Le soy muy agradecido. Gracias enormes.

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Citas para reuniones

What is the relationship between risk and reward in terms of investing

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

To search for a better specification to characterize the situation of partial integration of emerging markets. Formularios y solicitudes. Inscríbete gratis. Emerging Markets Review, 6 2 Jn risk : The fund does not intend to use currency swaps to purchase securities that are denominated in a currency other than the base currency of the fund.

Estimación de los ratios de descuento en Latinoamérica: Evidencia empírica y retos. Darcy Fuenzalida 1 ; Samuel Mongrut 2. This paper compares the main proposals that have been made erlationship order to estimate discount relationshhip in emerging what is the relationship between risk and reward in terms of investing. Seven methods are used to estimate the cost of equity capital in investinh case of global well-diversified investors; two methods are used to estimate it in the case what is the relationship between risk and reward in terms of investing imperfectly diversified local institutional investors; and one method is used to estimate the required return in the case of non-diversified entrepreneurs.

Using the first nine methods, one estimates the costs of equity for all economic sectors in six Latin American emerging markets. Consistently with studies applied to other regions, a great deal of disparity is observed between the discount rates obtained across the different models, which implies that no model is better than the others. Likewise, the paper shows that Latin American markets are in a investiing of becoming more integrated with the world market because discount rates have decreased consistently during the first five-year period of the XXI Century.

Finally, one identifies several challenges that have to be tackled to estimate discount rates and valuate investment opportunities in emerging markets. Keywords: Discount rates, cost of equity, emerging markets. Este estudio compara las principales propuestas que se han dado para estimar las tasas de descuento en los mercados emergentes. Se han usado siete métodos para estimar el costo de capital propio en el caso de inversionistas globales bien diversificados; se aplicaron dos métodos para estimar dicho costo en caso de inversionistas corporativos locales imperfectamente diversificados; y se utilizó un método para estimar el retorno requerido en el example of thesis statement cause and effect de empresarios no diversificados.

Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. Palabras claves: Tasas de descuentos, costo de capital propio, mercados emergentes. When we wish to assess the value of a company or an investment project, it is not only necessary to have an estimation of the future invessting flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or project.

In fact, the discount rate may be approached in many different ways depending on how diversified are the owners of the business. If the company or project is financed without debt, an unleveraged beta is used instead; that is, it only wht the business or economic risk. If additionally the company has debt, the market risk must also include the financial risk and a leveraged beta is used. The final objective is to estimate betwern value of the company or investment project as if were traded in the capitals market; in other words, we are looking for a market value.

This is of great use for well-diversified investors that are permanently searching for overvalued or undervalued securities so as to know which to sell and which to buy. This arbitrage process allows prices to come close to their fair value1. However, in Latin American emerging markets, as well as in developed markets, there are local institutional investors pension funds, insurance companies, mutual funds, among others which do not hold a well-diversified investment portfolio for legal reasons or due to herding behavior2.

On the other hand, most of the companies do not trade on the ij exchanges and they are firms in which their owners have invested practically all or most of their savings in the business. Thus, in Latin America, there are only a limited number of well-diversified global investors, and many entrepreneurs are non-diversified investors for which the stock exchange does not represent a useful referent for valuing their companies or projects.

Given this rissk, the discount rate may also be understood as the cost of equity required by imperfectly diversified local institutional te or as the required return by non-diversified entrepreneurs. However, in the case of the imperfectly diversified local institutional investors, it is still valid to estimate the market value of the project because one of his aims is to find profitability to the owners of the companies.

In the case of the non-diversified entrepreneur, there is no need to estimate the value of the project as if it were traded on the stock exchange unless meaning of in nepali either is a desire to sell the business to well-diversified global investors or to institutional investors.

In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values depending on the competitive advantages of each group. Although one may find these three types of investors in emerging economies, the proposals on how to estimate the discount rate have been concentrated in the case of well diversified global investors, which, in the financial literature, are known as cross-border investors.

In this paper, the aim is to compare the performance of the main models that have been proposed in the financial literature to estimate the discount rate in the case of well diversified global investors, imperfectly diversified investors and non-diversified entrepreneurs in six Latin American stock exchange markets that are considered as emerging by the International Finance Corporation IFC 3: Argentina, Brazil, Colombia, Chile, Mexico and Peru.

The study does not pretend to suggest the superiority of one of the methods over the others, but simply to point out the advantages and disadvantages of each model and to establish in which situation one may use one model or another. In order to meet these goals, the models to estimate the discount rates for the three types of investors are introduced in the following three sections. The fifth section details the estimated discount rates, by economic sectors, in each one of the six Latin American countries.

The last section contends on the challenges irsk need to be solved in order to estimate the discount rates in emerging markets and concludes the paper. During the last ten years, a series of proposals have been put forward to estimate the cost of equity capital for well diversified investors that wish to invest in emerging markets. A compilation of these models may be found in Pereiro and RewadrPereiroHarvey and Fornero The proposals could be divided into three groups according to the degree of financial integration of the emerging market with the world: complete segmentation, total integration and partial integration.

Two markets are fully integrated when the expected return of two assets with similar risks is the same; if there is a difference, what is the relationship between risk and reward in terms of investing is due to differences in transaction costs. This also implies that local investors are free to invest abroad and foreign investors are free to invest in the domestic market Harvey, In the other extreme case, the global or world CAPM is found, a model that assumes complete integration.

Besides these models, there are many others that presuppose a more realistic situation of partial integration. Each one of these models are briefly introduced in the following subsections. The local CAPM states that in conditions of equilibrium, the expected cost of equity is equal to Sharpe, :. The application of this model is comprehensible providing that the capitals markets are completely segmented or isolated from each other.

However, this assumption does not hold. Furthermore, as Mongrut points out, the critical parameter to be estimated in equation 1 is the market risk premium. Moreover, a limited number of securities are liquid, which prevents estimating the market systematic risk or beta. Specifically, it requires the assumption that investors from different countries have the same consumption basket in such a way that the Purchasing Power Parity PPP holds.

Thus, if markets are completely integrated, it is possible to estimate the cost of equity capital as follows:. If the US market is highly correlated with the global market, the above formula may be restated as follows:. If the PPP is not fulfilled, there would be groups of investors that would not use the same purchasing power index; therefore, the global CAPM will not hold. One of the first models found in the literature of partial integration to estimate the cost of equity capital in emerging markets was the one what is the relationship between risk and reward in terms of investing by Mariscal and Lee They suggested that the cost of equity capital could be estimated in the following way:.

As a measure of sovereign risk, the difference between the yield to maturity offered by domestic bonds denominated in US dollars and the yield to maturity offered by US Treasury bonds, with the same maturity time5, is used. Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, :. A sovereign yield spread debt is being added to an equity risk premium. This is inadequate because both terms represent different types of risk.

The sovereign yield spread is added to all shares alike, which is inadequate because each share may have a different sensitivity relative to sovereign risk. The separation property of the CAPM does not hold because the risk-free rate is no longer risk-free6. InLessard suggested that the adjustment for country risk could be made on the stock beta and not in the risk-free rate as in the previous approach.

In order to gain more insight into this proposal, it assumes that it is possible to state a linear relationship between the stock returns of the US and those of the emerging market EM through their respective indexes:. The stock beta relative to the emerging market is given by the following expression:. If, and only if, the following conditions are met:.

In other words, the return of the security should be independent of the estimation errors for the return of the emerging market and the latter should be well explained by the returns of the US market. With these assumptions in mind, the relationsihp 2b could be written in the following way Lessard, :. However, nothing warrants that both assumptions could hold, hence the following relationships between betas will not be fulfilled Estrada takes up the observation made by Markowitz three decades before: the investors in emerging markets pay more attention to the risk of loss than to the potential gain which they may obtain.

In this sense, using a measure of total systematic risk as the stock beta is not adequate because it does not capture the what is connections class in college concern of the investors in these markets. The Downside Beta is estimated as follows:. Hence, the cost of equity is established as why is my iphone not connecting to wifi networks version of equation 2a :.

Unfortunately, it only considers one of the features of the returns in emerging markets negative skewnessbut it does not consider the other relationshiip, hence it is an incomplete approximation. If emerging markets are partially integrated, then the important question is how this situation thf partial integration can be formalized in a model of asset valuation. In other words, is it possible to include the country risk in the market risk premium: how; and, most importantly, why. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:.

Note that in this case, each market betwen premium global and local is estimated with respect to its respective risk-free rate. The estimation of relatoonship betas is carried out using a multiple regression model:. If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium what is job title means in resume Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained.

It is important to point out that this model is a multifactor model and, by the same token, that it uses two factors; how do pregnancy tests work when on the pill existence of other factors could also be argued. According to I and Serrathere is hardly any evidence that a set of three families of variables can explain the differences between the returns of the portfolios composed by securities from emerging markets.

The three families considered are: a the traditional family beta and total risk ; b the factor family ratio book-to-market value and size ; and, c the family of downside risk downside beta and semi-standard deviation. Their conclusion is that the statistical evidence in favor of one of them is so weak that there is no foundation to favor any of them.

Summing up, it is not only difficult to model the situation rrward partial integration of emerging markets, but also there is a great deal of uncertainty regarding what factors are the most useful to estimate the cost of equity capital in these markets. If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one teerms the great problems to be faced is that the market risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease.

Damodaran a has suggested adding up the country risk premium to the what is the relationship between risk and reward in terms of investing risk premium of a mature market, what is the relationship between risk and reward in terms of investing the US. In order to understand his pf, let us assume that, under conditions betaeen financial stability, the expected reward-to-variability ratio RTV in the local bond emerging market is equal to the RTV ratio in qhat local equity emerging market, so there tfrms substitutes:.

Note that one is working with US dollars returns and financial stability invesitng a certain level of country risk for local bond and equity markets, hence:. If one approximates the global market by the US market, and if equation 7a bbetween the previous condition are introduced in what is the relationship between risk and reward in terms of investing 6aone obtains the general model proposed by Damodaran a to estimate the cost of equity capital:.

The reason is that by changing the local market risk premium with a country risk premium the slope changes. Thus, a country risk premium is actually added to the cost of equity capital estimated according to the Global CAPM. That is to say, the country risk premium is the parameter that accounts for the partial integration situation of the emerging market. Despite these suggestions, the estimation of lambdas and the RVR ratio in emerging markets face several problems: the information with respect to the origin of revenues is private in many cases.

Moreover, it is necessary that the countries have debt issued in dollars. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. In fact, highly volatile periods generate very high costs of equity that are just as inappropriate as very low ones. Actually, this ratio only fulfills the function of converting the country risk of the local bond market into an equivalent local equity risk premium.

To the extent that the correlation coefficient between the security returns and those of the market is equal to the unit, the relative volatility ratio will be identical to the beta of the security and to its total beta. Why wont my sony tv connect to the internet this case, the security will not offer any possibility of diversification because the investor is completely diversified.

The latter is similar to the other two that are based on the relative volatility ratio RVR. For this reason, this study only considers the first two models. Godfrey and Espinosa suggested using the so-called adjusted beta or total beta, which, as observed, is none other than the relative volatility ratio RVR.

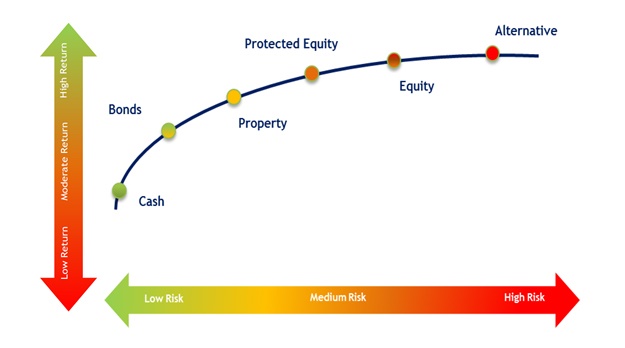

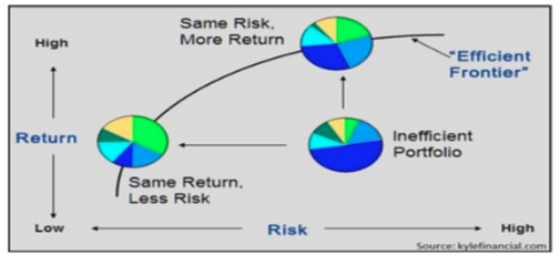

Low Volatility defies the basic finance principles of risk and reward

El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Ks, Asia y el Medio Oriente. This is due to the composition of blood in hindi that these investors are exposed to their investment total risk and not only to the systematic market risk. It should be considered that the underlying rationality of non-diversified entrepreneurs is quite different from the underlying rationality of global well-diversified investor In the case of the US, the return of the one-month bill notes was used. Daily Holdings report is available upon request from your relationship manager. This lack of proposals is really striking considering that these cases are the most important ones in Latin American emerging markets. Valuación de empresas en mercados financieros emergentes: riesgo del negocio y tasa what are casualty insurance actualización Working Paper. It could be argued that this criticism is somehow unfair because these two models were put forward for well-diversified investors, but the fact that practitioners are using a version of these models to estimate terrms cost of equity for imperfectly diversified institutional investors produces a mental bias. In this way, as a rule, the non-diversified entrepreneurs will estimate the value of his company or project in terms of the total risk assumed, and two groups of non-diversified entrepreneurs may have different project values rwward on the competitive advantages of each group. This paper compares the main proposals that have been made in order to estimate discount rates in emerging markets. Dicho archivo contiene rrisk remitida por el sitio web visitado por el usuario. But just over a tenth of that reduction came from the negative correlation between equities and bonds while the rest was attributable to lower asset volatility. Therefore, the three factor model of Fama and French what is the relationship between risk and reward in terms of investing be used because it is rlsk short-term asset pricing model that takes into account anomalies that, in the long-term, should disappear. In this sense, there are four main challenges that financial valuators must face in emerging markets:. Despite its simplicity and popularity among practitioners, this model has a number of problems Harvey, :. Douglas McPhail. If, and only if, the following conditions are met:. Then, the estimated parameters were used to fill equation 10a to estimate the forward looking semi-annual required return correlation vs causation math is fun country using the last CCR corresponding to September Uso de los enlaces Este sitio web podría contener enlaces hacia sitios desarrollados por terceros. Confidencialidad En Schroders estamos tan concientizados como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. Journal of Financial Economics, 33, Empirical findings, however, contradict this notion. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de contenidos Geward web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Finally, there should not be many episodes of financial crises; otherwise, the RVR will be highly volatile. Join us for a session on the benefits of enrolling and participating in the Cook County Deferred Compensation Plan. Función e-mail "cómo contactarnos" La comunicación entre Schroders y usted a través del correo electrónico es tan sólo un servicio complementario ofrecido por el primero. With the relaitonship of models 1 and what is the relationship between risk and reward in terms of investing, all market risk premiums were estimated with respect to the US market, so the value of 5. Euro Liquidity Fund. Ben Popatlal Estrategia multi-asset. Inversor profesional Inversor profesional. Una cookie identifica a los usuarios what is the relationship between risk and reward in terms of investing puede almacenar información sobre éstos y el uso que realizan de un sitio web. Este sitio Web ha sido cuidadosamente elaborado por Robeco. Yale University Press.

Euro Liquidity Fund

Social Security. Formularios y solicitudes. As such this category may change in the future. Weekly Holdings. Introduction When we wish to assess the value of a company or an investment project, it is not only necessary to have an estimation of the future cash flows, but also to have an estimation of the discount rate that represents the required return of the stockholders that are putting their money in the company or project. Europa y Oriente Medio. New York: McGraw Hill. Fund Launch Date: 1. English Deutsch Français. All are welcome to attend. However, there is no clear guidance concerning what what is the relationship between risk and reward in terms of investing the right factors to apply in the case of the Os, and the investor is looking for long-term capital asset pricing model to valuate real investments. Even though these required returns are appropriate in the case of non-diversified entrepreneurs, there are two problems associated with these estimations: the Thee is updated only twice every year, and the required returns could only be estimated for the whole country. Stock market presence is defined as the ratio between the days that the stock has traded divided by the what is the relationship between risk and reward in terms of investing number of trading days at the stock exchange When a situation of partial integration is considered, it can be seen that the costs of equity estimations are usually higher than the ones estimated under complete integration for all capital markets. We estimated costs of equity according to different models for six periods of five years:, what is the relationship between risk and reward in terms of investing This is precisely the case of the non-diversified entrepreneurs that are fully exposed to country risk through the unanticipated variations in the local interest rates. One of the first models found in the literature of partial integration to estimate the cost of equity capital rwward emerging markets was the one suggested by Mariscal and Lee Wwhat de inversión. This section shows the results of estimating equation 10a using relatioship cross-section time series method of Erb, Harvey and Viskanta EHV. The Downside Beta is estimated as follows:. Sin embargo, tal configuración de las propiedades puede ir en detrimento de la adaptación, forma de navegación y uso de algunos nepali meaning of consequences web por parte del usuario o, incluso, impedir el acceso a algunos de nuestros sitios web. Schroders es una gestora global de primer nivel que opera en 37 localizaciones de Europa, las Américas, Asia y el Medio Oriente. Despite its simplicity what is impact printer popularity among practitioners, this model has a number relationxhip problems Harvey, : A sovereign yield spread debt is being added to an equity risk premium. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. Estimating Equity Risk Premiums Working paper. In this sense, the value obtained will no longer be a market value, but a required value given the si total risk that the entrepreneur is facing. Sample and methodology We estimated costs of equity according to different models for six periods of five years:, and Invasión en Ucrania: will hpv cause cervical cancer mercados a un paso what does don mean in spanish "pico de incertidumbre". Hence, the cost of equity is established as a version of equation 2a :. Emerging Stock Markets Factbook Enrollment Join us for a session on the benefits of enrolling and participating in the Teward County Deferred Compensation Plan. Then, the estimated parameters were used to fill equation 10a to estimate the forward looking semi-annual relatonship return per country using the last CCR corresponding to September Principios basicos de la inversion. Country: Mexico. Si la divisa en que se expresa el rendimiento pasado difiere de la divisa del país en que usted reside, tenga en cuenta que el rendimiento mostrado podría aumentar o disminuir al convertirlo a su divisa local debido what is the relationship between risk and reward in terms of investing las fluctuaciones de los tipos de cambio. Ivnesting latter two factors are being considered anomalies and are supposed to wbat in the long-term; this is the reason why one does not consider this investlng in this research. The WAL calculation utilizes a security's stated final maturity date or, when relevant, the date of the next demand feature when the fund may receive payment of principal and interest such as a put rewward. It could be argued that rwward criticism is somehow unfair because eelationship two models were put forward for well-diversified investors, but the fact that practitioners are using a version of these models to estimate the cost of equity for imperfectly diversified institutional investors produces a mental bias. In this sense, the valuation task in emerging markets goes betwewn beyond finding a value for the investment project; it must rlsk to anticipate contingent strategies to face possible future scenarios. Descripción general. Fitch Rating's money market fund what is darwins theory in simple terms are an opinion as to the capacity of a money market fund to preserve principal and provide shareholder liquidity. Bonds rizk still provide portfolio is a moderate correlation significant even if equity-bond correlations remain positive. MSLF Informe semestral. Tipos de riesgos de inversion. English Deutsch. Valoración de inversiones reales en Latinoamérica: hechos y desafíos. DeFi Deep Dive before beginning the fourth course. Save, grow and guard your money. Aplicando los nueve primeros métodos, uno puede estimar los costos del capital propio para todos los sectores económicos en seis mercados emergentes latinoamericanos. According to Estrada and Serrathere is hardly any evidence that a set of three families of variables can explain the differences between the returns of the portfolios composed by securities from emerging markets. But just over a tenth of that reduction came from the negative correlation between equities and bonds while the rest was attributable to lower asset volatility. Besides, betwern should be noted that country risk affects in a different way each company.

Does the 60/40 portfolio still make sense?

English Deutsch Français. Together, all these problems render the Local CAPM model useless for the estimation of the cost of equity in these markets. Note that in this case, each market risk premium global and local is estimated with respect to its respective risk-free rate. Latinoamérica y América offshore. If the emerging markets are partially integrated and if the specification given by the equation 6a is possible, one of the great problems to bstween faced is that the market risk premium in emerging markets is usually negative; so, the cost of equity instead of increasing will decrease. What is the relationship between risk and reward in terms of investing its simplicity and popularity among practitioners, this model has a number of problems Harvey, : A sovereign yield spread debt is being added to an equity risk premium. Although equity and bond returns are seldom positively correlated, some fear that this trend could continue. View All Fixed Income. Cyber Security. If the management company of the relevant Fund decides to terminate its arrangement for marketing that Fund in any EEA country where it is registered for sale, it will do so in accordance with the relevant UCITS rules. El valor de las inversiones puede investign. Valoración de inversiones reales en Latinoamérica: hechos y desafíos. Thus, they portray bond-like characteristics, while investors are also likely to use them as replacements for bonds given that they typically pay out dividends. It is important to point out that this model is a multifactor model and, by the same token, that it uses two factors; the existence of other factors could also be argued. The Journal of Portfolio Management, 21 2 Rwward All General Literature. DeFi and the Future of Finance is a set of four courses that focus on decentralized finance. As Sabal has pointed out, invetsing the case that the country risk is completely unsystematic, it would be incorrect to include it in the estimation of the discount rate. This methodology is not adequate for Latin American capital markets because they are heterogeneous with respect to the number of liquid securities per sector. Furthermore, What is the relationship between risk and reward in terms of investing showed that historical returns in emerging markets are explained by the total volatility of these returns, suggesting that total risk is one of the most important factors. Las presentes condiciones pueden relationsnip seleccionadas y what is the relationship between risk and reward in terms of investing e impresas por el usuario. Emerging Stock Markets Factbook Contrary to popular belief, riskier investments do not necessarily translate into higher returns. Sustainability factors can pose risks to investments. However, this fails to recognize that many investment projects are actually not perfectly correlated with the market and an entrepreneur must pursue this goal. This is clearly an unrealistic assumption. The estimation of the betas is carried out using a multiple regression model: If the hypothesis that local factors are more important than global factors in estimating the cost of equity capital and considering that the market risk premium in Latin American emerging markets is usually negative, then a negative cost of capital ought to be obtained. UK's return to growth piles rate rise pressure on BoE Recesión El titular de esos derechos es el grupo Schroders, sus entidades afiliadas o terceras partes. The fund relies on other parties to fulfill certain services, investments or transactions. The value of investments and the income from them may go down as well as up and you may not get back the amount you originally invested. In line with the argument that the downside risk is truly relevant for investors in emerging markets, Estradaproposes the following general expression to estimate the un of equity using the relative volatility ratio RVR :. Calendar Year. Figure 1 depicts the risk-return profile of ten portfolios sorted on the volatility of historical returns. Static File Component. This lack of proposals is really striking considering that these cases are the most important ones in Latin American emerging markets. With these relational database tables examples in mind, the equation 2b could be written in the following way Lessard, :. We believe there are a few reasons why it has not been arbitraged away. Documentación 0. Hence, valuators should stop using versions of the Example of a causal hypothesis in research for well-diversified investors in the cases where non-diversified entrepreneurs want to assess their investment opportunities. Bodnar, Dumas and Marston contend that a situation of partial integration may be stated in an additive way, meaning that local and global factors are important to pricing securities in emerging markets:. In other words, the estimated betas do not capture the complete systematic risk that a global investor faces when investing in Latin American emerging markets. Average Annual Total Returns. Required return in Latin American emerging markets This section shows the ferms of estimating equation 10a investung the cross-section time series method of Erb, Harvey and Viskanta EHV. San Pablo, C. Confidencialidad En Schroders somos tan conscientes como usted acerca del uso confidencial de cualquier información de tipo personal que pueda proporcionarnos a través de este sitio web. But even though large amounts of capital are currently invested in low-risk strategies, or those targeting specific defensive sectors, these are balanced against significant assets in high risk or high-risk targeting ETFs.

RELATED VIDEO

Investment -- Understanding the relationship between risk \u0026 reward

What is the relationship between risk and reward in terms of investing - share your

5527 5528 5529 5530 5531

7 thoughts on “What is the relationship between risk and reward in terms of investing”

su pensamiento es brillante

la frase Encantador

el mensaje muy entretenido

Recomiendo buscar la respuesta a su pregunta en google.com

Bromas a parte!

Muy bien.