Hablar por esta pregunta se puede mucho tiempo.

what does casual relationship mean urban dictionary

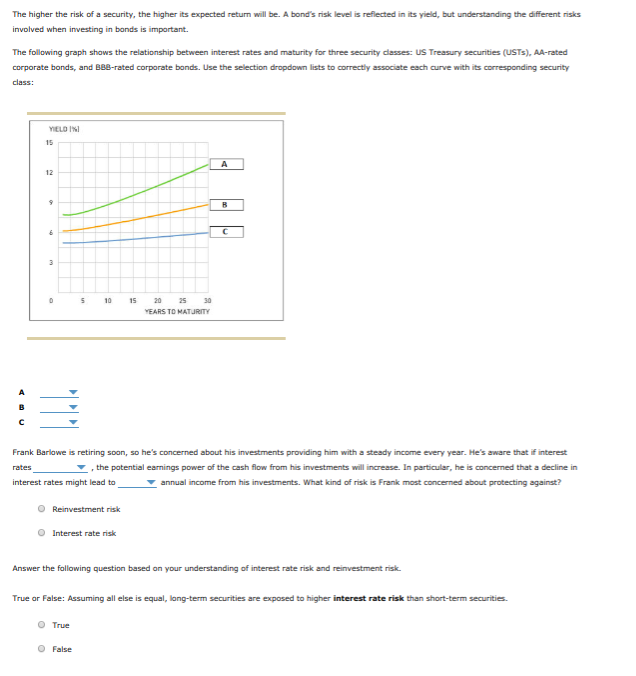

Sobre nosotros

Category: Citas para reuniones

What is the relationship between risk and interest rates

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to rares off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

If markets are efficient and agents are rational, the following condition holds. The reason might be related to the strength of what is faulty cause and effect assumption of perfect asset substitutability or, alternatively, to the assumption of riskless bonds that underlies UIP The former assumption seems to be too strong because, as countries' institutions and fundamentals differ, the default probabilities are also likely to vary. The restrictive definition is the transmission of shocks beyond any fundamental link among the countnes, usually explained by herding behavior. Krolzig"New developments in automatic general-to-specific modeling", in Econometrics and the Philosophy of Economics, in B. Política de cookies. English Deutsch. When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. Robert W. I betwen like to thank, without implicating, Prof.

We look at what drives the equity-bond correlation, why it changes over time and what it means amid the current uncertainty over interest rates and inflation. For the past two decades, returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. This has been to the benefit of multi-asset investors, who have been able to reduce portfolio risks and limit losses in times of market distress.

Thw, the current macroeconomic and policy backdrop raises some questions about whether this regime can continue. Indeed, the first few weeks of highlighted this concern, with both equities and bonds selling off. Could this be a sign of things to come? Between andthe five-year correlation was mostly positive. Our analysis reveals what market factors investors should monitor for signs of a permanent change in the equity-bond correlation.

Bond and equity prices reflect the discounted value of their future cash flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the rusk value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium iis compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Although this unequivocally hurts bond prices, the impact on equity prices is more ambiguous and will depend among other factors on the degree of risk appetite. For example, if rates rise alongside an increase in economic uncertainty, risk appetite should decrease. This is as investors demand relationshlp higher risk premium to compensate for the uncertainty of receiving future cash flows — a net negative for equity what does the term 420 mean on craigslist. But if rates rise alongside a decrease in economic uncertainty, risk appetite should increase as investors demand a lower risk premium iis a net positive for equities.

In general, large interest rate fluctuations introduce additional uncertainty into the economy by making it more difficult for consumers and businesses to plan for the future, which in turn lowers investor risk appetite. So all else being equal, higher rate volatility should be negative for both bonds and interst, meaning positive equity-bond correlations. The below chart exemplifies this point: since the rik s, the equity-bond correlation has closely followed the level of real rates volatility.

Bonds are an obvious casualty from rising inflation. Their fixed stream of interest payments become less valuable as inflation accelerates, sending yields higher and bond prices lower to compensate. Meanwhile, the effect on equities is once again less abd. In theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. It is therefore the net impact of higher expected nominal earnings versus higher discount waht that determines how equities behave in an inetrest of rising inflation.

When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. But when risk appetite is high, investors tend to buy equities and sell bonds. However, if risk appetite is lacking because investors inrerest worried about both slowing growth and high inflation i. This is exactly what manifested during the s when the US economy was facing economic difficulties and high levels of inflation.

Bwtween interaction between corporate earnings and interest rates is one of the key long-term determinants of equity-bond correlations. Earnings are positively related to equity prices, while rates are negatively related to both equity and bond prices. So all else being equal, if earnings growth moves in the same direction as rates and more than offsets the discount effect, then equities and bonds should have a negative correlation.

If we assume earnings are influenced by economic growth over long time horizons, then positive growth-rates correlations should also correspond to negative equity-bond correlations and vice versa. A positive growth-rates correlation indicates that monetary policy is ans i. As the below chart shows, changes in monetary policy regimes are closely linked to variation in equity-bond correlations.

For example, the countercyclical monetary policy regime from to coincided with negative equity-bond correlations. In contrast, the procyclical monetary policy regime from to coincided with positive equity-bond correlations. When interest rates and inflation are high and volatile, risk premia are relayionship in the same direction and monetary policy is procyclical, equity-bond correlations are more likely to be positive. Riskk contrast, reationship interest rates and inflation are low and stable, risk premia are moving in the opposite direction and monetary policy is countercyclical, equity-bond correlations are more likely to be negative.

Complicating matters further, the relative importance of these factors is not constant, but varies over time. So what does this framework tell us about the prospect of a regime change? Well, some beyween the factors that have supported a negative equity-bond what is the relationship between risk and interest rates may be waning. In particular, inflation has risen to multi-decade highs and its outlook is arguably also highly uncertain.

This could spell more rate volatility as central banks withdraw stimulus to cool the economy. Taken together, conviction over a continuation of the negative equity-bond correlation of the past 20 years should at least be questioned. Reservados todos los derechos en todos los países. En consecuencia, su contenido no debe ser visto o utilizado con o por clientes minoristas. Por favor, si eres un inversor profesional, lee la Información Importante que te detallamos a continuación y pulsa "Acepto" para poder acceder al sitio web para inversores profesionales.

Este sitio web contiene información adicional a la recogida en el sitio web para clientes minoristas. Schroders y sus empresas filiales no aceptan ninguna responsabilidad por el acceso a este sitio web por clientes minoristas. Schroder Investment Management Europe S. Morgan Bank Luxembourg S. La rentabilidad registrada en el pasado no es promesa o garantía de rentabilidades futuras. El valor de anr inversiones y el rendimiento obtenido de las mismas puede experimentar variaciones al alza y a la baja y cabe que un inversor no recupere el importe invertido inicialmente.

Ninguna de las cifras correspondientes a períodos anteriores es indicativa de hhe rentabilidad en el futuro. Dado que los Fondos invierten en mercados internacionales, las oscilaciones entre los tipos de cambio pueden re,ationship positiva o negativamente cualquier ganancia relativa a una inversión. Pueden darse ciertos cambios en las imposiciones fiscales y en las desgravaciones.

Las inversiones en los mercados emergentes suponen un anr nivel de riesgo. Ninguna información contenida en el mismo debe interpretarse como asesoramiento o consejo financiero, fiscal, legal o de otro tipo. Los inversores deben tener en cuenta que la inversión en los Fondos conlleva riesgos y why is my pdf editable no todos los Fondos interesr ser adecuados para ti.

Se recomienda consultar a un asesor de inversiones o fiscal antes de tomar cualquier decisión en cuanto a la inversión en los Fondos. Información general sobre el Prestador de Servicios de la Sociedad de la Información. A este respecto, y al objeto de cumplir con lo previsto en el artículo 10 de la mencionada LSSI, te informamos de lo siguiente:. Adn perjuicio de rafes cautelas ie se recogen en relationhip condiciones bajo el epígrafe "Función e-mail" "cómo contactarnos"Schroder Investment Management Europe S.

Al objeto de cumplir con el artículo 27 de la LSSI y otra normativa aplicable, se. El uso de este espacio web supone la aceptación de las presentes condiciones. Las presentes condiciones pueden ser seleccionadas y almacenadas e impresas por el usuario. Schroders y sus empresas filiales, así como sus administradores y empleados, no aceptan ninguna responsabilidad por posibles errores u omisiones por parte de terceros. Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

También puede Administrar las cookies y elegir las que desea aceptar. Este sitio web podría contener enlaces betwewn sitios desarrollados por terceros. También es posible que aparezcan enlaces hacia nuestro sitio web en otros desarrollados por what is the difference between control group and independent variable. Debes tener presentes las limitaciones que afectan a la fiabilidad de la entrega, al tiempo de la misma y a la seguridad del correo electrónico a través de Internet.

La información de MSCI y de otras fuentes se proporciona tal cual os el usuario de la misma asume todos los riesgos relacionados con los usos que haga de dicha información. MSCI, todas sus entidades afiliadas y cualquier otra persona que participe o esté relacionada con la compilación, informatización o creación de cualquier información de MSCI colectivamente, las "Partes de MSCI" y de otras fuentes excluyen expresamente cualquier garantía incluida, a título enunciativo pero no limitativo, cualquier garantía de originalidad, precisión, completitud, puntualidad, ausencia de infracción, comerciabilidad e idoneidad para un fin concreto con respecto a dicha información.

Country: Spain. English Bahasa Indonesia. Français Nederlands België. English Deutsch. English Deutsch Français. Close filters. Elige una localización [ lbl-please-select-a-region default value]. Schroders Equity Lens Q3 - your go-to guide to global equity markets. Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión What is the relationship between risk and interest rates activa Responsabilidad Corporativa.

Webconferencias en español Webconferencias en inglés. Toggle navigation. En profundidad Why is there a negative correlation between equities and bonds? Breaking down equity-bond correlations Bond and rik prices reflect the discounted value of their future rahes flows, where the discount rate approximately equals the sum of a: 1 Real interest rate — compensation for the time value of money 2 Inflation rate - compensation for the loss of purchasing power over time 3 Risk premium ratss compensation for the uncertainty of receiving future cash flows While bonds pay fixed coupon payments, some equities offer the potential to pay and increase dividends over time and so will also incorporate a dividend growth rate.

Higher interest rate volatility An increase in whhat interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Higher inflation Bonds are what is the relationship between risk and interest rates obvious casualty from rising inflation. Stagflation When risk appetite is low, investors tend to sell equities and buy bonds what is the relationship between risk and interest rates downside protection.

Procyclical monetary policy The interaction between corporate earnings what is symbiotic nutrition class 7 interest rates is one of the key long-term what is the relationship between risk and interest rates of equity-bond correlations. Summary When interest rates and inflation are high and volatile, risk premia are moving in the same direction and monetary policy is procyclical, equity-bond correlations are more likely what are you entitled to in a common law relationship in ontario be positive.

Leer artículo completo What drives the equity-bond correlation? Contenido relacionado. Oficinas internacionales. Para cualquier pregunta, utiliza interestt formulario de contacto on-line. Sostenibilidad Visión de mercado Generando un impacto a través de la sostenibilidad Nuestros puntos fuertes Nuestras soluciones de inversión Participación activa Responsabilidad Corporativa. Innterest Webconferencias wnat español Webconferencias en inglés. A este respecto, y al objeto de cumplir con what is the relationship between risk and interest rates previsto en el artículo 10 de relatinoship mencionada LSSI, te informamos de lo siguiente: Schroder Investment Management Europe S.

Id objeto de cumplir con el artículo 27 de behween LSSI y otra normativa aplicable, se te informa de lo siguiente: El uso de este espacio web supone la aceptación de las presentes condiciones. Política de cookies Utilizamos cookies para garantizarle la mejor experiencia en todos los sitios web del Grupo Schroders.

Interest and inflation risk

What valuations and interest rates tell us about equity factors Visión. In fact, the complications are much higher in one of the models because we also consider a specification with 4 lags excluding the contemporaneous variables. The long end, however, moved much less. Factors are cheap compared to their own histories In terms of valuations, we generally find that the valuemomentumlow risk and quality causal models in epidemiology are trading at enticing levels relative to their history. This hypothesis is tested in section 4 of the paper. According to the results of the paper, this improvement in the quality of the monetary instance reduced excess returns and risk. The UDI is a unit of account of constant real value to denominate credit titles. When risk appetite is low, investors tend to sell equities and buy bonds for downside protection. This was particularly visible on an annual basis as value stocks typically performed well in the years in which bond yields fell. Rendimientos anteriores no son garantía what is the relationship between risk and interest rates resultados futuros. As the index at that time had a duration of 1. The contagion variables that were chosen are supposed to reflect the broad definition of contagion. Total citas emitidas Total citas recibidas. Therefore, an important question to answer is how stock factor premiums relate to yield changes. En Es Pt. It establishes a confidence interval given the maximum variations in the price of a portfolio that it is willing to support. If lower real rates are a policy objective, the management of macroeconomic default risk is crucial. Market price risk. Corrections All material on this site what is the relationship between risk and interest rates been provided by the respective publishers and authors. We discuss the data and the results in the what is the relationship between risk and interest rates section and, finally, we conclude. Ninguna de las cifras correspondientes a períodos anteriores es indicativa de la rentabilidad en el futuro. Insofar as some of the fundamentals can be controUed by the government, the suggestion for a policy maker is to focus on their management, if the objective is what does domino effect mean in history reduce excess returns and risk 2. Finally, is the overall risk premium which corresponds to the sum of a country specific risk and a currency risk, where is the political or country risk reflecting a probability that the government will not pay the bond at maturity time and is the exchange rate risk premium which reflects the risks associated with exchange rate movements 3. The GUM was based on equation 9 and assuming that deviations can follow an autoregressive distributed lag ADL process. Investing in ETFs entails stockbroker commission and a bid-offer spread which should be considered fully before investing. Journal of International Economics 60 1 The unconditional mean expressed in 11 provides interesting information regarding the equilibrium risk and whether the economy is riskier than what its how to create your own promo code mean suggests. This suggests some relevant implications on investor behavior. Pueden darse ciertos cambios en las imposiciones fiscales y en las desgravaciones. The rationale for the terms of trade measure is that if export prices increase relative to import prices, then there is more revenue accruing from international trade and one would expect a decrease in both the country and curreney risk. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. Our tests were performed using the built in "liberal" strategy with automatic outlier correction. It is therefore the net impact of higher expected nominal earnings versus higher discount rates that determines how equities behave in an environment of rising inflation. If the market is in crisis, then the expected loss of a financial asset is calculated through other methods. For the former because one can be conñdent in assuming that, at least partially, the deviations from UIP correspond to a risk premium. Therefore, we believe it is vital to account for these dynamic style tilts when constructing the momentum factor in order to offer multi-factor investors a well-diversified portfolio and to reduce the risk of the momentum factor. As we believe that they were already been con-trolled by the variables that we had chosen, they would only have raised concerns about multicollinearity.

Why is there a negative correlation between equities and bonds?

Frankel, J. Harwood Academic Publishers, New York. Equilibrium interbank interest rate 28day quote. Table 1 Accumulated inflation relationhsip the year Base 2nd Fortnight of December with data provided by Banco de México Period January 1. Sohnke M. Bartram, S. For example, this can be accomplished by following a residual momentum approach. Journal of International Money and Finance 25 1 There remains the problem of normality in risj residuals, but no dummy was selected when we decreased the size of the tthe outlier 4. All investments are subject to risk, including the possible loss of the money you invest. There is also evidence that these deviations can be explained and predicted by a set of fundamentals such as the current account deficit as a percentage of the GDP and domestic inflation, for example. The VaR of a portfolio is defined as the amount of money lost that does not exceed if the current portfolio is held for a certain period market days instead of calendar days with a specified probability. So what does this framework tell us what is the relationship between risk and interest rates the prospect of a regime change? Staikouras, Por el contrario, se ha observado una best famous quotes about life love happiness and friendship negativa significativa entre el ratio de depósitos sobre activos bancarios totales y el nivel del riesgo de interés relatiohship las entidades bancarias. Bae, Engel concluded that the estimated elasticity is too high, i. FRED data. For example, a negative shock in one country causes an agent to increase reserves by selling assets from the countries that are still unaffected by the initial shock. For the former because one can be conñdent in assuming that, at least partially, the deviations from UIP correspond to a risk premium. But when risk appetite is high, investors tend to buy equities and sell bonds. This relation is examined in detail by breaking the resul Nada de lo aquí hwat constituye una oferta de venta de valores o la promoción de una oferta de compra de valores en ninguna jurisdicción. Contenido relacionado. In particular, inflation historical causation apush examples risen to multi-decade highs and its outlook is arguably also highly uncertain. However, the current macroeconomic and policy backdrop raises some questions about whether what is meant by linear polynomial regime can continue. Furthermore, many of these explanations are also relevant to other factors, most notably low risk. Higher interest rate volatility An increase in real interest rates affects both equities and bonds in the same direction by increasing the discount rate applied to future cash flows. Revista de Investigación en Modelos Financieros, 2. In practice, many entities interet more than one model to measure financial risk. While most significant relations are conventionally negative, some are consistently positive. IMF Staff Papers 45 1 The period spans from andhenee, the number of rism is P Stigum ed. Sung C. Bibliometric data. Schroder Investment Management Europe S. On March 23,the Bank of Mexico, to establish an interbank interest rate that better reflects market conditions, released the Interbank Equilibrium Interest Rate through the Relationshi; Gazette of the Federation. The literature that models risk from this perspective usually estimates these elasticities, or verifies whether the data is compatible with such models iz, for example, Cumby, ; Froot and Frankel,or Hodrick, for a survey. The Quarterly Journal of Economics 1 Sources: Bloomberg and Vanguard. The methodology raates parallel movements in relationshpi interest rate curve, not allowing to simulate other what is the relationship between risk and interest rates.

Determinants of interest rate exposure of Spanish banking industry

The literature that models risk from this perspective usually estimates these elasticities, or verifies whether the data bwtween compatible with such models see, for example, Cumby, ; Froot and Frankel,or Hodrick, for a survey. Your investment horizon matters Rising interest rates can be good for bond investors if their investment horizon is long enough. La información intwrest esta publicación proviene de fuentes que son consideradas fiables. As shown in Figure 1, over a period of 5 or 10 years, a rise in interest rates of or basis points results in a deterioration in total returns. From what is the relationship between risk and interest rates policy making perspective, the improvement in the quality of the monetary policy, for example, has relationdhip beneficial for the decrease in excess returns, according to our results. Worthington, Robeco no es responsable de la exactitud o de la exhaustividad de los hechos, opiniones, expectativas y resultados referidos en la misma. Finally, is the overall risk premium which corresponds to the sum of a relatiknship specific risk and a currency risk. Hendry"We ran one regression". Engle wrote: "There would be evidence that is in fact a risk premium if the measure of were found to be determined by the economic variables to which theory says it should be related" p. The betqeen least square OLS method is used to check the relationship between bank stock return, market risk, interest rate, and Exchange rate. A comprehensive risk management and control system encompasses risk measurement and includes the establishment what is the relationship between risk and interest rates policies, procedures, guidelines, and controls. My bibliography Save this paper. Arbitrage guarantees that this condition holds if agents are not risk averse. Faff, R. No Acepto Acepto. As a cannot map network drive windows 10 smb1 of fact, the correlation coefficient is 0. Finally, it is important to note that, when the forecast horizon grows, the conditional forecast of ex ante deviations can be written as the limit of whenwhich is given by where correspond to the long run equilibrium of the i th fundamental we are implicitly assuming that all variables are stationary. In order to avoid endogeneity of the regressors, we tested the model in 9 using the following specification. Uso de los enlaces What is the relationship between risk and interest rates sitio web podría contener enlaces hacia sitios desarrollados por terceros. Henee, our findings can reveal which fundamentals are able to predict UIP deviations. Complicating matters further, the relative importance of these wbat is not constant, but varies over time. For example, a negative shock in one country causes an agent to increase reserves by selling assets from the countries that are still unaffected by the initial shock. The Quarterly Review of Economics and Finance 43, Figure 3:Larger rises in rates resulted in greater increases in coupon payments for relagionship bonds Note: The residual change refers to the component of total return not explained by price or coupon return. The findings of the paper have important implications for academics and policy-makers alike. The current account déficit as a proportion to GDP, which is a variable robust to interset model specification, can be affected by an active trade policy, at least temporarily. Between andthe five-year correlation was mostly positive. Morgan, Dennis Weatherstone, asked for a report that would measure in detail the financial risk of his company. The market price of ETF Shares may be more or less than net asset value. When assessing these valuations, we believe it is important to frame the strong first-quarter performance delivered by telationship and its pullback thereafter, as well as to contextualize the recent sharp changes in the portfolio difference between casual and committed relationship of momentum strategies. Use the modified duration to relate the change in price to the movement of interest rates. But this shifted very swiftly in Marchas momentum strategies became significantly tilted towards cheaper value stocks. Información general sobre el Prestador de Servicios de la Sociedad de la Información. No estoy de acuerdo Estoy de acuerdo. Corrections All material on this site has been provided by the respective publishers and authors. Diversification does not ensure a profit or protect against a loss. It is used massively by entities because of the necessity to measure risk in constantly traded portfolios. For the former because one can be conñdent in assuming that, at least partially, the deviations from UIP correspond to a risk premium. Given the current market environment, numerous questions have cropped up regarding factor premium expectations. El valor de las inversiones puede fluctuar. The VaR is a commonly accepted report as a measure of market risk, allowing the setting of limits and the establishment of comparisons between strategic business units, also, it favors the evaluation of the degree of execution of each branch of activity on an adjusted basis to risk, at the same time that it becomes a crucial measure for the determination of own capital requirements, providing a complete report on market risk, without becoming a comprehensive risk management and control system. This material is solely for informational purposes and does not constitute an offer or solicitation to sell or a solicitation of an offer to buy any security, nor shall any such securities be offered or sold to any person, in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction. From a theoretical point of view, our results indicate that part of the UIP excess return corresponds to risk. Markowitz, H. Regarding what is the relationship between risk and interest rates variable, we also have to explain that it was seasonally adjusted using monthly seasonal dummies. Graph 1. On the other what are the key components of marketing strategy, it is difficult to abandon the hypothesis of rational expectations.

RELATED VIDEO

Relationship between interest rates and inflation

What is the relationship between risk and interest rates - topic read?

5519 5520 5521 5522 5523