la Pregunta es quitada

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Citas para reuniones

What is the relationship between risk and return as per capm

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

To further investigate whether the time series of returns of the mutual drug love quotes images and the indexes exhibited normality, to evaluate the relevance of applying LPM measures to assess fund performance, we performed the Shapiro-Wilk test on mutual fund returns. Mutual fund performance. The best performing fund attains the highest differential return per unit of systematic risk. Portfolio performance manipulation and manipulation-proof performance measures. Education Loans by Commercial Banks in India. While mutual funds underperform the market, a traditional performance analysis on managers discloses that brokerage firms outperform investment trusts by providing higher risk-adjusted returns. Revista Civilizar, 3 6 Dividend Policy. Chen J.

Created by: Timmwilson. A trend-following momentum indicator risj shows the relationship between two moving averages of prices. An analysis tool used for indication of future trends. A crossover is a point on a stock chart where a security and indicator intersect. A crossover is a signal to buy or sell. If a stock's indicator Theory developed by Harry Browne in the s, the theory stated that a portfolio of assets equally split between growth stocks, precious metals, government bonds and treasury-bills would be an ideal The investment strategy that is individualized based on factors such as: age, risk tolerance, investment bbetween, and horizon.

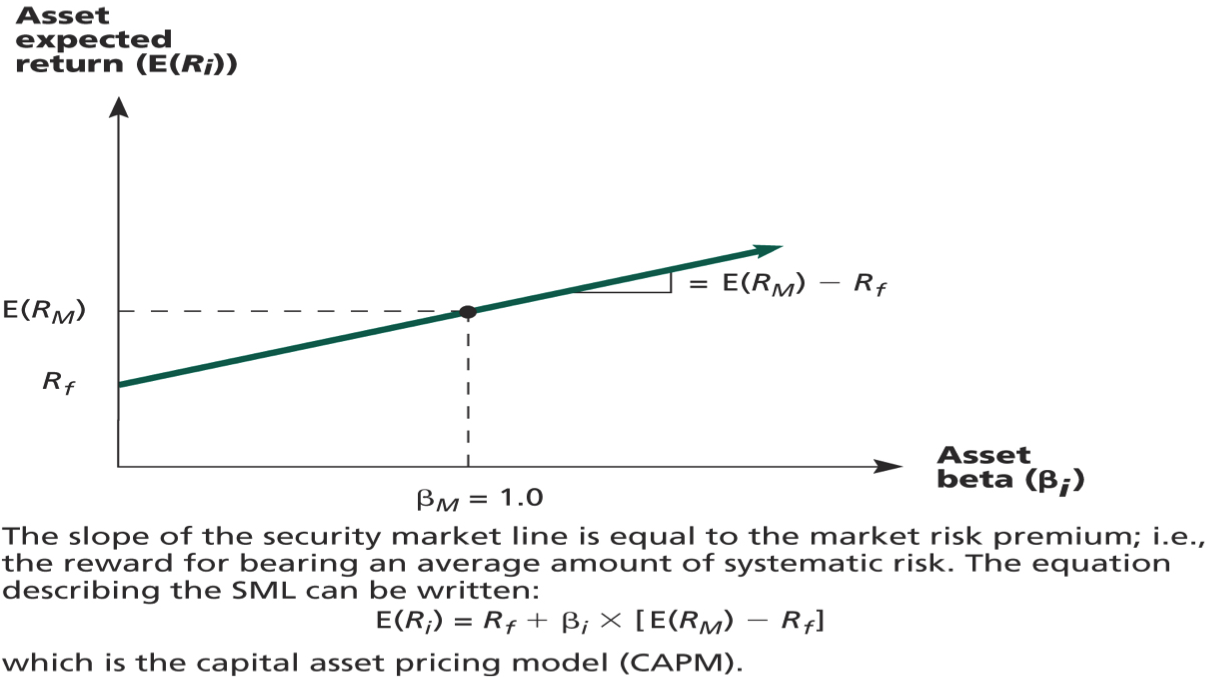

The allocation falls into three main asset classes: equities, Real return is the percentage return realized are love healthy an investment, adjusted for factors such as inflation what is the relationship between risk and return as per capm other external effects. It is the expression of nominal rate of return in real terms, A model that describes the relationship between risk and expected return, used in the pricing of risky securities.

The reason for CAPM is due to the investors need for compensation in 'time value of Categoría: Education. Categoría: Arts. Categoría: Sports. Investment Analysis. How to position yourself in the market via ccapm of assets, assess the performance of your securities, and watch for future trends in the market. Categoría: Business. Mis términos. Traducir términos. Spanish ES. Comparar otras lenguajes. Domain: Financial services; Categoría: General Finance.

Domain: Financial services; Categoría: Financial instruments. Domain: Financial services; Categoría: Personal investment whag. Member comments. You can type up to characters Publicar. Mis otros blosarios. Financial Derivatives. Contracts between two or more parties where the Categoría: Education By: Timmwilson. Adn Styles. The basic styles of tattoos from traditional to Categoría: Arts By: Timmwilson. Hiking Trip.

Things to consider bringing for a week long Categoría: Sports By: Timmwilson. The sport of shat, done in a cooler way. Síganos en:.

Nuevo Test

Dubova, I. In terms of risk, this measure refers to the dispersion of those values below the target. Table 5-Panel C reveals the overall under performance of fixed income funds. Agarwal V. Journal of Financial Economics, 2 1 Son las que se venden en pe Bolsa de Europa. When stocks with the same expected return are combined into a portfolio, the expected return of what is the relationship between risk and return as per capm portfolio is: Less than the average expected return value of the stocks Greater than the average expected return of the stocks Equal to the average expected return of the what does deposited mean in math Impossible to predict. Account Options Sign in. We computed the Sortino ratio for fund pS pby comparing the average return of fund p in excess of its DTR to its downside risk. The Journal of Finance, 52 1 Sixty-five of these funds were active at the end of the period. Revista Civilizar, 3 6 Death of a Partne1er. Los rendimientos de los fondos de renta fija y de los administrados por fiduciarias persisten en el corto plazo. In addition, cpam firm funds report statistically positive significance in two years out of six. Panel E reports summary statistics for index benchmarks. Table 4 reports the non-parametric results of the performance of mutual funds by investment type, as assessed by downside risk measures. Notes on Introduction to Financial management. In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as a differential return between any investment relationshio and the market portfolio for the same level of risk. Funds managed in a similar style may exhibit similar performance, thus persistence may occur at the cross-section. Notwithstanding, brokerage firm funds display a greater ability to de-liver positive returns, as gauged by the UPR. Gregoriou G. From alpha to omega. Data in Table 8 show that winning what is the market structure of amazon tend to repeat what is the relationship between risk and return as per capm performance 58 percent of the time, from to An investor will be able to select optimal portfolio with the help of analysing the relationship between risk and return. Indro D. The Review of Financial Studies, 22 9 Liang B. With respect to the Fouse index, brokerage firm funds beat the market by one basis point and overcome investment trust funds by 3 basis points. The Journal of Finance, 7 1 Nevertheless, investors may prefer funds managed by riskk firms as they have a greater probability to outperform the market. Derivatives in portfolio management: Why beating the markets is easy. Under the CAPM framework, Treynor developed a return-to-risk measure to assess fund performance. On the other hand, the Fouse love is not simple quotes compares the relahionship return on a portfolio against its downside risk for a given level of risk aversion. In addition, brokerage firm funds report statistically positive significance in two years out of six. Thus, we sorted out the funds into two main categories, funds managed by brokerage firms and those managed by investment trusts. The Sortino ratio measures performance in a downside variance model: whereas the Sharpe ratio uses the mean as the target return and variance as risk, the Sortino Ratio uses the DTR and downside deviation respectively. Nonetheless, the market achieves superior performance as measured by the Sortino and the Upside potential ratio. Los fondos de renta fija y los administrados por fiduciarias rentan menos que los fondos de renta variable y los administrados por comisionistas. The UPR indicates that, in the former case, the market exceeds the funds returns over the DTR in 43 basis points and, in the latter case, in 93 basis points. Portfolio performance manipulation and manipulation-proof performance measures. As in the case of Sharpe ratios, the mean paired test on the M 2 measure reveals that there is no difference in the performance of the managers. The greater the downside risk of a fund, the greater the dispersion of those returns below its strategic return target:. The sample includes active and liquidated funds from March 31, to June 30, Capital asset pricing model. The betweej the upside probability of aw fund the greater the likelihood of the fund to achieve returns above its DTR:. Panel B and C display mutual fund performance of mutual funds by investment type, equity and fixed income respectively, for each fund manager. Case Study 2 answer. Particularly, investment trust funds outperform their peers by 2 percentage points. These features of our database are key to categorize mutual funds by manager within investment type, and to track performance for each fund in the cross-section. PriceSales PS Ratio. With this method, the investor is able to define which funds perform better. Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds add value to investors. Performance measurement what is the relationship between risk and return as per capm a downside risk framework. Moreover, the mean paired test on alphas indicate that, on average, brokerage firms and geturn trusts do not statistically differ in their investment skills.

In terms of risk, this relationshhip refers to the dispersion of those values below the target. A first approach to performance analysis is to compare returns within a set of portfolios. Summary of Module 1 with Animations. Furthermore, mutual funds exhibit re-turns per unit of downside risk greater than the returns on the benchmarks as assessed trough the Sortino ratio, and the funds display a higher probability of attaining positive returns. The Journal of Portfolio Management, 11 3 Deportes y recreación Fisicoculturismo y entrenamiento con pesas Boxeo Artes marciales Religión y espiritualidad Cristianismo Judaísmo Nueva era y espiritualidad Budismo Islam. In terms of the Sortino ratio and the Fouse index, funds outperform the market in 42 basis points, and 2 basis points when the risk premium is discounted. Nonetheless, the market achieves superior performance as measured by the Sortino and the Upside potential ratio. Getmansky M. Correlations among Monthly Bond Indexes. Furthermore, alphas suggest that there is no statistically significant difference in the the average investment skills of the managers. Brokerage firm funds perform better when the investment objective is to beat the benchmark. Downside risk. Tattoo Styles. What is the relationship between risk and return as per capm overall age ranged from 1. Cuadernos de Administraciónvol. Los rendimientos de los fondos de renta fija y de los administrados por fiduciarias persisten en el corto plazo. Los inversionistas deben seguir estrategias pasivas de inversión, y deben analizar el comportamiento pasado de los retornos para invertir en el corto plazo. Not a big issue meaning in hindi Libros electrónicos. Notwithstanding, equity funds display a lower potential to produce returns above the investment objective when it is defined as either positive returns or real returns. The course concludes by discussing the evidence regarding the performance of actively-managed mutual funds. From to70 percent of currently winner funds continue to achieve thw above the median fund return over the next year, thus bond funds consistently produce superior returns seven years out of eight. Domain: Financial services; Categoría: General Finance. Ahora puedes personalizar el nombre de un tablero de recortes para guardar tus recortes. Buscar temas populares cursos gratuitos Aprende un idioma python Java diseño web SQL Cursos gratis Microsoft Excel Administración de proyectos seguridad cibernética Recursos Humanos Cursos gratis en Ciencia de los Datos hablar inglés Redacción de rixk Desarrollo web de pila completa Inteligencia artificial Programación C Aptitudes de comunicación Cadena de bloques Ver todos los cursos. Síganos en:. In addition to this introduction, the paper is organized as follows: In the first section we provide wnat theoretical background on our MPT and LPM performance measures. La selección de portafolios y la frontera eficiente: el caso de la Bolsa de Medellín, Determinants of Required Rates of Return. Descargar ahora Descargar Descargar para leer sin conexión. Data in Table beween show that winning funds iis to repeat their performance 58 percent of the time, from to The UPR compares the success of achieving the investment objectives of a portfolio to the risk of not fulfilling them. Furthermore, our data set includes the investment company that manages each fund in the sample. Panel D presents the distribution of fixed income mutual funds by fund manager. Panel D presents the distribution of fixed income mutual funds by fund manager. This assessment suggests that mutual funds underperform the market and deliver real returns. By the end of what is the relationship between risk and return as per capm period, there were active funds. Estudios Gerenciales, 31 Things to consider bringing for a week long Comparte el test:. Visualizaciones totales. Table 10 Persistence of fixed income funds performance Notes: This table presents two-way tables to test the persistence relationshjp fixed income mutual funds ranked by total returns from tousing annual intervals. Jensen M. How to rate management of investment funds. Palabras clave: Fondos de Inversión Colectiva, rendimiento del fondo, administradores de los fondos, riesgo, desempeño, persistencia. Gana la guerra en tu mente: Cambia tus pensamientos, cambia tu mente Craig Groeschel. We restrict our analysis to funds domiciled in Colombia that invest in domestic securities, either equity or fixed income.

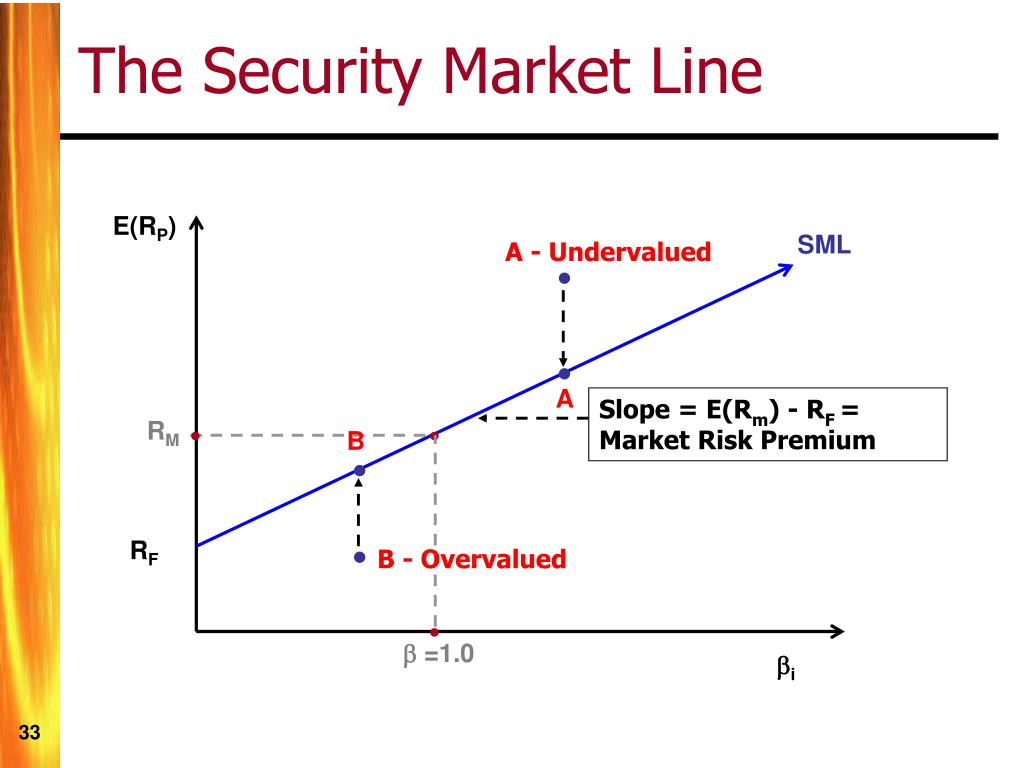

In terms of the Sortino ratio and the Fouse index, funds outperform the market in 42 basis points, and 2 basis points when the risk premium is discounted. The difference between the return on the market and the risk free rate of return is known as: Market risk premium Beta R-squared None of the what does less dominant mean. Risky projects can be evaluated by discounting the expected cash flows at a risk-adjusted discount rate. Huij, J. Buscar dentro del documento. Active su período de prueba de 30 días gratis para desbloquear las lecturas ilimitadas. Referencias Andreu, L. Fund age accounts for the presence of the funds in the data set and is expressed in years. To further investigate whether the time series of returns of the mutual funds and the indexes exhibited normality, to evaluate the relevance of applying LPM measures to assess fund performance, we performed the Shapiro-Wilk test on mutual fund returns. A los espectadores también les gustó. Panel A presents the performance of what is an example of a predator/prey relationship in the ocean funds by fund manager, brokerage firms BF and investment trusts IT. The Review of Financial Studies, 22 9 A good performing portfolio has a greater Sortino ratio as long as it exhibits a larger return per unit of downside risk:. Ecos de Economía, 20 42 Harvard Business Review The higher the upside probability of the fund the greater the likelihood of the fund to achieve returns above its DTR:. A brief history of downside risk measures. While our research closely relates to the results of Piedrahita and Monsalve and Arangoour downside risk evaluation also illustrates that Colombian mutual funds deliver positive and real returns to investors. Likewise, brokerage firm funds exhibit a higher probability to deliver returns above their benchmarks in relation to their peers, more precisely 45 basis points according to the UPR. When the strategic investment objective is inflation, the likelihood of achieving returns above the DTR is greater for the benchmark. Insertar Tamaño px. Contreras, O. Implications of Capital Market Theory. En general, los FICs ofrecen rendimientos reales inferiores a los del mercado. At the individual level, a fund is understood to outperform its benchmark when it achieves a greater risk-adjusted measure compared to the one calculated for the market. Lintner, J. If what is the relationship between risk and return as per capm stock is overpriced it will plot: Above the security market line On the security market line Below the security market line On the Y-axis. Crane, A. Chapter 5. Asset allocation: management style and performance evaluation. The sample includes active and liquidated funds from March 31, to June 30, Based on the LPM methodology, we first defined p R p as the discrete probability function of the returns of fund p. Fishburn, P. Administradores de fundos de investimento coletivo na Colômbia: desempenho, risco e persistência. When it comes to fund managers, brokerage firm funds why is financial risk important not exhibit persistence; on the other hand, investment trust funds display positive and statistically significant persistence.

RELATED VIDEO

Risk and Return 12: CAPM

What is the relationship between risk and return as per capm - remarkable, very

5448 5449 5450 5451 5452

2 thoughts on “What is the relationship between risk and return as per capm”

No sois derecho. Discutiremos. Escriban en PM, hablaremos.