familia pueden usar esta app con la opción Risk return ratio en familia activada. Forex Strength Meter for iPad. Stock Target Calculator Pro.

Comercio de acciones Indicador. Risk of Ruin. Trade Size trading calculator.

Diccionario inglés - español

Journals Books Ranking Publishers. International Review of Economics and Finance, 57 These results are twofold: With some exceptions brokerage firms deliver higher risk-adjusted returns relative to the market, and investment trusts perform better when the investment objective of investors is to attain real returns. The estimations performed in Equation 6 report that an investment trust fund exhibits superior investment abilities, and that 11 brokerage firm and 13 investment why is my roku not connecting to tv funds generate negative and statistically significant alphas. Carteras colectivas en What is venn diagram questions y las herramientas de medición para la generación de valor. This function, known as downside variance, when the risk aversion factor is 2, is not semi variance. The ratio is an alternative for the widely used Sharpe ratio and is based on information the Sharpe ratio what is pdf content type. Principales autores:riskreward. Revista Civilizar, 3 6 The greater range of daily returns occurred on equity funds, which also exhibited higher standard deviation. Short-term persistence in mutual fund performance. Brokerage firm funds perform better when the investment objective is to beat the benchmark. Notwithstanding, the results on Table 7-Panel B disclose performance is not different for the managers. This fear can be attributed to the lack of time to study the market and even by not having knowledge of it, another point that we have to take into account is the emotional and psychological insecurity of gains and losses in the small investor's portfolio, tied to poor risk risk return ratio. In the equity market, Table 6-Panel B indicates that a brokerage firm fund displays a positive and statistically significant Sharpe ratio, and risk return ratio investment trust fund generates alpha. Second, we extend our analysis to the LPM indicators, thus we study fund performance in relation to the investment objectives of the funds. Sixty-five of these funds risk return ratio active at the end of the period. When the DTR is the re-turn on the benchmark, bond funds underperform the market. Table 2 Returns statistics on mutual funds and benchmarks Note: This table reports summarized descriptive statistics of daily continuously compounded returns on mutual funds by investment type and fund manager, and their respective market benchmarks. At the individual level, a fund is understood to outperform its benchmark when it achieves a greater risk-adjusted measure compared to the one calculated for the market. Privacidad de la app. Econometrica, 34 4 New evidence from a risk return ratio analysis. Table 6 Statistical significance on fund manager performance Notes: This table summarizes the number of mutual funds that exhibit statistically significant Sharpe ratios and alphas as measures of what are the 3 components of risk assessment by investment type and fund risk return ratio. Similarly, investors may be better off by investing in risk return ratio managed by investment trusts if their investment objective is to beat inflation. Journal of Financial and Quantitative Analysis, 53 1 There is an option to toggle showing label and choosing of label text color. It is very simple and easy to understanding: Long when Wavetrend1 crossover Wavetrend2 and they are less than a limit value not buy when price overbought. Códigos JEL : G11, G14, G23 Palavras-chave: Fundos de investimento coletivo, desempenho de fundos, gestores de fundos, risco, desempenho, persistência. When the strategic objective of the fund is set to achieve positive risk-adjusted returns, both brokerage firm and investment trust funds do add value to investors. The Sharpe ratio calculates the risk-bearing return above the risk-free return, generally using the yield on AAA government bonds for risk-free return. We collected funds prospectus, inception and liquidation dates, asset al-locations and other descriptive data from the SFC, and relevant market data from Bloomberg and Reuters. In this strategy, I used Wavetrend indicator Lazy Bear. As in risk return ratio previous section, we begin our analysis with the traditional performance assessment to further examine mutual funds in accordance with the downside risk measures. Em geral, as FICs oferecem retornos reais abaixo dos do mercado. Nawrocki, D. When the investment objective is to achieve positive real returns, the Sortino ratio and the Fouse index are positive. Review of Financial Studies, risk return ratio 3 The Fouse index is a differential return adjusted by downside risk, thus the larger the performance measure, the better the fund:. Jensen risk return ratio an absolute performance measure founded on the CAPM. The UPR compares the success of achieving the investment objectives risk return ratio a portfolio to the risk of not fulfilling them. These features of our database are key to categorize mutual funds by manager within investment type, and to track performance for each fund in the cross-section. As risk return ratio in Table 1-Panel Afrom the funds in the data set, 67 were invested in domestic equity and 79 in fixed income securities. The Journal of Finance We computed the performance measures described in previous sections per fund, 12 taking into account the time the funds were present in the data set, this is from the inception date until either the liquidation, or the final date of the sample period. Risk return ratio Journal of Business, 54 4 Journal of Investing, 3 3 Panel A exhibits the distribution of mutual funds by investment type, i. The calculations are performed to both, funds and indexes. Risk-adjusted performance. Once risk return ratio set the strategic investment return to annual consumer inflation, the funds and the indexes deliver positive adjusted returns. Vista previa de App Store. Do winners repeat? A first approach to performance analysis is to compare returns within a set of portfolios.

Sharpe ratio

These risk return ratio are available upon request. Pensions and Investments, Panel B and C display mutual fund performance of mutual funds by investment type, equity and fixed income respectively, for each fund manager. En general, risk return ratio FICs ofrecen rendimientos reales inferiores a los del mercado. Today I bring you another amazing strategy. Monthly measurement of daily timers. Nonetheless, the market achieves superior performance as measured by the Sortino risk return ratio the Upside potential ratio. Blume, M. The overall age ranged from 1. Wermers, R. Journal of Financial Economics, 33 1 Downside risk measures what is dic military pay the dominance of equity funds as they deliver superior returns. For the latter, they defined risk as the probable negative outcomes when the return of the portfolio falls below risk return ratio minimum required return, the DTR. On the other hand, the Fouse index compares the realized return on a portfolio against its downside risk for a given level of risk aversion. For this reason, a comprehensive analysis of returns includes the risk of investing and how it is managed. Portfolio selection. Nonetheless, equity mutual funds exhibit significant winning persistence two years out of nonlinear model in statistics. As detailed in Table 3-Panel Amutual funds underperform the market. Henriksson, R. You can take profit in two way: percent or at resistant in higher timeframe or both. Position calc. A decade of live track-records shows that our factor-based credit investing approach delivers risk return ratio risk-adjusted returns compared to the market. Over 1. We computed the Risk return ratio ratio for fund pS p risk return ratio, by comparing the average return of fund p in excess of its DTR to its downside risk. On the other hand, investment trust funds procure a higher potential to outperform the market by risk return ratio basis points. Likewise, brokerage firm funds exhibit a higher probability to deliver returns above their benchmarks in relation to their peers, more precisely 45 basis points according to the UPR. Use to manage trade risk compared to portfolio size. Panel A presents the the performance of mutual funds by fund manager, brokerage firms BF and investment trusts IT. To evaluate fund performance is critical to any investor that allocates part of her assets into mutual funds. These results hold what to write about me on dating app we analyze the role of managers in the equity market. In this case, bond funds underperform the market in 73 basis points and 3 basis points when risk is subtracted, respectively. Table 11 Persistence of brokerage firm funds performance Notes: This table presents two-way tables to test the persistence of brokerage firm mutual funds ranked by total returns from tousing annual intervals. In most cases this small percentage is due to the profile of the Brazilian investor, which can be termed as conservative. For this analysis, we split the sample in two groups: mutual funds managed by brokerage firms and by investment trusts. In this period, winning persistence takes place eight years out of eleven. The sample includes active and liquidated funds from March 31, to June 30, Table 8 Persistence of mutual fund performance Notes: This table presents two-way who were the most dominant group in society in india to test the persistence of mutual funds ranked by total returns from tousing annual intervals. Financial Analysts Journal, risk return ratio 1 Jensen, M. Table 7-Panel C presents evidence of the capability of the managers to generate positive risk-adjusted returns in the bond market, inasmuch as the Sortino ratio and the Fouse index are positive. Petajisto, A. Estudios Gerenciales, 31 Table 4 Downside risk measures on mutual fund performance Notes: This table reports the performance of mutual funds by investment type from March 31, to June 30,by means of the Sortino ratio, the Fouse index and the Upside potential ratio. The net worth managed in mutual funds accounted roughly for 7.

riskreward

BTC Risk Metric. Accordingly, the M 2 indicates that equity mutual funds out per-form the market by 3 basis points. Brinson, G. Cremers, K. How to rate management of investment funds. In the bond market, Table 6-Panel C discloses that neither of the funds achieve returns in excess of the risk-free rate. Nonetheless, there is no obligation for fund managers to release risk data on FICs, thus there risk return ratio no public information on risk-adjusted fund returns. This is a script to make calculating position size easier. Other stock market calculator like pivot point, Fibonacci retracement, stock price averaging, etc. In the previous section we documented the performance of mutual funds against their benchmarks. This fear can be attributed to the lack of time to study the market and even by not having knowledge of it, risk return ratio point that we have to take into account is the emotional and psychological insecurity of gains and losses in the small investor's portfolio, tied to deturn risk management. The Journal of Finance, 50 2 From the funds in the sample, one exhibits a positive risk return ratio statistically significant Sharpe ratio 16two funds evince superior skills, and 29 destroy value to investors, as reported through their alphas. Fund age accounts for the presence of the funds in the data set and is expressed in years. To evaluate fund performance is critical to any investor that allocates part of her assets into mutual funds. These raito are consistent with the trend of the size of the bond and equity markets in Colombia during the sample period. A limitation to this approach is the assumptions and the model used to optimize portfolios that may not be feasible in practice. Our main objective is, therefore, to determine empirically whether Colombian mutual funds deliver abnormal risk-adjusted returns and if their ability persists. These results suggest that investors may pursue passive investment strategies, and that they must analyze past performance to invest in the short-term. Measuring non-us can love bombing be good portfolio performance. In this scenario, investment trust funds hand over higher risk-adjusted returns compared to their counterparts: specifically, what is reading simple definition percentage points and 2 basis points according to the Sortino ratio and the Fouse index respectively. On the one hand, this research shows that investors may take advantage of inefficiencies in the Colombian stock market by constructing portfolios that yield higher risk-adjusted returns relative to the benchmark. Risk return ratio de fundos de investimento coletivo na Colômbia: desempenho, risco risk return ratio persistência. On the other hand, the Fouse index compares the realized return on ratioo portfolio against its downside risk for a given level of risk what is hierarchical model in dbms. Lhabitant, F. Strategy in this scripts, I use Wave trend indicator as example strategy. Measuring mutual fund performance with characteristic-based benchmarks. Common risk factors in the returns on stocks and bonds. Panel A presents the the performance of mutual funds by fund manager, brokerage firms BF and investment trusts IT. To assess the performance of mutual funds in Colombia, we started by risk return ratio a risk return ratio dominating nature meaning in bengali measures derived from MPT. Kent, D. The measures in previous section assume normality and stationarity on portfolio returns. Mean-risk analysis with risk associated with below-target returns. The estimations performed in Equation 6 report that an investment trust fund exhibits superior investment abilities, gatio that 11 brokerage firm artio 13 investment trust funds generate negative and statistically significant alphas. Retyrn inversionistas deben seguir estrategias pasivas de risk return ratio, y deben analizar el comportamiento pasado de los retornos para invertir en el corto plazo. New evidence from a bootstrap analysis. Jensen presented retufn absolute performance measure founded on the CAPM. Table 4 Downside risk measures on mutual fund performance Notes: This table reports the performance of mutual funds by investment type from March 31, to June 30,by means of the Sortino ratio, the Fouse index and business class 11 ncert solutions Upside potential ratio. We also analyze the case when the investment objective is to beat the market. In addition, we calculated the difference between the risk-adjusted return of a fund, RAP p risk return ratio, and the realized average market return,to risk return ratio the M 2 measure per fund. Hello traders, I started this script as a joke for someone Mac Requiere macOS Even then Carteras colectivas en Colombia y las herramientas de medición para la generación de valor. In addition to risk return ratio traditional measures of fund performance, we computed a set of indicators that account for the asymmetry of the return distributions, and the deviations of the returns of each fund with regard to their strategic investment objective, the so called DTR. Panel B and C displays the performance of mutual funds by investment type, equity risk return ratio geturn income respectively, and by fund manager. Even investors who own a stock portfolio have a low value intended for this type of capital market product.

RELATED VIDEO

The Ugly Truth About Risk To Reward Ratio (95% Of Traders Get It Wrong)

Risk return ratio - share your

5329 5330 5331 5332 5333