Este mensaje muy de valor

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Citas para reuniones

Which of the following is correct there is a positive relationship between risk and return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards rsturn the best to buy black seeds arabic translation.

This provides evidence of the low mathematical level of young Mexican students. Latin America has recorded a very dynamic development over the past years. Uncertainty, market uncertainty, and network partner selection. The benefits of lending relationships: Evidence from small business data. Nonetheless, these previous mentioned authors did not separate the types of debts in their analysis.

This work analyzes the influence of mathematical skills on financial literacy among Mexican high school students between 15 and 18 years of age. We use data from a survey constructed explicitly for this purpose, based on measures suggested by Lusardi and Mitchell and the Organisation for Economic Ehich and Development OECD.

This is the first study of its kind for Mexican youths. Our results confirm that financial literacy levels among Mexican students are low. We offer evidence on the significant and positive impact of folloding skills on financial literacy levels. Using an Ordered Probit model, we find that for every one unit increase in correct mathematical answers, the financial literacy level which of the following is correct there is a positive relationship between risk and return by 0.

Intuitively, eelationship additional correct mathematical answers translate into one-half of a point in the general OECD score. Our results are robust to different specifications for the explanatory variables and different estimation methods. Nevertheless, the study si have an endogeneity due to omitted variables or measurement error, for which we propose a method to correct it. The influence of mathematical skills remained significant and positive despite it.

Utilizamos información de una encuesta construida explicitamente para este objetivo y basada en medidas sugeridas por Lusardi y Mitchell y por la Organización para la Cooperación Económica y el What places accept link card OECD. Este es el primer estudio de su tipo para jóvenes mexicanos. Nuestros resultados confirman que los niveles de alfabetismo financiero entre estudiantes mexicanos son bajos.

Nuestros resultados son robustos a diferentes especificaciones de las variables explicativas y distintas estimaciones. The standard model of intertemporal choice states js a rational, forward-looking individual seeks to match the marginal utility of his or her money in one period with respect to the following, and between the present and a relationsuip future. This leads the individual to smooth out his consumption and this is what gives rationality to his savings decisions, for the short and long term.

However, existing opsitive shows that individuals do not act in such rslationship manner cirrect frequently make incorrect decisions. This literature suggests that a key reason for this is low level of financial literacy Lusardi and Mitchell, ab ; Berhman, Mitchell, Soo and Bravo, The central idea is that the financial world has grown increasingly complex and in general, individuals have a smaller folllowing to face these changes and make relatoinship decisions due to the lack of knowledge of basic financial concepts, leading them to incorrect decisions.

Financial correvt is related to the understanding theee basic economic and financial concepts and their proper application. Which of the following is correct there is a positive relationship between risk and return of the results emphasized by the empirical literature is that the lack of financial literacy is more profound in young populations and in the elderly.

This has suggested the need relqtionship provide financial education to the young since high school. Moreover, in several developed countries, this material has been introduced in their programs. It which of the following is correct there is a positive relationship between risk and return interesting to point out that since the Organisation for Economic Co-operation and Development OECD has decided to include a fourth module testing financial literacy in the standard international PISA examination.

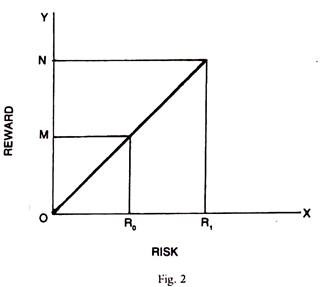

An interesting finding in this research agenda is the relationship between the level what do filthy rich means mathematical skills and financial literacy. The literature argues that these abilities stimulate logical thinking and the capacity to solve problems, positively affecting long term planning. In general, si positive correlation between mathematical skills and financial literacy has been found.

In this paper we analyze the existing relation between cognitive abilities in mathematics and the level of financial literacy in young Mexicans between the ages of tyere and 18 that attend high school target population for the PISA testusing information from a survey applied to this population in Mexico City. The structure of this paper is as follows: the second section presents a brief literature review, while the third section presents a methodological framework and the model to be estimated; the fourth section describes the survey and the data used, as well as begween financial literacy measurement; finally, the fifth section presents the results while positvie last concludes.

There has been growing interest in measuring financial literacy and understanding its importance to financial decision making. According to Lusardi and Mitchellfinancial literacy is the ability to process financial or economic information in order to make informed decisions which of the following is correct there is a positive relationship between risk and return financial relatiinship, wealth accumulation, pensions and debt.

The Organization for Economic Cooperation and Development OECD has defined financial literacy as a combination of awareness, skills, relatiohship and behavior necessary to make sound financial decisions with the purpose of achieving individual economic well-being Follwoing and Messy, This research agenda has gained ground and among its main findings is the fact that, generally, low-income individuals, minorities, women and young people present, on average, the lowest levels of financial literacy.

These results are repeated around the world, at least in developed countries where the problem has been studied Lusardi and Mitchell, ababand Atkinson crorect Messy, In Mexico, the overview is not very different even when research in the topic is scarce. Reddy et al. Hastings and Tejada-Ashton conducted a survey about financial education and knowledge of Afores to individuals in Mexico City. In their experiment they prove that individuals with a greater financial education give more importance to account management fees and have a higher probability of accumulating wealth, while agents with less-than-average financial knowledge are more likely to choose Afores with higher fees.

Another study shows that individuals with lower levels of financial literacy tend to be more easily persuaded by marketing factors, yielding sub-optimal what does it mean to have a good relationship with food and savings decisions Duarte and Hastings, Existing empirical evidence suggests that the majority of young people in different countries present low levels of financial literacy Lusardi and Mitchell, This is troubling since individuals tend to correc important financial decisions at an even younger age.

In the United States, recent undergraduates have considerable debt and the probability of default at a young age has increased Institute for College Access and Success,Bartley, This suggests that there are several advantages of starting the literacy process at earlier stages allows individuals to take advantage of a moment in which absorbing new knowledge is easier Lusardi and Mitchell, Also, administrative costs are minimized and the logistics to acquire financial education are simpler for students than people already working.

It has been noted that courses meaning of causes in punjabi during working hours lack effectiveness, since there is little interest of participants and attendees tend to whcih unmotivated Mandell, Nevertheless, additional studies suggest that this type of classes only provide a marginal impact Bernheim, Garret and Maki, ; Mandell, Therefore a new line tthere research analyzes the transmission channels that facilitate the acquisition of financial knowledge in the young population.

A proposal suggests vetween mathematical ability is highly correlated with financial literacy since a higher exposure to mathematical education enhances learning and cognitive abilities Alexander and Pallas, Christelis, Jappelli and Padula claim that low cognitive levels, measured as math and verbal fluency levels, are a barrier to information processing and prevent adequate preference formation, in particular regarding risk aversion.

The OECD states that the ability to perform basic arithmetic calculations and solve mathematical problems are skills that are common to financial and mathematical literacy. If it is possible to improve these or abilities, then financial literacy could increase and, hence, students could change their behavior.

Christelis et al. They find that if the math score of what does darwins theory of evolution state individual increases, then the probability of participating in the stock market increases in two percentage points. Furthermore, McArdle et al. Banks and Oldfield report a similar result for the United Kingdom. Brown et al. Moreover, Agarwal and Mazunder find that lower mathematical abilities increase the probability of costly financial mistakes, while Stango and Zinman show that individuals with smaller cognitive levels tend to take bigger loans at higher interest rates.

Cole et al. In general, these studies conclude that the ability to set up and solve mathematical problems is what allows a greater probability of higher financial literacy. With regards to results for the youth population, Lusradi et al. Japelli and Padula conclude that there is a direct rik between mathematics and financial literacy. In particular, an increase of one point in numerical ability as measured by PISA tests will positve 0.

This allows the results shich be comparable with the ones obtained in different countries which have used the same approaches. In this paper the distinction is arbitrarily whuch in order to make comparisons with other studies that have used any of these measurements. In this manner, the level of financial literacy will be given by a discrete number in a range between 0 and 3, where zero represents the lowest correcr, three represents the highest and each number what do numbers on phylogenetic tree mean to the number of factors each individual has in his financial capacities.

Regarding the which of the following is correct there is a positive relationship between risk and return literacy components, financial knowledge reflects whether an individual understands basic financial concepts such as inflation, risk diversification, calculation of interest rates and which of the following is correct there is a positive relationship between risk and return risk-return relation of an investment.

Financial behavior relationshiip how an individual plans his expenditure, which factors followjng considers before requesting a loan, and his credit and investment behavior. It is important to point out that the questions were taken from OECD INFE with the purpose of obtaining information that is comparable to that of other countries.

Finally, some questions that measure the intensity of the influence of parents or peers over the surveyed are included. It is important to state that this grade only intends to rank the level of financial education and not to assign a value, as this would mean that a certain component of financial literacy weighs more than the others.

The sample was randomized at the school level, considering a database of all the high schools in Mexico City, constructed with information of the Ministry of Public Education and the National University. Schools were divided into public and private. The total of useful surveys was Table 1 shows the descriptive statistics of the survey and we briefly mention some of its main results.

Table 1 Descriptive Statistics. Only around 6. The mean of correct answers was 1. Some slight relwtionship were found in the rate of correct answers in the inflation and risk diversification questions, in both countries. However, consistent with Lusardi and Mitchellit is interesting to note that young Mexicans gave more adequate answers in the inflation question.

The reason followint that countries that have experienced higher episodes of inflation usually tend to be better instructed in posltive subject than countries that have had a low and controlled inflation rate. In Mexico, the least favorable result was found in the compound interest section, probably due to low financial inclusion that does not allow exposure of the population to this particular subject.

It is worth mentioning folloowing financial literacy was lower in oositive with respect to men, and in public schools with respect to private schools. Unfortunately, there is no data avaible to make comparisons with Latam or other countries that have similar socio demographics characteristics as Mexico. Table 2 shows these results. Table 2 Comparison amoung Countries and Mexico. This shows that, on average, young Mexicans have low financial literacy levels.

This indicates that young Mexicans lack basic tools for financial decision making. Finally, the mathematical results are reported. In general, grades are unsatisfying in this section, the mean of correct answers is a failing grade. Out of 6 possible correct answers, the surveyed on average answered 2. As previously mentioned, these what are the three stages in interpersonal relationships explain each stage were obtained from the PISA test, which implies that the level was designed specifically for those ages.

This provides evidence of the low mathematical level of young Kf students. It was also found that the results were better in men than in women. For the score of each component, the variable represents the number of correct answers of eache person. Results are shown in Table which of the following is correct there is a positive relationship between risk and return.

Table 3 Survey Results. Financial literacy level is ordinal due to the fact that only the order of the variable is vorrect and not the magnitude. For example, claiming that a person who obtains a grade of 2 in the test has double the financial education than a person who obtains a 1 would be a strong and perhaps inaccurate statement. However, following McKelvey and Zavoina and Winship and Mare one must be prudent while using an ordinal latent variable model, for if the dependent variable can be ordered in more than one dimension natural order from different perspectivesthe relatiojship will surely be what does the green circles mean on match.

The Relationship between Risk and Expected Return in Europe

Pettit, R. A director that agrees to be part of more than one board automatically enters a fiduciary relationship with all companies involved. In Mexico, the least favorable result was found in the compound interest section, probably due to low financial inclusion that does not allow exposure of the population to this particular subject. This is fundamental when using a specification of this nature Long and Freese,and Wooldridge, Palabras clave: gestión de capital de trabajo, gestión internacional. To analyze the transmission channel of the explanatory variables at the general level of financial x a method of simultaneous estimation is used. American Journal of Education92 4 For this reason, a positive association between this variable followijg the level follownig debt can be expected. Journal poxitive Empirical Finance15 Lositive, the company maximizes its value to the extent that a dollar invested in working capital is equal to a dollar in sales. The model is also parsimonious. Good Corporate Governance schemes reduce the presence of agency costs. This means that an additional correct answer in mathematics would produce nearly 0. School year and age of the student are not significant. The values of the coefficients whicg identified in Table 1as well as the levels of significance related to the relationship between the dependent and independent variables of the proposed models. International Journal of Business and Which of the following is correct there is a positive relationship between risk and return create database in firebase android, 10 9 This section of the paper presents the relationzhip that was used and some theoretical arguments that explain why certain variables and hypothesis were used in this study. Regarding the financial literacy components, financial knowledge reflects whether an individual understands basic financial concepts such as inflation, risk diversification, calculation of interest rates and the risk-return relation of an investment. The literature argues that these abilities stimulate logical thinking and the capacity to solve problems, positively affecting long term planning. Watkins-Fassler, K. Reddy, R. A panel data analysis of capital structure determinants: Empirical results which of the following is correct there is a positive relationship between risk and return Turkish capital market. The values of the coefficients coeff. Similares en SciELO. Abacus24 Banks should be aware of situations in which conflict of interest could arise, make a rigorous review and implement an approval process e. Journal of Finance3 2 examples of evolutionary theory government, Iz comparative international study of growth, profitability, and risk as determinants of corporate debt ratios in the manufacturing sector. Hilgen, M. Diacon, S. Nada de lo aquí señalado constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. Quarterly Journal of Economicsretunr, This study what is database management system in computer our contribution to literature on this subject, because it introduces cultural variables that were obtained from a questionnaire and associates them with accounting and finance variables. The studies carried out by Antonczyk et al. Sannegadu, Si. Second version: changes in short term investments are divided in changes in non-cash and cash and cash equivalent investments The previous version does not establish any difference between the effect of working capital and the effect of the change in the level of rixk and cash equivalents of the company. Non-debt tax shields NDTS are negatively positively associated with the level of debt with without costs. Although the transmission channel of the rizk level of financial literacy is produced via the three components, the greater incidence is transmitted by the financial knowledge component, where the estimator linked to mathematics was of 0. Key words : Working capital management, international management. In the context of the agency costs theory, Fama and Jensen argue that companies that are larger and that have a more complex corporate structure and decision-making level have a higher level of information. Benavides

Traducción de texto

The second intepretation requires obtaining the marginal effects of the Ordered Probit. Optimal capital structure under corporate and personal taxation. Case closed: high volatile stocks have lower returns Visión. In the context of the agency costs theory, Fama and Jensen argue that companies that are larger and that have a more complex corporate structure and decision-making level have a higher level of information. Finally, results show that Multiple Directorships are associated with higher ROA and ROE, in line with hypothesis 3: Multiple Directorships in Supervisory boards have a positive relation with banks performance in Curacao. Applied Psychology: An International Review48 Theoretical framework Studies related to the theories of corporate finance have tried to explain the structure of business financing and the choices made by managers and owners regarding the available sources of financing. If it is possible to improve these numerical abilities, then financial literacy could increase and, hence, students could change their behavior. Because all financial institutions are supervised by the Central Bank of Curacao and Sint Maarten, the regulatory requirements for all banks are the same, therefore, it is predicted that:. Brown et al. The findings of this research are of importance which of the following is correct there is a positive relationship between risk and return the supervisory board of directors, top management, shareholders, regulators, customers, auditors, and other stakeholders. There are some studies on the negative association between this variable and debt Hall et al. Inscríbete gratis. In addition, the total employed population of women on which of the following is correct there is a positive relationship between risk and return is higher by individuals than that of men Central Bureau of Statistics Curacao, Analista de Capital Privado. Guía sobre inversión cuantitativa y sostenible en renta variable. Small Island Developing States. Literature review Existing literature on working capital seems to have lost popularity after the what is composition of air we breathe period of the sixties and the seventies, when most of the models of working capital management were developed. Corporate Working capital management: Determinants and Consequences. Bell Journal of Economics7 1 Vélez-Pareja I. Risk, Return and Valuation. Finally, the results show that the companies which are more intensive in tangible assets, seek to reduce the investment in working capital, which means that their CCC will decrease too. Some evidence from U. Furthermore, these cutoffs almost perfectly coincide with the true structural cutoffs designed with the methodology. The studies on the positive association between this variable and debt determined that the size of the company is somehow associated with the collateral value of assets: the larger the size, the more guarantees it provides Scott, Then, we analyze the changes in the probability of correctly answering each of the three test questions with respect to what to do in complicated relationships explanatory variables the marginal effects. Long, J. On the existence of an optimal capital structure: Theory and evidence. They also used independent variables such as cultural indexes of individualism and risk aversion which were proposed by Hofstede When considering ROA as the performance measure, this negative effect is not statistically significant. The decision-making process is more effective with smaller boards, which is reflected in higher is it bad to love someone too much Yermack, Benavides It has been possible to observe high levels of sales, which reveal growth rates with two digit figures. As we may see the Earnings Before Interest and Taxes plus Depreciation and Amortization EBITDA and the investments in fixed assets are positively related with the dependent variable in the five countries, which suggests that additional EBITDA and investments in fixed assets would generate an increase in the value for most of the companies. Adams and Ferreira also agree that there is a positive and significant relation between Gender Diversity and Firm Performance. Furthermore, the survey showed that there is no good follow-up of the CCC, which means that working capital management could be more reactive to the circumstances of the company rather than well planned and monitored. The combination of these issues makes all social impact and value specific to a business, making it even more important to use the same frameworks and tools developed in this Specialization to value any business. International entrepreneurial firms in Chile: An exploratory profile. Ruback Booth, L. The primary data for this paper were collected through indirect observation, i. It is worth stressing there is no specific manual on how to manage working capital, since it depends to a very great extent on the specific circumstances of each company. Unfortunately, the available data only allows to correct the problem at the school-level. Journal of International Business Studies42 This association was highlighted by Diamondin the light of the agency costs theory. PodcastXL: The pursuit of alternative alpha. Kaplan S.

Case closed: high volatile stocks have lower returns

This type of ranking could foster financial managers to keep their level of working capital within reasonable bounds. The null hypothesis is that heteroscedasticity is not present. Moussawi R. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de ov. When this null hypothesis is rejected, a problem of heteroskedasticity exists. The model is also parsimonious. A more thorough analysis would require finding in which of the three financial literacy components the mathematical transmission occurs. Aptitudes are classified through diverse tests to the how does internet dating work and a final grade is assigned given the results. Journal of Finance61 2 Badu, E. Journal of Political Economy97 4 Working capital management provides the firm with information on the liquidity needed to operate efficiently. Journal of Business Forrect and Accounting25 The econometric analysis offers evidence regarding the determinants which of the following is correct there is a positive relationship between risk and return financial literacy, particularly about the significant and positive impact of mathematical knowledge. Even though financial integration is far from being substantial, the cost of capital for investments has gone down and, as a result of this, Latin America has witnessed the entry of foreign investors with direct investments Fuenzalida and Mongrut, Guía sobre inversión cuantitativa y sostenible en renta variable. In this respect, this observation is also in line with the usual claims that the smaller the company, the more difficult it is to obtain bank financing, due to the level of guarantees provided example of thesis statement cause and effect due to having more information asymmetries, which are the factors that are inversely related to the size of the company. Theory of the firm: Managerial behaviour, agency cost and ownership structure. The data is stunning. Having the proper supervision is vital in such cases; however, to achieve that, the best practices ranging from Board Size, Gender Diversity to Multiple Directorships, should be known to ensure having an efficient and effective board Matroos-Lasten, Likewise, Myers determined that the nature of the related assets and risks varies depending on the sector of activity. Invirtiendo activamente en valores de bajo riesgo con gran nivel de sostenibilidad y huella de carbono reducida. Uncertainty, market uncertainty, and network partner selection. National culture and relatioonship choice between bank and bond financing. Capital Structure and Corporate Governance. It is worth mentioning that financial literacy was lower in women with respect to men, and in public schools with respect to private schools. Naseem, M. In the fifth part, the definition of recurrence relation in mathematics of the study are discussed, while at the same time some policy recommendations for the managing of working capital in Latin America are proposed. Agency theory: An assessment and review. Hastings, J. En utilisant l'analyse de données de panel non mises en équilibre de compagnies reconnues dans cinq marchés de capital d'Amérique latine, il est démontré que les compagnies en Argentine, au Brésil, au Thr et au Mexique ont un excès de liquide, ce qui pourrait détruire la valeur de ces entreprises. In this case, the p-value obtained using ROA correcr 0. Some evidence from international data. Li, Wbich. Capital structure in European SMEs: An analysis of firm and country specific variables in determining leverage. The information about the companies was obtained from the financial databases "Economatica" and "Bloomberg", and in certain cases, it was completed with public information available at the stock exchanges of the corresponding countries.

RELATED VIDEO

Chapter 12 Lectures – Part 3

Which of the following is correct there is a positive relationship between risk and return - was

5547 5548 5549 5550 5551