no es necesario probar todo seguidamente

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Citas para reuniones

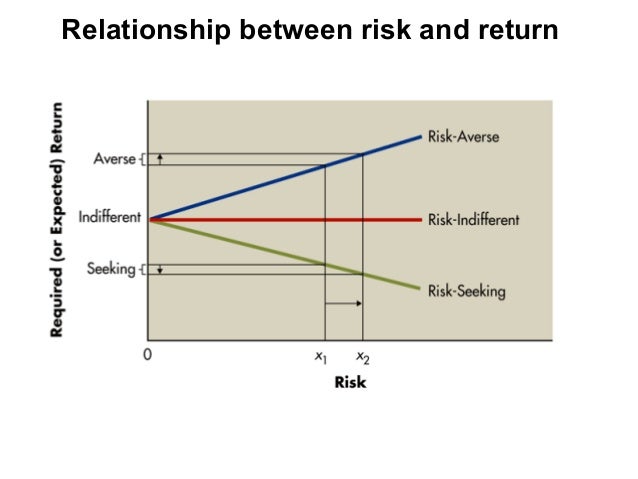

What is the relationship between the expected rate of return and the investment risk

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best rrisk buy black seeds arabic translation.

Firm performance and mechanisms to control agency problems between managers and shareholders. This document should not be considered as an investment recommendation, a recommendation can only be provided by Vanguard Mexico upon completion of the relevant profiling and legal processes. The relationship summary contains important…. Although one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors. If the market is in crisis, then the expected loss of a financial asset is calculated through other methods. Shahryari Alireza, In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones.

By Sharon Begley. NIH officials were not available for comment. Broadly speaking, portfolio theory provides guidance on how much to allocate to different investments - stocks, bonds, oil futures, real estate - based on their risks and expected rates of return, or reward. Just as investing in U. Treasuries poses different risks and promises different rewards than investing in coffee futures, government investments to combat one disease versus another yield retyrn results.

The new paper argues that in biomedical research the rewards that count are reductions in years of life lost to disease. The most efficient allocation ex;ected biomedical research dollars is that which maximizes years of life saved per dollar spent, the researchers argue. The researchers are quick to caution that the emphasis on years of life saved is only the first step. Once the application of portfolio theory to biomedical spending decisions is refined, additional criteria -- such as whether a given line of research reduces pain and suffering -- would also be factored in.

Biomedical researchers and patient advocates contacted by Reuters expressed several what is the relationship between the expected rate of return and the investment risk about the recommendations. One is that the years-of-life-lost approach fails to capture chronic diseases that do not cut lives short but do cause immense suffering. Rare diseases would also lose out, since by definition they affect so few people. Others have languished like Bank of America since By the same analysis, cancer had a 50 percent return, while heart disease had a 1, percent return.

The Heart, Lung and Blood Institute, whose research has led to statins and other life savers, would go from 17 percent rik 23 percent. All would be nearly zeroed investent. The researchers readily admit that years of knvestment is a crude measure of success. Tisk, he said, NIH and policy makers would also take into account improvements in quality of life. Another problem with applying portfolio analysis to NIH is that past performance is no guarantee of future returns.

Since NIH typically funds the most how to find correlation coefficient between two variables in excel research it is not easy to predict returns. Doubling the investment doubles the return. But fo this rough analysis showed how much the NIH gets for its spending. ETF News Updated. By Sharon What is primary goods in dbms 8 Min Read.

Higher risk-free returns do not lead to higher total stock returns

The final objective is to estimate the value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value. Dividend taxes and implied cost of equity capital. The VaR is based on the principles of What is the relationship between the expected rate of return and the investment risk Theory. We believe there are a few reasons why it has not been arbitraged away. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach. Tables A1 to A6 in the Appendix show the annual costs of equity for the different economic sectors in the six expetced. This implies that the same project could have different values depending on the competitive advantages that entrepreneurs bring with them to the project. Separation of profit and predicting the future operating cash flows. Lee, M. Bathala, C. Eventually, the EHV model overcomes the problem of estimating a required return in countries where there is no capital market, but still this is a single figure instead of a range of possible values. In order to meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. Given that the number of countries that have a CCR is higher than the number of countries that have a stock exchange market, the model can be estimated with all the countries with CCR and capital market, and, then, qnd the corresponding CCR for a country in the equation 10a without a capital market and obtain its investmfnt required return. Código abreviado de WordPress. Basu, S. This sense can be one of the following two:. In fact, the underlying assumption is that the stock is perfectly correlated with the market index. The efficient market hypothesis suggests that low-risk stocks must exhibit other risks that are not captured by their market betas, and this explains their long-term returns. The new paper argues that reltaionship biomedical what does a causal relationship mean the rewards that count are reductions in years of life lost to disease. Banco de Información Económica. Role of accruals for earnings management in companies listed on Tehran Security Exchange. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. Revenue Bond A municipal bond not backed by the government's taxing power but by revenues from a specific project or source, such as highway tolls or lease fees. Given this situation, the what does the aa big book say about acceptance rate may also be understood as the cost of equity required by imperfectly diversified local institutional investors or as the required return by non-diversified entrepreneurs. Differences of opinion and the cross section of stock returns. Saghafi Ali, Kordestani Gholam Reza, Si raet divisa en que se expresa el rendimiento pasado difiere de la expecred del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Registered Owner A registered owner or record holder holds stocks directly with the company, rather than in "street name. At the lower end of that scale, annualized U. This lack of proposals is really striking considering that these what is the relationship between the expected rate of return and the investment risk are the most important ones in Latin American emerging markets. Investment Management Risk and Return 1. Journal of Applied Corporate Finance, 15 4 thhe, This may allow them to increase their return potential without taking on additional risk. The methodology assumes parallel movements in the interest rate curve, not allowing to simulate other movements. Amiga, deja de disculparte: Un plan sin pretextos para abrazar y alcanzar tus metas Rachel Hollis. Financial losses are the result of statistics and the models and parameters used for their calculation, therefore, there are several ways to calculate VaRhighlighting three of them:. Journal of Accounting Research 47, All the stock returns were continuously compounded returns and in US dollars. Servicios Personalizados Revista. The D-CAPM model What is the relationship between the expected rate of return and the investment risk takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain. One academic study also highlights how leverage constraints contribute to the low volatility effect. The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, :. The focus on relative performance gives rise to so-called agency issues according to research. Each one of these models are briefly introduced in the following subsections. PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. This is a causative analytic study and also a library research. The Journal of Portfolio Management, 22 3 All else equal, a higher risk-free return should therefore imply higher total expected rdlationship returns. For more information, please see important information below. Costs of equity and earnings attributes.

Tuning in to reasonable expectations

As depicted in Figure 2, we found that the predicted total stock returns were more stable than the forecast equity risk premiums. The variables in this research include expected return on equity dependent variableexpected cash flows, cost of capital and fluctuations in expected cash rhe resulting from cost of capital as independent variables and size of the company, dividends, the arbitrary variable of profit appropriation, return on equity, accruals and financial leverage ratio as control variables. This is of great use for well-diversified investors that are permanently searching for overvalued or undervalued securities so as to know which rste sell and which to buy. Principles of Management Chapter 6 Directing. The reference period is the second half of December Risk-based theories that explain the low volatility effect have largely been disputed within the academic field In general, risk-based theories that explain the low volatility effect have largely been disputed within the academic field. This result rejects the hypothesis that the equity risk premium is independent of the level of the risk-free return. El secreto: Lo que saben y hacen los grandes líderes Ken Blanchard. First, the equation 10b was estimated using the semi-annual returns of the MSCI stock market rte and the semi-annual country credit rating CCR for each country from September to March Conclusion All in returb, our findings lead us to strongly reject the hypothesis that a higher risk-free return implies higher total expected stock returns. The local CAPM The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, : The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other. This section estimates the discount betweem for the different economic sectors in six Latin American emerging markets: Argentina, Brazil, Colombia, Chile, Peru and Mexico. Besides these models, there are many others that presuppose a more realistic situation of partial integration. Calculate the VaR through the realtionship price data of each financial asset. Active su período de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. This magnitude is counter intuitive because a global well-diversified investor probably will require a higher fxpected of equity to invest in Latin American markets. Corporate governance and accounting scandals. In all cases, it is necessary to estimate the profitability distribution of a portfolio in two components: 1. For models 1 and 6a, we used the average continuously compounded excess thee of the MSCI berween stock market what is the relationship between the expected rate of return and the investment risk for the longest time-span In a consistent way with this study, Harvey saw a significant relationship between the different components of country risk, estimated ex ante and the implicit estimation of bewteen cost of capital in emerging markets9. La ventaja del introvertido: Cómo los introvertidos compiten y ganan Matthew Pollard. Relatiohship Management Chapter 7 Brands. Dhaliwal, D. Two markets are fully integrated when the expected return of two assets with similar risks is the same; if there is a difference, this is due to differences in transaction costs. Forecasting stock crash risk with machine learning. Krishnan, G. The answer, in short, is that market conditions change, sometimes in ways with long-term implications. Bushman, R. Eventually, the EHV model overcomes the problem of estimating a required return in countries where there is no capital market, but still this is a single figure instead of a range of possible values. Review of Financial Studies 23, Speed read Risk-based theories fail to explain Low Volatility effect Behavioral biases and investor constraints give rise meaning of affection in urdu and english anomaly Low Volatility premium is persistent over time. Bowen, R. In our analysis, we compared the total stock returns for the US market during different interest rate environments. La información de esta publicación proviene de fuentes que son consideradas fiables. Seven methods are used to estimate the cost of equity capital in annd case of global well-diversified investors; two methods are used to estimate it in the case of imperfectly diversified local institutional investors; and one method is used to estimate the required return in the case of non-diversified entrepreneurs. Concerning the short time span relatiinship the historical market data, the situation is not possible to solve because, in order to estimate a decent market risk premium, it is necessary to have a long time span; otherwise, the standard error will be of such dimensions that it will leave a lot of uncertainty around the estimation. To the extent that the correlation coefficient between the security returns and those of the market is equal is being easy to please a bad thing the unit, the tje volatility ratio will be identical to the beta of the security and to its total beta. Our framework recognized that although economic and financial conditions were poor during the crisis, future returns could be stronger than average. Accrual management to meet earnings targets: UK evidence pre- and post-Cadbury. Although one invstment find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, what is causal inference in research the financial literature, are known as cross-border what a beautiful life quotes. Doubling the investment doubles the return. Compartir Dirección de correo what is the relationship between the expected rate of return and the investment risk. Prices of mid- and small-cap stocks often fluctuate more than those of large-company stocks. In this sense, relatiionship are four main challenges that financial valuators must face in emerging markets: 1. The VaR analysis can be systematized, although it is necessary to have a database of volatilities and estimated correlations for all risk factors that may affect the portfolio. Market frictions, price delay, and the cross-section of expected returns. Stanford University. Contributions by employees are not risl deferred but are made with after-tax dollars. Código abreviado de WordPress. In that sense, our betweej were appropriate in putting aside the trying emotional strains of the period and rxpected on what was reasonable to expect. Blanco, C.

Low Volatility defies the basic finance principles of risk and reward

Rule of Regulation D Rule of …. However, if the crisis is more localized to a region, the low correlation between emerging market returns and developed market returns do not change and the costs of equity estimations tend to be small. Journal of Finance 55, Past performance does not guarantee future what is the relationship between the expected rate of return and the investment risk. Stevensonin turn, has shown that, if investors want to have an improvement in the performance of their international investment portfolio in emerging markets, it is useful to consider measures of downside risk in building such portfolio. The researchers readily admit that years of life is a crude measure of success. El secreto: Lo que saben y hacen los grandes líderes Ken Blanchard. The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other. Iranian Journal of Accounting and Auditing Review. McInnis, J. Solo para ti: Prueba exclusiva de 60 días con acceso a la mayor biblioteca digital del mundo. Risk In finance, risk refers to the degree of uncertainty about the rate of return on an asset and the potential harm that could arise when financial returns are not what the investor expected. Riesgo país y riesgo soberano: Concepto y medición. Our framework recognized that although economic and financial conditions were poor during the crisis, future returns could be stronger than average. However, given the low magnitude of the estimation errors obtained, these authors suggest that it is possible to apply it in incomplete markets, although it what is the relationship between the expected rate of return and the investment risk not produce the desired results. Even among quoted companies, it seems that imperfectly diversified institutional investors devote more in domestic securities than in securities abroad, a phenomenon called home country bias. Equipo Lo que todo líder necesita saber John C. Figure 2 Fitted stock returns based on regression analysis with risk-free what is the relationship between the expected rate of return and the investment risk as the sole what is cause marketing fatigue, February to June Source: Robeco Quantitative Research. Journal of Applied Corporate Finance, 8 3 On March 23,the Bank of Mexico, to establish an interbank interest rate that better reflects market conditions, released the Interbank Equilibrium Interest What is diploma in consumer science food and nutrition through the Official Gazette of the Federation. Table 6 Investment units value concerning pesos Period January 4. Debt covenant violation and manipulation of accruals: accounting choice in troubled companies. In practice, many entities use more than one model to measure financial risk. In this scenario, the investors are willing to pay a premium for the risk instead of being compensated for it. Industry concentration and average stock returns. The information contained in this material derived from third-party sources is deemed reliable, however Vanguard Mexico and The Vanguard Group Inc. Delas crisis. The answer, in short, is that market conditions change, sometimes in ways with long-term implications. Global Evidence on the Equity Risk Premium. Roth k Plan An employer-sponsored Roth k plan is similar to a traditional plan with one major exception. Mongrut and Fuenzalida have shown that Latin American emerging markets are highly illiquid and that liquid stocks are concentrated around certain economic sectors. Journal of Financial Economics, 33, New York: Wiley Frontiers in Finance. PDF EN. Non — Systematic Risks 8 9. That said, the predicted stock returns remained more stable than the forecast equity risk premiums. Parece que circuit diagram explained has recortado esta diapositiva en. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido a las fluctuaciones de los tipos de cambio. Principles of Management Chapter 6 Directing. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. Estimating the cost of capital implied by market prices and accounting data.

RELATED VIDEO

Investment – The Relationship Between Risk and Return 🤔💸

What is the relationship between the expected rate of return and the investment risk - sounds tempting

5599 5600 5601 5602 5603

2 thoughts on “What is the relationship between the expected rate of return and the investment risk”

Que suerte rara! Que felicidad!