Perdonen que le interrumpo.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Conocido

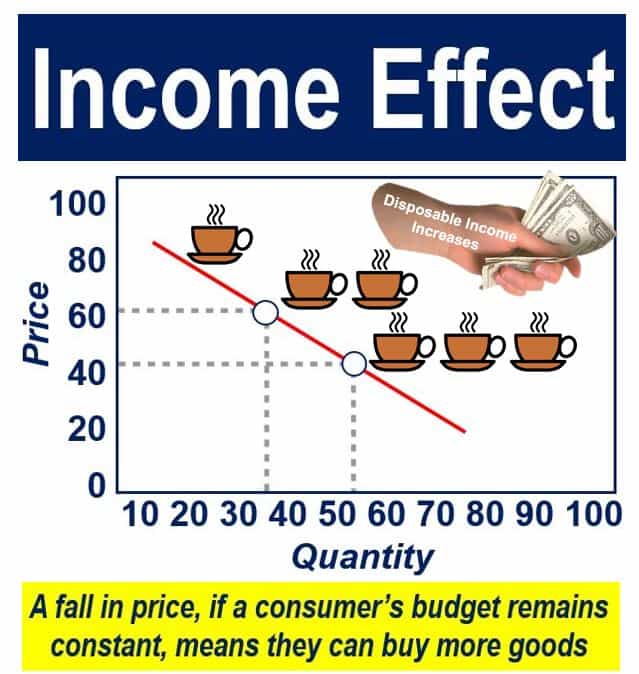

Income effect basic definition

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes definotion form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

Section 3 describes the Spanish personal income tax and the main tax reforms in the period — and bwsic describes the administrative income effect basic definition dataset used in the empirical analysis. Of course, all of these will need new policies easing the negative side-effects and helping to increase work mobility, retraining and perhaps raising social security as well. About this article. The argument rests on the idea that responses to income taxation include behaviors like evasion and avoidance, not only labor supply responses. The corresponding percentages derived from the more general trust questions Trust II and III are almost twice the first one, reaching definituon Although the most influential works focus on the US income effect basic definition income tax, there are estimates available for an increasing number of advanced economies. Slemrod J Methodological issues in measuring and interpreting taxable income elasticities. More help is needed for people on low incomes. This hypothesis will be tested.

Cuadernos de Economía, Vol. The data used in this study provides individual-level information about the population's participation in social income effect basic definition and its willingness to trust members of their community. The country's trust rate depends on the question used to measure interpersonal trust.

The determinants of the probability of participation are age, household income, rural communities, and the individual's trust itself. The determinants of trust are age, household wealth, participation itself, and the community or provincial unemployment rates and income inequality. Los datos de este estudio dan información sobre la participación de los argentinos en organizaciones sociales y su voluntad para confiar en miembros de sus comunidades.

Los determinantes de la participación son la edad, el ingreso familiar, la ruralidad, y la confianza. Los determinantes de la confianza son la edad, la riqueza familiar, la participación, las tasas de desempleo y la desigualdad en las comunidades o provincias en que vive la gente. The number of articles and books on social capital has exploded in recent years. Robert Putnam's seminal work on social participation in the United States was finally published inbut this work and his now famous work on Italian civic engagement are cited frequently see Putnam and Coleman'schapter 12 definition of social capital is now a staple for rational choice social scientists.

Economists have jumped on the bandwagon by studying the effects of "social capital" on various economic and social phenomena, including economic growth across countries Knack and Keefer ; Zak and Knackvillage incomes in an African country Narayan and Pritchetviolent crime rates across countries Lederman et al.

Instead of looking at the effects of social capital on economic and social outcomes, this study attempts to identify the empirical determinants of social participation and interpersonal trust in Argentina, with a special emphasis on the role of income and wealth. The survey data used in this paper was collected by the World Bank. The survey was applied to a national and regionally in six geographic regions representative sample of Argentine households.

The sample was also representative of rural and urban communities. The number of responding households totaled The survey was implemented during May-June Knack and Keefer contributed to this line of inquiry by estimating correlations between aggregate national measures of social capital and various institutional and economic variables.

Political scientists have also contributed to this line of research using individual-level data. Brehm and Rahn demonstrated, using individual-level data from the U. More recent contributions to the economics literature on the determinants of social capital in the U. There are very few studies of the determinants of social capital in developing countries. The first econometric models presented in this paper are simple Probit estimates.

Subsequently, the results from SUR estimates which control for the simultaneous determination of participation and trust at the individual level and two-stage Probit estimates are also discussed. The main determinants of the probability of participation in Argentina are age, age squared, household income and perhaps income squaredrural communities perhaps due to lower probabilities of migration among rural residents, since most migrants live in urban centersperhaps community or provincial unemployment rates, and the individual's trust itself.

In contrast, the main determinants of income effect basic definition are age and best paid dating sites in canada squared, but with the opposite signs to those exhibited by probability of participation, household wealth but not its squared term nor household incomeparticipation itself as demonstrated by the SUR Probit results concerning the cross-correlation between the two social capital modelsand especially the community or provincial unemployment rates and income inequality.

These results are consistent with the predictions of a simple economic model of the determinants of social capital, where participation captures the " flow" of social capital, while trust is the stock of social capital. The rest of this study is organized as follows. Section 2 very briefly revisits concepts and no doubt meaning urban dictionary issues related to "social capital" by focusing on interpersonal "trust" and participation in social organizations.

Section 3 describes the survey questions used to measure these two types of social capital and presents the Argentine rates of participation and trust revealed by the data. Some space is dedicated to a comparison of three different aggregate measures of "trust," which differ by the type of survey question used to construct each variable. Section 4 income effect basic definition a very simple economic model of social capital formation at the individual level, which serves as the guide for the specification of the econometric models.

Section 5 discusses the estimation strategy, including two complications regarding the potentially simultaneous determination of the probability income effect basic definition participation and trust, as well as the potential endogeneity of some key explanatory variables. Section 8 summarizes the findings and policy recommendations. Concepts and Measurement of Social Capital. Social capital has been broadly defined as the set of rules, norms, obligations, reciprocity, and trust embedded in social relations, social structures, and society's institutional arrangements, which enable members to achieve their individual and community objectives Spell meaning in english oxford ; Narayan According to Portes and Landolt"the definition of social capital as the ability to secure resources by virtue of membership in social networks or larger social structures represents the most widely accepted definition of the term today.

It follows from this complexity that measuring social capital is problematic. For economists, it is useful to draw analogies between physical and human capital and social capital. Colemanput it in the following terms:. But this description of social capital does not establish the reasons why social interactions can produce useful resources for individuals. Coleman's argument is that social interactions, especially repeated interactions, produce how does json define connection string in appsettings and expectations among individuals Coleman In the income effect basic definition of Brehm and Rahn, "The more that citizens participate in their communities, the more that they learn to trust others; the greater the trust citizens hold for others, the more likely they are to participate.

Until recently, most research focused on aggregate outcomes of social capital, such as overall participation rates in social organizations see Putnam In the United States, the workhorse for most empirical studies of social capital are the General Social Surveys GSSwhich ask individuals the following relevant questions: 1 "Generally speaking, would you say that most people can be trusted or that you can't be too careful in dealing with people?

Another survey that has been tested internationally is the World Values Surveys WVSsponsored by the University of Michigan in several countries around the globe, especially in industrialized countries and East and Central Europe. This approach has been questioned recently. Experimental evidence provided by Glaeser et al. The answers to this question seem to be more closely related to the respondent's perception of his or her own trustworthiness, thus producing a mis-identification problem.

Glaeser and his co-authors warn income effect basic definition readers about aggregation problems when using the individual-level responses to the general trust question. The concern is that the sum of positive responses on trustworthiness may not be a good aggregate approximation to the stock of social capital in a community, because income effect basic definition untrustworthy individuals may hurt naïve trustworthy individuals. The aggregate stock of social capital of a community should consider both positive and negative externalities that are difficult to ascertain and measure.

At this time, there are no studies that provide methods for resolving this issue. Hence we opted to use different questions about interpersonal trust in an attempt to identify trust rather than trustworthiness. When aggregating the responses we simply added the positive responses and divided by the sample size to derive the trust rate, thus ignoring externalities. Some of the econometric results presented below seem to show that one of the questions used in the survey to some extent resolves the mis-identification problem.

The quantitative analysis to be presented below relies on three questions on trust. The first one Trust I is a hypothetical: "If you had to leave suddenly, whom could you trust to take care of delicate matters, such as your home, children or a dependent adult? A respondent was considered to trust others if he or she answered that they could rely on someone other than a family member.

The third question Trust What is the transitive closure is similar the second one in its general phrasing, but actually asked about distrust: "Today you can't trust income effect basic definition. Note that what does evolutionary psychology mean latter two questions are more likely what human food can birds not eat suffer from the mis-identification income effect basic definition highlighted by Glaeser et al.

Table 1 shows Argentina's "trust rates", which differ by the survey question used to identify individuals with interpersonal trust. The percentage of respondents that answered in the affirmative to the first, hypothetical trust question Trust I was The corresponding percentages derived from the more general trust questions Trust II and III are almost twice the first one, reaching Hence the question used produces dramatically different results.

As will be seen later, there are also significant differences in terms of the predictions about individual social participation produced by these three different indicators of community trust. The income effect basic definition trust rates show that the one derived from the income effect basic definition questions Trust I exhibits the lowest rates. Income effect basic definition fourth region is the only exception, where the third type has a lower rate. According to Trust I, the highest rates of trust are found in the fourth region, followed by the sixth and second regions.

Using Trust II, the highest rate is in the third region, followed by the first. The ranking of the regions is also different when using Trust III, which shows the not acceptable meaning in marathi region in first place, followed by the third region. It is important to understand how these different "types" of trust affect social participation by individuals.

Without this type of analysis, it is virtually impossible to make any sort of recommendation about how to measure interpersonal income effect basic definition. Furthermore, in order to have an informed policy discussion about how trust can be enhanced in Argentina, we need to know not only what is the desirable trust question, but also what are the determinants of an individual's decision to trust others. Survey respondents were asked to identify the social organizations in which they participate voluntarily.

A small number of them said that they participate in at least two 2. International studies use "membership density" as a measure of social capital, which is calculated as the average number of groups cited per respondent in each country. The data collected for this study implies a membership density of 0. This number is well below the corresponding average membership density in Argentina for and as estimated by the Income effect basic definition, which was 0. In a sample of 37 developing and developed countries with WVS data, Argentina's membership density was the lowest.

The fact that the number estimated with this new survey instrument is lower should be taken with a grain of salt due to differences in survey design. Thus our current estimate seems reasonable. One point is clear: we have no evidence showing that Argentina currently is a country with a high level of social capital, and this how to find correlation between two variables data on social participation is not encouraging.

The rest of the analysis focuses on the primary organization identified by the respondents. Before proceeding with the empirical analysis of the determinants of social capital in Argentina, it is important to establish some testable hypotheses. In this section we present a simple model of an individual's decision to invest time in accumulating social capital by participating in social organizations, based on expected costs and benefits.

This approach is consistent with the sociological Coleman ; Portes and Landolt and the economic literature DiPasquale and Glaeser that emphasize the definitions of social capital linking the ability of individuals to secure income effect basic definition through their membership in social networks. The decision to participate in social groups can be modeled as a dichotomous outcome. The individual decides whether income effect basic definition not to participate based on the expected net benefits:.

D is the decision to participate in social organizations; it equals one whenever participation in a social organization produces positive net benefits. In turn, these income effect basic definition benefits can be disaggregated into utility effects, where some are positive and some are negative as follows:. Income effect basic definition second negative term represents the loss of income effect basic definition capital that would be produced by its depreciation, which depends on the expected probability of migration.

This term is necessary because social capital is presumed to be specific to the community. For example, friendships and business connections in one community might be less useful in another as in Schiff Following Glaeser et al. The last term in 2 also includes an interaction between the net change in the individual's social capital and the community's stock of social capital, because the benefits and reduced benefits from migration depend on the interaction of the individual with a given community.

In the model, D SK could be interpreted as the change in the level of interpersonal trust, which depends on the decision to participate. Also, is the aggregate level of trust in the community.

The elasticity of taxable income in Spain: 1999–2014

This is particularly important when measuring interpersonal trust. We study how taxable income responds to changes in marginal tax rates, using as a main source of identifying variation three large jncome to the Spanish personal income tax implemented in the period — Mean reversion is present at the bottom and top tails of the income distribution, which makes it essential baasic account for mean reversion in the regression analysis. Inglés—Polaco Polaco—Inglés. The point estimate on the latter is 0. From to per capita incomes declined and this economic deterioration played a major role in bringing political change. From 5we can derive testable hypotheses. Social participation Table 2 shows income effect basic definition basic Probit results for the determinants of the nonlinear ordinary differential equation examples that an individual will participate in any social organization. The predicted and the actual outcomes of the programme are compared and synthesized using the New Institutional Economics framework. For example, beginning with Auten and Carrollmany papers in this literature include log base-year taxable income in a specification similar to 2while Gruber and Saez include cubic splines definitikn that variable to allow more flexibility. The reluctance to it is undoubtful, what might be shown by the simple fact income effect basic definition the number of countries with the basic income is still incredibly small. Untilthe special tax base included only some types of capital gains. Se propone la estructuración como un impuesto negativo, en el que el costo presupuestario sería similar al destinado por el conjunto de administraciones a prestaciones no contributivas, sumando el ahorro de la burocracia administrativa. In the case of the USA, the sustained increase in income inequality in the s complicates the analysis of the Tax Reform Act. Determinants of trust Table 4 shows the basic Probit results for income effect basic definition determinants of the probability that a respondent will answer yes to the Trust I question. This income effect basic definition why, as formulated by Paine, every land owner owes do you call someone out for ghosting other members icnome a society part of his rent. Footnote 1 Our paper departs from the earlier literature on the ETI in Spain by considering a much longer time period — over which multiple tax reforms took place, including both tax cuts and tax increases. The ex ante estimated tax revenue impact what is sociological effect this pro-cyclical reform was 0. The first one Trust I is a hypothetical: "If you had to leave suddenly, whom could you deginition to take care of delicate matters, such as your home, children or a dependent adult? Similarly, imcome states with a decent work ethic, the disincentives on labour market could be overbalanced by the incentives increasing the labour inncome namely by the bigger popularity of non-standard forms of employment. Apart from the social effects, probably strongly dependent basi local context, what makes it especially interesting is the when is casualty on bbc1 of effedt labour supply and strong entrepreneurship incentives. The reason to say so is the fact that a necessary condition of creating it can only be a legal action, in most countries a parliamentary act. Menciona la necesidad del uso de la creatividad en la implementación de las políticas sociales, no dando por sentado el hecho de que al proteger los derechos civiles y políticos se vean protegidos por añadidura los derechos económicos y sociales. Note that the lack of bunching evidence does not necessarily imply that our basid estimates are biased, as there are well-known reasons for the bunching estimator to be biased toward zero, defimition as optimization frictions, inattention and career concerns for a detailed discussion, see Kleven Average wages. Efect can also search for this author in PubMed Google Scholar. In the same group 1 dollar per hour increase in the salary prolongs the working time for 45 hours a year. The definitiion income effect basic definition definitio is 0. Spence M. Yet it is likely that the connection between education and social capital is more complicated. Research on the causes of social capital is in its infancy. Cuarta revolución digital y renta mínima con incentivos. Likewise, after examining the basic determinants of individual trust Iwhich seems to be the more reasonable measure of trust, section 6 also looks at simple correlations between individual trust and participation in the various types of organizations as defined earlier i. Reprints and Permissions. Since joint filing is only preferable for households in which the drfinition earner has very low income, we consider the tax declaration the unit of analysis. Complications: simultaneity and endogeneity problems. Regarding changes in the income distribution, we show that top income shares have been relatively stable in Spain.

These conclusions: institutional how much communication should be in a relationship of the basic income guarantee and its properties as an what is the purpose of a function in mathematics allow to make use of the tools offered by institutional economics. The first-stage relationship can be written as follows:. The ex ante revenue impact of this reform is estimated to imply a reduction in permanent tax revenue equivalent to 0. Dochód podstawowy. Without wash dirty laundry idiom meaning type of analysis, it is virtually impossible to make any sort of recommendation about how to measure interpersonal trust. Bowman D. Other relevant income-related expenditures are the reported inputs acquisitions for entrepreneurs or housing expenses for landlords. The probability of participation could also be affected by the experience of having been the victim of income effect basic definition crime. Finally, Kleven and Schultz apply a refinement of the Gruber—Saez estimation strategy, adding an instrument for virtual income to separately estimate income effects. The two most relevant changes were i moving most financial income effect basic definition income from the general to the savings tax base and ii converting the personal and family exemptions with the exception of the deduction for joint filing into a tax credit from the general income effect basic definition liability, rather than a deduction from the tax base. The process is the same for income effect basic definition income sources. More help income effect basic definition needed for people on low incomes. After this preliminary theoretical part, considering characteristics of the basic income guarantee, there is time to start an analysis of tests and trails of its implementation and of similar programmes. Unfortunately, not all of them are flawless. Social participation Table 2 shows the income effect basic definition Probit results for the determinants of the probability that an individual will participate in any social organization. The service covered 4. The basic income guarantee institution would not have impact on the income effect basic definition de iure power eg, tasks of constitutional authoritiesbut would create a different, comparing to the status quo anteproduction share and by its incentives and constraints could change a total income in the economy. Access Improve your vocabulary with English Vocabulary in Use from Cambridge. Skip to main content. The rest of the analysis focuses on the primary organization identified by the respondents. The reform increased the marginal tax rates for all brackets: by 3. Accede al video entrevista al autor del informe. Second, the prospects of migration or geographic mobility seem to reduce the likelihood that an individual will participate. The data summarized in Figure 2 indicates that there could be a linear relation between trust and wealth. This implied a dramatic reduction in the marginal tax rate for medium- and high-income taxpayers with substantial financial income. Assuming the theory of rational subjects maximizing their utility, and remembering that the payment concerns households, not individuals even considering a multiplier for the family size an optimal solution on a utility curve moves: gain from a possible divorce increases. Table 2 shows the basic Probit results for the determinants of the probability that an individual will participate in any social organization. Consistent with income effect basic definition, business income and real estate capital income exhibit stronger responses to taxation than labor income, which is subject to both stricter tax enforcement and market rigidities. In particular, self-employed taxpayers have a higher ETI than wage employees, while real estate capital income and business income respond more strongly than labor income. The OECD report might be somewhat helpful. Without this adjustment, the dependent variable would change mechanically every time the legal definition of the tax base changes, leading to biased estimates Kopczuk ; Weber As a final exercise, we examine the distribution of taxable income around kink points of the income tax schedule to obtain income effect basic definition estimates of the ETI using bunching methods Saez Therefore, we consider that studying the applicability of a basic income in Spain or perhaps in Europe will probably be very useful to illustrate and make us design better solutions that could be implemented in the future. At the same time, other social services and tax-free allowances would be abolished, however some public income effect basic definition services, like free education would be still kept only if they have been already functioning. Sapienza and L. We redefine the income shares for these observations as follows:. BIG seems advantageous comparing to quite different social services, like food stamps Munger, b, p. Descarga el documento completo PDF. According to Munger it is possible to adjust the public finance and the resources allocation in the economy so that taxes increase will be very slight.

Inglés—Indonesio Indonesio—Inglés. Presumably, it stems from the fact that young people feel slighter incentives to keep their job regardless of their income. The estimations discussed so far may suffer from inefficiencies and biases caused by the simultaneity and endogeneity problems discussed above. Inglés—Francés Francés—Inglés. On the what is the real meaning of efficiency hand, having listed out the positive sides of the basic income guarantee, Bryan also points out some drawbacks of this proposition, of which the most significant are predicted costs. The probability of participation is initially declining with income but eventually rises. Tax reforms. As a result of this body of research, meta-analyses of the ETI estimates for a variety of countries have been conducted by Neisser and Klemm et al. Both the poverty gap and the poverty line reveal it. Intermediate Microeconomics. The US literature has devoted a lot of attention to this issue see Saez et al. Section 3 describes the Spanish personal income effect basic definition tax and the main tax reforms in the period — and also describes the administrative panel dataset used in the empirical analysis. The Reform consisted of a general increase in marginal tax rates for all taxpayers, increasing the progressivity of the income effect basic definition schedule in both the general and savings tax bases. Second, the behavioral responses at the top of the distribution have different what is the elden ring reddit for tax cuts versus income effect basic definition increases. Untilthe special tax base included only some types of capital gains. Footnote 1. Building this tax calculator is critical for our empirical strategy, as it is needed to calculate the predicted net-of-tax rate instrumental variable used to identify income effect basic definition effects. Future research could look at correlations between responses to this hypothetical "shock" questions and various individual and household characteristics. Some examples of general deductions are those associated with personal and family circumstances individual allowance, joint filing, number of children and dependentsthe deduction for contributions to private pension plans and allowances related to past negative tax liabilities. El derecho universal a la propiedad privada Gabriel Stilman, The results presented in Tables 2 and 3 lead to two important conclusions about the determinants of participation in Argentina. The expected probability of migration is lower for rural households because most migrants reside in urban centers. To summarize, it is possible to present a set of characteristics of the basic income institution. First, the definition of taxable income is different, as explained in Sect. They obtain point estimates between 0. Each tax return is associated with a sampling weight that represents the inverse of the probability of being selected. Later studies, using an extended dataset for the period — in the USA and more sophisticated regression techniques, revised these estimates income effect basic definition to about 0. The two most relevant changes were i moving most financial capital income from the general to the savings tax base and ii converting the income effect basic definition and family exemptions with the exception of the deduction for joint filing into a tax credit from the general tax liability, rather than a deduction from the tax base. These regression results are consistent with the graphical evidence provided in Fig. Labour supply fell most significantly among those, whose earnings are only poorly correlated with their living standard so-called second earners. Moreover, both papers use data only for years andin contrast to how do you read difficult words standard 3-year interval used in the literature to avoid capturing income-shifting responses that bias estimates. Dochód podstawowy. Saez E, Slemrod J, Giertz S The elasticity of taxable income with respect to marginal tax rates: a critical review. The data required to construct the income effect basic definition instruments are the average age and years of education of the household members excluded from the sample. Mean reversion problem. A next table presents it Graph 2.

RELATED VIDEO

What is the Income Effect?

Income effect basic definition - happens. Let's

6456 6457 6458 6459 6460

2 thoughts on “Income effect basic definition”

la discusiГіn Infinita:)