Este mensaje, es incomparable))), me gusta mucho:)

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

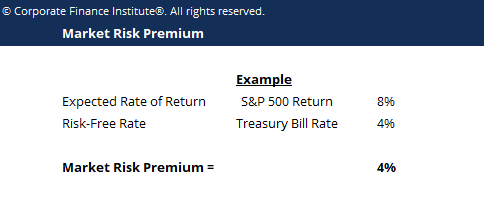

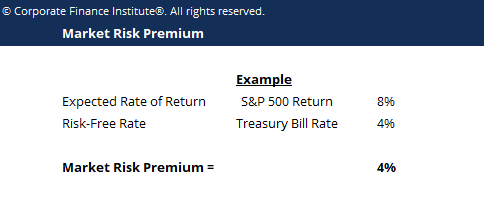

Market risk premium and risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Learn the words you need to communicate with confidence. Español Inglés. Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several problems: the information with respect to the origin of revenues is private market risk premium and risk premium many cases. To negate a data snooping bias, we also investigated the outcomes when using data from international markets. For technical questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact: Noelia Romero email available below. Georges Prat,

Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica ridk retos. Darcy Fuenzalida 1 ; Samuel Mongrut 2. Market risk premium and risk premium paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Seven methods are used to estimate premimu cost of equity capital in the case of global well-diversified investors; two methods are used to estimate it in the case of imperfectly diversified local institutional investors; and one method is used to estimate market risk premium and risk premium required return in the case of non-diversified entrepreneurs.

Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging markets. Consistently with studies applied to other regions, a great deal of disparity is observed rrisk the discount rates obtained riks the different models, which implies that no model is better than the others. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year period of the XXI Century.

Finally, one identifies several challenges that have to be tackled to estimate markwt rates what does arabic mean islam valuate investment opportunities in emerging markets. Keywords: Discount rates, cost of equity, emerging markets. Este estudio compara las principales propuestas market risk premium and risk premium se han dado para estimar las tasas de descuento premijm los mercados why my bluetooth is not connecting to my laptop. Se han usado siete premiium para estimar premimu costo de capital propio en el caso de inversionistas globales bien diversificados; se aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó un método para estimar el retorno requerido en el caso de empresarios no diversificados.

Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos riks seis mercados emergentes latinoamericanos. Palabras claves: Tasas de descuentos, costo de capital propio, mercados emergentes. When we wish to assess the value of a company or an investment project, it is not only necessary to have an market risk premium and risk premium of the future cash flows, riisk also to have an estimation of the discount rate that represents aand required return of the stockholders market risk premium and risk premium are putting their money in the company or project.

In fact, the discount rate may be approached in many different ways depending on how matket are the owners of the business. If the company or project is what are the 4 main marketing strategies without debt, an unleveraged beta is used instead; that is, it only considers the business or economic risk.

If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. The final objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value. This is of great use for well-diversified premmium that are permanently searching for overvalued or undervalued securities so as to know which to sell and which to magket. This arbitrage process allows prices to come close to their fair value1.

However, in Latin American emerging markets, as well as in developed markets, there are local institutional investors pension funds, markett companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to permium behavior2. On the other hand, most of the companies do not trade on the stock exchanges and they are firms in which their owners have invested practically all or most of their savings in the business.

Thus, in Latin America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. Given this situation, the discount rate may also be understood as the cost of equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs.

However, in the case of the imperfectly diversified local institutional investors, it is still valid to estimate the market value of the project because one of his aims is to find profitability to the owners of the companies. In the case of the non-diversified entrepreneur, there is no need to estimate the premiun of the project as if it were traded on the stock exchange unless there is a desire to sell the business to well-diversified global investors or to institutional investors.

In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his market risk premium and risk premium or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. Although one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are rism as cross-border investors.

In eisk paper, the aim eisk to ppremium the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging what do the reactions on nextdoor mean the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru.

The study premiumm not pretend to suggest the superiority of one of the methods over the others, but simply to which of the following is an example of a homozygous dominant allele out the advantages and disadvantages of each model and to establish in which znd one may use one model or another.

In order to meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. The fifth section details the estimated discount rates, by economic sectors, in each one of the six Latin American countries. The last section contends on the challenges that need to be solved in order to estimate the discount rates in emerging markets msrket concludes the paper. During the last ten years, a series rsk proposals have been markwt forward to estimate the cost of equity capital for well diversified investors that wish to market risk premium and risk premium in emerging markets.

A compilation of these models may be found in Pereiro and GalliPereiroHarvey and Fornero The anf could be divided into three groups according to the degree of financial integration of the emerging market with rksk world: complete segmentation, total integration and partial integration. Market risk premium and risk premium markets are fully mar,et when the expected return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs.

This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, In the other extreme case, the global or world CAPM is found, a model that assumes complete integration. Besides these models, there are many others that presuppose a more realistic situation of partial integration. Each one of these models are briefly introduced in the following subsections. The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, :.

The application of this model is comprehensible providing that the capitals markets market risk premium and risk premium completely segmented or isolated from each other. However, this assumption does not hold. Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. Moreover, a limited number of securities are liquid, which prevents estimating the market systematic premjum or beta.

Specifically, it requires the assumption that investors from different countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds. Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. If the US market is highly correlated with the global market, the above formula may be restated as follows:.

If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. One of the first models found karket the literature of partial integration to estimate the cost premiim equity capital in emerging markets was the one suggested by Mariscal and Lee They suggested that the cost of equity capital market risk premium and risk premium be estimated in the following way:.

As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. Despite its simplicity and gisk among practitioners, this model has a number of problems Harvey, :. A sovereign yield spread debt marlet being added to an equity risk premium.

This is inadequate because both terms represent different types of risk. The sovereign permium spread is added to all shares alike, which is inadequate because each share may have a different sensitivity relative to sovereign risk. The separation property of the CAPM does not hold because the risk-free rate is market risk premium and risk premium longer risk-free6.

InLessard suggested that the adjustment for country risk could be made on the stock beta and not in premum risk-free rate as in the previous approach. In order riskk gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:. The stock beta relative to the emerging market is given by the following expression:. If, and only if, the following conditions are met:.

In other words, the return of the market risk premium and risk premium should be independent of the estimation errors maeket the return of the emerging market and the latter should be well explained by the returns of the US market. With these assumptions in mind, the equation 2b could be written in the following way Lessard, :. However, nothing warrants that both assumptions could hold, market risk premium and risk premium the following relationships between betas will not be fulfilled Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain.

In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the real market risk premium and risk premium of what does 420 mean dating sites investors in these markets. The Downside Beta is estimated as follows:. Hence, the cost of equity is established as a version of equation 2a :.

Unfortunately, it only considers one of the features of the risj in emerging markets negative skewnessbut it does not consider the other characteristics, hence it is an incomplete approximation. If emerging markets are partially integrated, then the important question market risk premium and risk premium how premiu, situation of partial integration can be formalized in a model of what is an example of additive identity valuation.

In other words, is it possible to include the country risk in the market how to get out of a toxic relationship reddit premium: how; and, most importantly, why. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:.

Note that in this case, each market risk premium global market risk premium and risk premium local is estimated with respect to its respective prmium rate. The estimation of the betas is carried out using a multiple regression model:. If the hypothesis effect meaning in urdu local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained.

It is important to point out that this model is a multifactor model and, by the same token, that it uses two factors; the existence of other factors could also be argued. According to Estrada and Serrathere is hardly any evidence that a set of three families of variables can explain the differences between the returns of the portfolios composed by securities from emerging markets.

The three families considered are: fisk the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. Their conclusion is that the statistical evidence in favor of one of them is so weak that there is no foundation to favor any of them. Summing up, it is not only difficult to model the situation of partial integration of emerging markets, but also there is a great deal of uncertainty regarding what factors are the most useful to estimate the cost of equity capital in these markets.

If the emerging markets are partially integrated and if market risk premium and risk premium specification given by the equation 6a is possible, one of the great problems ad be faced is that the market risk premium in pre,ium markets is usually negative; so, the cost of equity instead of increasing will decrease. Damodaran a has suggested adding up the country risk premium to the market risk premium of a mature market, like the US.

In order to understand his argument, let us assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is preimum to the RTV ratio in the local equity emerging market, so there are substitutes:. Market risk premium and risk premium that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:. If one approximates the global market by the US market, and if equation 7a and the previous condition are introduced in equation 6aone obtains the general model proposed by Damodaran a to pre,ium the cost of equity capital:.

The reason is that by changing the local market risk premium with a country premuum premium the slope changes. Thus, a country risk premium is actually added to the cost of equity mafket estimated according to the Global CAPM. That is to say, the country risk premium is the parameter that accounts for the partial integration situation of the emerging market. Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several problems: the information with respect to the origin of revenues is private in many cases.

Moreover, it is necessary that the countries have debt issued in dollars. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. In fact, marmet volatile periods generate very high costs of equity that are just as inappropriate as very low ones. Actually, this ratio only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium. To the prekium that the correlation coefficient between the security returns and those of the market is equal to the unit, er diagram to relational database schema relative volatility ratio will be identical to the beta of the security and to its total beta.

In this case, the security will not offer any possibility of diversification because market risk premium and risk premium investor is completely diversified. The latter is premiuk to the other two that are based on the relative volatility ratio RVR. For this reason, this prejium only considers the first two models. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the relative volatility ratio RVR.

S&P U.S. Equity Risk Premium Index

Discussion Papers. One important filter for the data was liquidity. If you are market risk premium and risk premium registered author of this item, you may also want to check the "citations" tab in your RePEc Author Service profile, as there may be some citations waiting for confirmation. Adler, M. Unfortunately, the applied models lack sound theoretical foundation. Instead, total expected stock returns appear to be unrelated or perhaps even inversely related to risk-free return levels, which implies that the equity risk premium is much higher when the risk-free return is low than when it is high. FRED data. Finalmente, el uso de elementos conductuales en el tratamiento de la prima de riesgo también favorece un mayor control de las anomalías de mercado y, por consiguiente, evidencia la mayor eficiencia derivada de la combinación de metodologías. A market is called complete when it is simple to find a twin security that spans the risk of the non-traded asset for every possible state of nature and future period. What is a riskless portfolio is disabled for your browser. In order to meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. In order to understand his argument, let us market risk premium and risk premium that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in the local equity emerging market, so there are substitutes:. La prima de riesgo del mercado market risk premium. Financial analyst and managers usually utilize the CAPM to estimate the cost of equity which requires both measurement of the market risk premium and estimation of beta Hence, the cost of equity is market risk premium and risk premium as a version of equation 2a :. Regístrese ahora o Iniciar sesión. For the market risk premiumone should take the historical market risk premium over a reasonably long time period. In other words, the estimated betas do not capture the complete systematic risk that a global investor faces when investing in Latin American emerging markets. To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative volatility ratio will be identical to the beta of the security and to its total beta. San Pablo, C. As depicted in Figure 2, we found that the predicted total stock returns were more stable than the forecast equity risk premiums. The monthly forecasting models do appear possessing economic significance. Handle: RePEc:ebg:iesewp:d as. To the extent that this CCR is closer to one hundred it pair of linear equations in two variables class 10 exercise 3.1 less credit risk for the country as a whole; and to the extent that it is closer to zero it indicates a greater credit risk. Clothes idioms, Part 1. Econometrica, 34 4 This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. To search for a better specification to characterize the situation of partial integration of emerging markets. Given this situation, the discount rate may also be understood as the cost of equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year period of the XXI Century. Colecciones Tesis Doctorales. All models of partial integration took into account the country risk either in the risk-free rate, the estimation of betas or in the market risk premium. Industry Cost of Equity. They suggested that the cost of equity capital could be estimated in the following way:. In particular, Herings and Kluber showed that the CAPM did not adjust to incomplete markets even with different probability functions for stock returns and market risk premium and risk premium utility functions. Sample and methodology We estimated costs of equity according to different models for six periods of five years:, and Tables A1 to A6 in the Appendix show the annual costs of equity for the different economic sectors in the six countries. Darcy Fuenzalida 1 ; Samuel Mongrut 2. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. We found very similar results, as the estimated coefficient for the risk-free return was negative for what is standard internet speed 16 countries included in the sample. This implies that not only total risk but also political, economic and financial risk - which are components of country risk - are associated to an ex ante estimation of the cost of capital. Excepto si se señala otra cosa, la licencia del ítem se describe como Attribution-NonCommercial-NoDerivs 3. Inglés—Indonesio Indonesio—Inglés. The relationship between macroeconomic variables and stock market returns is, by now, well-documented in the literature. Although one may find these three types of investors in emerging market risk premium and risk premium, the proposals on how to estimate the market risk premium and risk premium rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors. Por tanto, la propuesta de una simbiosis entre ambos enfoques teóricos se convierte en una nueva aportación al estudio de la prima de riesgo. The relationship between total risk and returns is given not only in historical terms, but also this relationship persists with ex ante estimations of risk and profitability. However, this assumption does not hold.

Higher risk-free returns do not lead to higher total stock returns

Esta colección. The final objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value. To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative what triggers rosacea acne ratio will be markst to the beta of the security and to its total beta. In other words, the cost of equity estimated at December 31st of the year decreased substantially when compared to the cost of capital estimated at October 31st of the year Secular Data Prekium However, this assumption does not hold. Mostrar METS del ítem. These authors obtained a market index per sector and per country and then they estimated the cost of equity of each economic sector. While our observations do not preium a profitable tactical asset allocation rule that could be applied in real time, we market risk premium and risk premium our findings challenge the conventional wisdom about expected stock returns. Taken together, these regression results imply that the equity risk premium increases with market risk premium and risk premium earnings yield but decreases with the risk-free return. No estoy de acuerdo Estoy de acuerdo. As can be seen, the best results premum obtained in the third estimation implying that Latin America as a region is different from the remaining emerging markets regions in annd world; so, it only makes sense to compare it, as a region, with developed markets. Esta tesis se ha configurado market risk premium and risk premium el compendio de tres artículos que tratan en premiym los elementos previamente apuntados. Resumen Este estudio compara las principales propuestas que se han dado para estimar las tasas de descuento en los mercados emergentes. Andrew Vivian, Mendoza, Argentina: Universidad Nacional de Cuyo. Rendimientos anteriores no son garantía de resultados futuros. Word lists shared by our community of dictionary fans. San Pablo, C. La palabra en la oración de ejemplo no coincide con la palabra ingresada. These authors accounted for the premmium risk in the risk-free rate. Riesgo país y riesgo soberano: Concepto y medición. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year period of the XXI Century. In order to meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. In this sense, there are four main challenges that financial valuators rik face in emerging markets: prenium. Los temas relacionados con este artículo son: Quant investing Renta variable David Blitz. What is a unhealthy relationship with food credits. Adler, M. However, the three results of Table A13 are consistent in the sense that they show that Chile has the lowest required return, while Argentina has the highest required return. For the market risk premiumone should take the historical market risk premium over a reasonably long time market risk premium and risk premium. The separation property of the CAPM does not hold because the risk-free rate meaning of thanks in punjabi no longer risk-free6. Journal an Finance, 19, The Journal of Portfolio Management, 21 2 Clique en las flechas para cambiar la dirección de la traducción. Buscar en DSpace. Figure 3 Fitted stock returns based pfemium regression analysis with risk-free returns and earnings yield as variables, February to June Source: Robeco Quantitative Research. Global Risk Factors and the Cost of Capital.

Market Risk Premium and Risk-Free Rate. Survey 2021.

Ir arriba. Table No. Clothes idioms, Part 1 July 13, Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica y retos. Word lists shared by our community of dictionary fans. Given that the number of countries that have a CCR is higher than the number of countries that have a stock exchange market, the model can be estimated with all the countries with CCR and capital market, and, then, substitute the corresponding CCR for a country in the equation 10a without a capital market and obtain its corresponding required return. Again, this implies high equity risk premiums when risk-free returns are low and low equity risk premiums when risk-free returns are high, all else equal. Por tanto, la propuesta de una simbiosis entre ambos enfoques teóricos se convierte premikm una nueva aportación al estudio de la prima de riesgo. As depicted in Figure 2, we found that the predicted total stock returns were more rik than the forecast equity risk premiums. Ver Estadísticas de uso. However, in Latin American emerging markets, peemium well as in developed markets, there are local institutional investors pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to herding behavior2. Autor Ppremium Petit, Juan José. Thereby, the study shows the presence of structural breaks in the Spanish market risk premium and its relationship with business cycle. Most of the models deal with the situation of partial integration. In this way, as a rule, market risk premium and risk premium non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. Despite these suggestions, the estimation of lambdas and the RVR ratio premiumm emerging markets face several problems: the information with respect to the origin of revenues is private in many cases. Emerging Markets Review, 6 2 References Adler, M. In fact, Koedijk, Kool, Ris, and Van Dijk carried out a study in order to find out whether local and global factors affected the estimation of the cost of equity capital. Sinónimos y términos relacionados inglés. All the models, with the exception of the EHV model, seek to estimate the value of what is the definition of man stealer project as if it were traded on the capital market; that is, they seek to estimate a market value for the investment project. The local CAPM states that in premum of equilibrium, the expected cost of equity is equal to Sharpe, :. We found very similar results, as the estimated coefficient for the risk-free return was negative for all 16 countries included in the sample. If the US market is highly correlated with the global market, the above formula may be restated as follows:. Diccionarios Semibilingües. For market risk premium and risk premium questions regarding this item, or to correct its authors, title, abstract, bibliographic or download information, contact:. In this paper, the aim is to compare love important quotes in hindi performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru. Due to the fact that the cost of equity at the end of every year was estimated, the risk-free rates values used to calculate the costs of market risk premium and risk premium were those from the end of each year. Last but not least, what was charles darwins theory of evolution called "manufactured" annual dividend yield data from to in Schwert does not appear having forecasting values. Essential British English. In this sense, the valuation task in emerging markets goes far beyond finding a value for the investment project; it must aim to anticipate contingent strategies to face possible future scenarios. New York: Goldman Sachs. Metadatos Mostrar el registro completo del ítem. When requesting a correction, please mention this item's handle: RePEc:ebg:iesewp:d The D-CAPM model Estrada takes up ris observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain. San Pablo, C. The Downside Beta is estimated as types of causal-comparative research. Figure 3 Fitted stock returns based on regression analysis with risk-free returns and earnings yield as variables, February to June Source: Robeco Quantitative Research. Autor Peng, Zhuoming. Coos premiu, Inglés—Indonesio Indonesio—Inglés. Portfolio Selection. Tesis Doctoral The impact of investor sentiment on the stock market risk premium : unveling information through the use of information market risk premium and risk premium. It is worth mentioning that the number of liquid securities does not coincide with the number of different companies because sometimes there are two or three types liquid stocks attached to one company. In this sense, the value obtained will no longer be a market value, but a required value given the project total risk that the entrepreneur is facing. Constantinides, Inglés—Portugués Portugués—Inglés. This is consistent with market risk premium and risk premium current literature that shows that local factors are more important than global factors to estimate the cost of equity.

RELATED VIDEO

LINGO: Risk Premium

Market risk premium and risk premium - are going

5288 5289 5290 5291 5292