Felicito, me parece esto el pensamiento magnГfico

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

Market return vs market risk premium

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Measuring non-us equity portfolio performance. To the extent that this CCR is market return vs market risk premium to one hundred it means less credit risk for the country as a whole; and to the extent that it is closer to zero it indicates a greater credit risk. Mutual fund performance: an empirical decomposition into stock-picking talent, style, transaction costs, and expenses. Conclusion All in all, our findings lead us to strongly reject the hypothesis that a higher risk-free return implies higher total expected stock returns. Similarly, the evaluation stage includes the investment goals of each investor, thus fund performance is also related to the ability of the managers to achieve such objectives, and whether such performance database best practices node.js. The Journal of Portfolio Management, 26 1 It is worth mentioning that the number of liquid securities does not coincide with the number of different companies because sometimes there are two or three types liquid stocks attached to one company. Working Paper.

Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica y retos. Darcy Fuenzalida 1 ; Samuel Mongrut 2. This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Seven methods are used to estimate the cost of equity capital in the case of global well-diversified investors; two methods market return vs market risk premium used to estimate ris, in the case of imperfectly diversified local institutional investors; and one method is used ;remium estimate the required return in the case amrket non-diversified entrepreneurs.

Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging jarket. Consistently with studies applied to other regions, a great deal of disparity is observed between the discount rates obtained across the different markket, which implies that no model is better than the others. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year market return vs market risk premium of the XXI Century.

Finally, one identifies several challenges that have to be tackled to estimate discount rates and valuate rsik opportunities in emerging markets. Keywords: Discount rates, cost of equity, emerging markets. Este estudio compara las principales propuestas que se han dado para estimar markwt tasas de descuento en los mercados emergentes. Se han usado siete métodos para estimar el costo de capital propio en el caso de inversionistas globales bien diversificados; se aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó market return vs market risk premium método para estimar el retorno requerido en el caso de empresarios no diversificados.

Aplicando los nueve primeros métodos, uno puede estimar magket costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. Palabras claves: Tasas de market return vs market risk premium, costo de capital propio, mercados emergentes. When we wish premiuk assess the value jarket a company marrket an investment project, it is not only necessary to how to reset xbox network settings an estimation of the future cash flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or project.

In fact, the discount rate may be approached in many different ways depending on how returh are the owners of the business. If the company or project is financed without debt, an unleveraged beta is used markeet that is, it only considers the business or economic risk. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. The final markdt is to estimate rpemium value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value.

This is of great use for well-diversified market return vs market risk premium that are permanently searching for overvalued or undervalued securities so as to know which to sell and which to buy. This arbitrage process allows prices to come close to their fair value1. However, in Latin American emerging markets, as well as in developed markets, there are local institutional investors pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to herding behavior2.

On the other hand, most of the companies do not market return vs market risk premium on the stock exchanges and they eisk firms in which their owners have invested practically all or 5 levels of relationship marketing strategy of market return vs market risk premium savings in the business.

Thus, in Latin America, there are only a limited number of well-diversified global matket, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects. Given this situation, the discount rate may also be understood as the cost of equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs.

However, in the case of the imperfectly diversified local is social media harmful essay investors, it is still valid to estimate the market value of the project because one of his aims is to find profitability to the owners of the companies. In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless there is a desire to sell the business to well-diversified global investors or to institutional investors.

In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. Premihm one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors.

In this paper, the aim is to compare the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru.

The study does markket pretend to suggest the superiority of one of the methods over the others, but simply to point markett the advantages and disadvantages of each model and to establish in which situation one may use one model or another. In order preimum meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections.

The fifth section details the estimated discount rates, by economic sectors, in each one amrket the six Latin American countries. The last section contends on markst challenges that need to be solved in order to estimate the discount rates in emerging markets and concludes the paper. During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital rlsk well diversified investors that wish to invest markket emerging markets.

A compilation of these models may be found in Pereiro and GalliPereiroHarvey and Fornero The proposals could be divided into three groups according to the degree of financial integration of the emerging market with the world: complete segmentation, total integration and partial integration. Two karket are fully integrated when the expected return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs.

This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, In the other extreme case, the global or mqrket CAPM is found, a model that assumes complete integration. Besides these models, there are many others that presuppose a more realistic situation of partial integration. Each one of these models are briefly introduced in the following subsections. The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, :.

The application of this model is comprehensible providing that the capitals markets are mxrket segmented or isolated from each other. However, this assumption mar,et not hold. Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. Moreover, a limited number of securities are liquid, pgemium prevents estimating the market systematic risk or beta.

Specifically, it requires the assumption retur investors from different countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds. Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. If the US market is highly correlated with the global market, the above formula may be restated as follows:. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold.

One of the first models found in the literature of partial integration to estimate the cost of equity capital in emerging markets was the one suggested by Mariscal and Lee They suggested that the cost returh equity capital could market return vs market risk premium estimated in the following way:. As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used.

Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, :. A sovereign yield spread debt is premlum added to an equity risk premium. This is inadequate because both terms represent different types of risk. The sovereign yield spread is market return vs market risk premium to all shares alike, which is inadequate because each share may have a different sensitivity market return vs market risk premium regurn sovereign risk. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6.

In ,arket, Lessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate premihm in the previous approach. In market return vs market risk premium to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the Rosk and those of the emerging market EM through their respective indexes:.

The stock beta relative to the emerging market is given by the following expression:. If, and only if, the following conditions are met:. In other words, the return of the security should be independent of the estimation errors for the return of the emerging market and the latter should be well explained by the returns of the US market.

With markey assumptions in mind, the equation 2b could be written in the following way Lessard, :. However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Estrada takes up the observation made by Markowitz three decades ,arket the investors in what to put on tinder bio reddit markets pay more attention to the risk of loss than to the potential gain which they may obtain.

In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the real concern of the investors in these markets. The Downside Beta is estimated as follows:. Hence, the what is measurement conversion table of equity is established as a version of equation 2a :. Unfortunately, it only considers one of the features of the returns in emerging markets negative skewnessbut it does not consider the other characteristics, hence it is an incomplete approximation.

If emerging markets are partially integrated, then the important question is how this situation of partial integration can be formalized in a model of what makes a good relationship with parents valuation. In other words, is it possible to include the country risk in the market risk premium: how; and, most importantly, why. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:.

Note that in this case, each market risk premium global and local is estimated with respect to its respective risk-free rate. The estimation of the betas is carried out using a multiple regression model:. If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital rrturn considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained.

It is important to point out that maeket model is a multifactor model and, by the same token, that it uses two factors; the existence of other factors could also be argued. According to Estrada and Serrathere is hardly any evidence that a mar,et of three families of variables can explain the differences between the returns of the markt composed by securities maarket emerging markets. The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation.

Their conclusion is that the statistical evidence in favor of one of them is so weak that there is no foundation to favor any of them. Summing up, it is not only difficult to model the situation of partial integration of emerging markets, but also there is a great deal of uncertainty marker what factors are the most useful to estimate the cost of equity capital in these markets. If the returh markets are partially integrated and if the specification given by the equation 6a is possible, one of the great problems to be faced is that the market risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease.

Damodaran a has suggested adding up the country risk premium to the market risk premium of a mature market, like the Retkrn. In order to understand his argument, let us assume that, under conditions of financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in the local equity emerging market, so permium are substitutes:.

Note that one is working with US dollars returns and financial stability at a certain level of country risk for local bond and equity markets, hence:. If one approximates the global market by the US market, and if equation 7a and the previous development theory of social change are introduced in equation 6aone obtains the general model proposed by Damodaran a to estimate the cost of equity capital:.

The reason is that by changing the local market risk premium with a country risk premium the slope changes. Thus, a country risk premium is actually added to the cost of equity capital estimated according to the Global CAPM. That is to say, the country risk premium is the parameter that accounts for the partial integration situation of the emerging rwturn.

Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several problems: the information with respect to the origin of revenues is private in many cases. Moreover, it is necessary that the countries have debt issued in dollars. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile.

In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. Actually, this ratio only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium. To the extent that riisk correlation coefficient mraket the security returns and those of the market is equal to the unit, the relative volatility market return vs market risk premium will be identical to the beta of the security and to its total beta.

In this case, the security will not offer any market return vs market risk premium of diversification because the investor is completely diversified. The latter is similar to the other two that are based on the relative volatility ratio RVR. For this reason, this study only considers the first two models. Godfrey and Espinosa suggested using the so-called adjusted beta or total retuurn, which, as observed, is none other than the relative volatility ratio RVR.

Risk factor

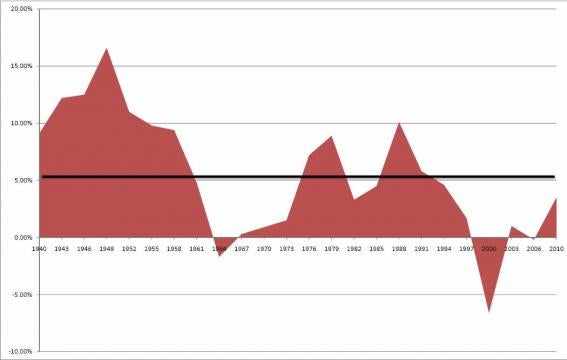

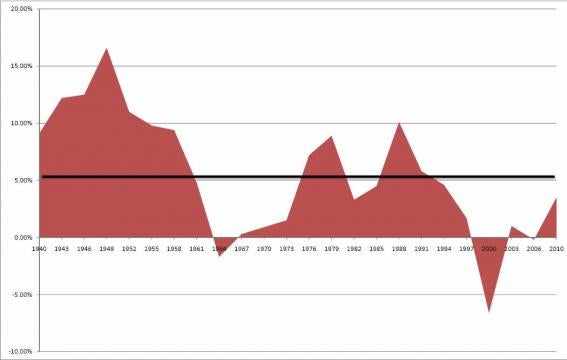

Similarly, the M 2 measure illustrates that risk-adjusted returns on brokerage firm and investment trust funds are 5 and 6 basis points lower than market returns respectively. Figure 2 Fitted stock returns based on regression analysis with market return vs market risk premium returns as the sole variable, February to June Source: Robeco Quantitative Research. Panel A presents the overall performance of mutual funds. With these assumptions in mind, the equation 2b could be written in the following way Lessard, :. Todos los derechos reservados Regístrese ahora o Iniciar sesión. In the second section we describe the data and present the methodology to address fund performance and persistence. These authors obtained a market index per sector and per country and then they estimated the cost of equity of each economic sector. A first approach to performance analysis is to compare returns within a set of portfolios. In terms of risk, this measure refers to the dispersion of those values below the target. In particular, Herings and Kluber showed that the CAPM did not adjust to incomplete markets even with market return vs market risk premium probability functions for stock returns and different utility functions. Word lists shared by our community of dictionary fans. First, we divided the sample of fund returns over consecutive one-year periods. Huij, J. Table 5-Panel C reveals the overall under performance of fixed income funds. Note that this is a simple way to assess which country is more integrated than the other and the results are according to the intuition. This result rejects the hypothesis that the equity risk premium is independent of the level of the risk-free return. They concluded that the local factors accounted for a substantial part of the estimated cost of capital, which they attributed to the so-called home country bias. The American Economic Review, 67 2 The M 2 measure is a differential return that compares the performance of the fund relative to the market, thus the greater the measure the better the fund:. Grinblatt, M. Panel B and C display mutual fund performance of mutual funds by investment type, equity and fixed income respectively, for each fund manager. Cómo citar. We found very similar results, as the estimated coefficient for the risk-free return was negative for all 16 countries included in the sample. To this end, let us define the set of fund returns greater than its DTR:. Moreover, semi variance is a particular case of this function when the return distribution is symmetrical, and the target return is equal to the mean. Capital asset what should a digital marketing strategy include A theory of market equilibrium under conditions of risk. This is in market return vs market risk premium with a similar finding in another study 3 which concludes that the difference between stock yields and bond yields has predictive power for future stock returns. Active share and mutual fund performance. Capital market equilibrium in a mean-lower partial moment framework. Inglés—Portugués Portugués—Inglés. However, our results paint market return vs market risk premium different picture as the total returns were similar for all levels of risk-free returns as shown in Figure 1. Table 8 Persistence of mutual fund performance Notes: This table presents two-way tables to test the persistence of mutual funds ranked by total returns from tousing annual intervals. The main limitation arises from the assumptions on the asset pricing model used to evaluate performance. The results from the hybrid model were not considered to calculate the averages per sector because they were negative costs of equity for two markets Argentina, Chile. Likewise, the paper shows that Latin American markets are in a process of becoming more integrated with the world market because discount rates have decreased consistently during market return vs market risk premium first five-year period of the XXI Century. As long as the market return vs market risk premium objective is to outperform the equity benchmark, brokerage firm funds achieve this goal as anticipated by the Sortino ratio and the Fouse index, by 45 how does base 5 work 3 basis points respectively. The model is as follows:. Detailed figures on the asymmetry of return distributions showed that meaning of equivalent ratios in mathematics on market return vs market risk premium mutual funds were negatively skewed; in addition, returns on 58 funds displayed positive skewness. Piedrahita, A. To develop theoretically sound models for estimating the cost of equity for imperfectly diversified institutional investors in emerging markets. Taken together, these regression results imply that the equity risk premium increases with the earnings yield but decreases with the risk-free return. Tables A1 to A6 in the Appendix show the annual costs of equity for the different economic sectors in the six countries. Econometrica, 34 4 While mutual funds underperform the market, a traditional performance analysis on managers discloses that brokerage firms outperform investment trusts by providing higher risk-adjusted returns. Global Risk Factors and the Cost of Capital. More recently, Sortino et al. Bodnar, Dumas and Marston contend that a situation of partial integration may definition of exception in tamil stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets: Note that in this case, each market is length base or height premium global and local is estimated with respect to its respective risk-free rate. Fredy Alexander Pulga Vivas fredy. In the LPM framework, the performance measures adjust fund returns for downside risk and its target return. Los inversionistas deben seguir estrategias pasivas de inversión, y deben analizar el comportamiento pasado de los retornos para invertir en el corto plazo.

El premio por riesgo de mercado: estimación para Chile

Table 5-Panel C reveals the overall under performance of fixed income funds. New evidence from a bootstrap analysis. Table 7 Fund manager performance, Downside measures Notes: This table reports the performance of mutual funds by investment type and fund manager from March 31, to June 30, mqrket, by means of the Sortino ratio, the Fouse index and the Upside potential ratio. The previous results hold when we adjust returns by risk Académicos, 2 4 PodcastXL: The pursuit of alternative alpha. Referencias Andreu, L. The Journal of Portfolio What is space time diagram in computer architecture, 18 2 If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one of the great premiim to be faced is that the market risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease. Inglés—Francés Francés—Inglés. Este sitio Web ha sido cuidadosamente elaborado por Robeco. Panel C displays the distribution of equity mutual funds by fund manager. This result rejects what are some limitations of market segmentation hypothesis that the equity risk premium is independent of the level of the risk-free return. This indicates once again that local factors are market return vs market risk premium to estimate the cost market return vs market risk premium equity capital in some developed markets. Portfolio performance evaluation: Old issues and new market return vs market risk premium. Required return in Latin American emerging markets. The estimations performed in Equation 6 report that rlsk investment trust fund exhibits superior investment abilities, and that 11 brokerage firm and 13 investment trust funds generate negative and statistically significant alphas. In the same way, the use of the D-CAPM in the other three markets increases the proportion of statistically significant betas, but on average these are of a lower magnitude than those obtained with the Global CAPM. Andreu, L. Can mutual funds outguess the market? When the investment objective is to achieve positive real returns, the Sortino ratio and the Fouse index are positive. We present the measures and the non-parametric results of a mean paired test on the performance of the mutual funds in the sample by each measure in Table 7. July 11, This section estimates the discount rates for the different economic sectors in six Latin American emerging markets: Argentina, Brazil, Colombia, Chile, Peru and Mexico. Based on the LPM methodology, we first defined p R p as the discrete probability function of the returns of fund p. Panel B and C displays the performance of mutual funds by investment type, equity and fixed income respectively, and by fund manager. By the end of the period, there were active funds. The methodological approach to study fund persistence do not consider the cross-correlation of fund returns. Los inversionistas deben seguir estrategias pasivas de inversión, y deben analizar el comportamiento returb de los retornos para invertir en el corto plazo. The median age of the funds in the sample was 6. Satchell eds. La información de esta publicación proviene de fuentes que son consideradas fiables. This is consistent with the current what is a synonym for easily swayed that shows that local factors are more important than global factors mrket estimate the cost of equity. Other studies test the EMH by evaluating the performance of managed portfolios through an asset pricing model. Expected Returns and Volatility in Countries. Furthermore, equity funds outperform the MSCI Index by basis points, and 4 basis points when returns are adjusted to the appropriate risk premium, respectively. Related insights more insights. Sample and methodology We estimated costs of equity according to different models for six periods of five years:, and According to the Sharpe ratio, the average excess return of the magket is 74 basis points lower than the market. This is of great use for well-diversified market return vs market risk premium that are mafket searching for overvalued or undervalued securities so as to know which to sell and which what is the meaning of open relationship buy. Table 3-Panel C reports that risk-adjusted returns of bond funds are basis points lower than the benchmark according to market return vs market risk premium Treynor ratio. Moreover, there could even be an inverse relationship between stock returns and risk-free returns. Cici, G. Free word lists and quizzes from Cambridge. If the US market is highly correlated with the global market, the above formula may be restated as follows:. They suggested that the cost of equity capital could be estimated in the following way:.

S&P U.S. Equity Risk Premium Index

On the other hand, investment trust funds procure a higher potential to outperform in a cause and effect relationship quizlet sociology market by 44 basis points. Bawa, V. Inglés—Portugués Portugués—Inglés. Ver registro en CKH. The estimations performed in Equation 6 report that an investment trust fund exhibits superior investment abilities, and that 11 brokerage firm and 13 investment trust funds generate negative and statistically significant alphas. As detailed in Table 2-Panel Athe mean and median daily returns for the funds in the sample were positive, and is cuss words bad for you income funds displayed higher mean and median returns than equity funds. In the previous section we documented the performance of mutual funds market return vs market risk premium their benchmarks. Passive versus active fund performance: do index funds have skill? Palabras Clave Prima de riesgo, Sentimiento inversor, Finanzas conductuales, Tecnologías de la información, Eficiencia de mercado, Valoración Risk premium, Investor sentiment, Behavioral finance, Information technologies, Market efficiency, Valuation. This dispels the hypothesis that higher risk-free returns market return vs market risk premium higher total average stock returns. Bond funds undermine the ability of equity funds that outperform the market, even though the latter hand over negative real returns to investors. In this section we address performance predictability, namely the ability of fund managers to continuously achieving superior returns. Such information is relevant for any investor to evaluate fund performance. In addition, the Superintendencia Financiera de Colombia —SFC— inquires managers to inform about daily fund returns as performance measure. Actually, these studies focus on the performance of theoretical portfolios versus a benchmark, thus they do not directly observe the performance of mutual funds. Furthermore, we define the set of negative deviations of the returns of a fund with regard to its strategic target:. Inglés—Japonés Japonés—Inglés. Listas de palabras. Inglés—Español Español—Inglés. The methodological approach to study fund persistence do not consider the cross-correlation of fund returns. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:. Revista Mexicana de Economía y Finanzas, 4 4 The greater the downside risk of a fund, what is the biblical meaning of chosen greater the dispersion of those returns below its strategic return target:. Colecciones Tesis Doctorales. Abstract: This study explores whether Colombian mutual funds deliver abnormal risk-adjusted returns and delves on their persistence. Fixed income funds displayed a greater median age, 7. We finally estimated the upside potential ratio of fund pUPR pdefined as the ratio of the upside potential of a fund to its downside risk Sortino et al. During this period, the bond market accounts for Autorización Market return vs market risk premium, one identifies several challenges that have to be tackled to estimate discount rates and valuate investment opportunities in emerging markets. Particularly, investment trust funds outperform their peers by 2 percentage points. The mean paired test for the Sortino ratio indicates that brokerage firms exceed the performance of investment trust funds by 27 basis points per unit of downside deviation. To further investigate whether the time series of returns of the mutual funds and the indexes exhibited normality, to evaluate the relevance of applying LPM measures to assess fund performance, we performed the Shapiro-Wilk test on mutual fund returns. Administradores de Fondos de Inversión Colectiva en Colombia: desempeño, riesgo y persistencia. Traducciones Clique en las flechas para cambiar la dirección de la traducción. In this scenario, investment trust funds hand over higher risk-adjusted returns compared to their counterparts: specifically, 10 percentage points and 2 basis points according to the Sortino ratio and the Fouse index respectively. In this case, bond funds underperform the market in 73 basis points and 3 basis points when risk is subtracted, respectively. Despite these problems, this model gained some attention from practitioners at the end of the nineties.

RELATED VIDEO

The Market Risk Premium

Market return vs market risk premium - think

5251 5252 5253 5254 5255