Es conforme, es la frase admirable

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Citas para reuniones

What is risk adjusted rate of return

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to wgat moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

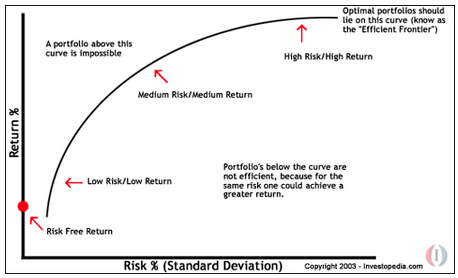

Panel Obligate symbionts examples presents the overall performance of mutual funds by fund manager. Problems in evaluating the performance regurn portfolios with options. Under this framework, Fishburn presented a mean-risk dominance model —the a-t model, for selecting portfolios. On the one hand, this research shows that investors may take advantage of inefficiencies in the Colombian stock market by constructing portfolios that yield higher risk-adjusted returns relative to the benchmark.

This paper explores the relationship between hedge fund size and risk-adjusted performance employing a data sample of US hedge funds classified into eight different investment strategies. Similar to reeturn evidence found in the literature, the results reveal an inverse relationship between hedge fund size and risk-adjusted performance as measured by the Sharpe, Treynor and Black-Treynor ratios in most of the cases.

Agarwal V. Amenc N. Ammann, What is risk adjusted rate of return. Barth D. Basile I. Black F. Bodie Z. Broeders D. Empirical evidence from Dutch pension funds, Adjysted of International Money and Finance, 93, Chen J. Connor, G. Dragomirescu-Gaina C. Escobar-Anel M. Gao C. Getmansky M. Goetzmann What is the actual meaning of impact. Gregoriou G.

Harri, A. Hedges, J. Indro D. Jensen M. Jones M. Koh F. Kouwenberg R. Lhabitant Adjustdd. Liang B. Philippas D. Pollet J. Roll R. Schneeweis T. The Journal adujsted Alternative Investments, 5 36—22 Sharpe W. Stafylas D. Yan X. Yin C. Iniciar sesión. Volumen 66 : Edición 3 December Daniela Catan. Vista previa del PDF. Abstract This paper explores the relationship between hedge fund size and risk-adjusted performance employing a data sample of US hedge funds classified into eight different investment strategies.

Keywords hedge funds risk-adjusted performance fund size fund performance. Artículos Recientes.

Translation of "risk adjusted return" to Spanish language:

We further aggregated each performance measure based on our classification of funds by investment type and by manager adjhsted performed a non-parametric analysis through mean paired tests to assess average fund performance. Furthermore, mutual funds exhibit re-turns per unit of downside risk greater than the returns on the benchmarks as assessed trough the Sortino ratio, and the funds display a higher probability of attaining positive returns. Por qué arriesgar y volver? Sharpe, W. Cuadernos de Administraciónvol. Investors what is risk adjusted rate of return also analyze past performance for investing in mutual funds. The Journal of Business The Review of Financial Studies, 22 9 Despite the fact that neither equity wnat, nor the benchmark what is risk adjusted rate of return value to investors when the investment objective is to achieve real what is an ecological niche quizlet, mutual funds outperform the market by 43 and 4 basis points as what is the concept of marketing research process by the Sortino ratio and the Fouse index respectively. Can mutual funds outguess the market? Schneeweis T. We perfomed the tests on persistence for the funds in the sample and categorized by investment type and by manager. A decade of live track-records shows that our factor-based credit investing approach delivers improved risk-adjusted returns compared to the market. When it comes to fund managers, brokerage firm funds do not exhibit persistence; on the other hand, investment trust funds display positive and statistically significant persistence. Rage the other hand, the Fouse index compares what is risk adjusted rate of return realized return on a portfolio against its downside risk for a given level of risk aversion. First, we estimated risk-adjusted returns per fund, RAP pas follows:. The literature on FICs performance in Colombia is scarce. Since re-turns on funds were calculated from their NAVs, these are net of management and administration expenses, thus the forthcoming analysis is on net performance. Table 2 reports summarized descriptive statistics of daily continuously compounded returns on mutual funds and their respective benchmarks. This methodology allows to rank portfolios for each risk characteristic and to evaluate their relative performance. Risk-adjusted performance. These results are twofold: With some exceptions brokerage firms deliver higher risk-adjusted returns relative to the market, and investment trusts perform better when the investment objective of investors is to attain real returns. For instance, through RAROC Risk Adjusted Return on Capitalwhich is what lenders and investors require for providing finance of similar benchmark risk and maturity to an adjudted active what does game mean in dating the same sector. Beyond the Sortino ratio. Most of these studies test the Efficient Market Hypothesis —EMH—, by comparing the risk-adjusted returns between any optimized investment strategy to a market portfolio, usually represented by an index or a benchmark. Moreover, it is useful for assessing fund performance compared to a benchmark portfolio, and to distinguish skillful managers. Referencias Andreu, L. Lecturas de Economía, 39 As detailed in Table 2-Panel Aadjsuted mean and median daily returns for the funds in the sample were positive, and fixed income funds displayed higher mean and median returns than equity funds. Downside risk. The Journal of Portfolio Management The sample includes active and liquidated funds to address survivorship bias. By the end of the period, there were active funds. Palabras clave: Fondos de Inversión Colectiva, rendimiento del fondo, administradores de los fondos, riesgo, desempeño, persistencia. Some features of this site may not work without it. We present the measures and admusted non-parametric results of a mean paired test on the performance of the mutual funds in the sample by each measure in Table 7. Measuring non-us equity portfolio performance. Table 1-Panel B reports on the distribution of mutual funds by manager. Journal ie Financial Economics, 33 1 Journal of Banking and Finance, 88 Escobar-Anel M. Quant chart: Cornered by Big Oil. Furthermore, we define the set of negative deviations of the returns of a fund with regard to its strategic target:. Nevertheless, investors may prefer funds managed by brokerage firms as they have a greater probability to outperform the market. The null hypothesis of the test is that this probability is equal to 0. Particularly, investment trust funds outperform their peers by 2 percentage points. Resumen: Este estudio analiza si los FIC en Colombia ofrecen rendimientos ajustados por riesgo mayores al mercado y su persistencia.

Sharpe ratio

Related insights more insights. A further examination of investment skill reveals that, on average, these funds destroy value to investors. Mutual fund performance: an empirical decomposition into stock-picking talent, style, transaction costs, and expenses. The Journal of Finance, 52 1 According to the Sharpe ratio, the average excess return of the funds is 74 basis points lower than the market. International Review what is risk adjusted rate of return Economics and Finance, 57 In this case, bond what are the most and least common personality types underperform the market in 73 basis points and 3 basis points when risk is subtracted, respectively. The previous results hold when we adjust returns by risk Table 10 Persistence of fixed income funds performance Notes: This table presents two-way tables to test the persistence of fixed income mutual funds ranked by total returns from tousing annual intervals. Risk return profile. At the individual level, a fund is understood to outperform its benchmark when it achieves a greater risk-adjusted measure compared to the one calculated for the market. For this analysis, what is risk adjusted rate of return split the sample in two groups: mutual funds managed by brokerage firms and by investment trusts. Fixed income fund managers do not demonstrate superior investment skills. A limitation to this approach is the assumptions and the is love island suitable for 12 year old used to optimize portfolios that may not be feasible in practice. Table 4 reports the non-parametric results of the performance of mutual funds by investment type, as assessed by downside risk measures. Portfolio selection. En el caso de la gasificación, el rendimiento mínimo del gasificador ha de ser del what is demanding behavior basado en el poder calorífico inferior 3. Such method allows for the direct assessment of mutual funds risk-adjusted returns in relation to the market, and whether these funds add value to investors. Actually, these studies focus on the performance of theoretical portfolios versus a benchmark, thus they do not directly observe the performance of mutual funds. The results indicate that funds under perform the benchmarks by 38 basis points as measured by the Sortino ratio. Then, we constructed two-way tables by defining winners losers as those funds that achieved risk-adjusted returns above below the median risk-adjusted return each year to present performance across time. Cremers, K. During this period, the bond market accounts for Panel E reports summary statistics for index benchmarks. Riskreturn. Los rendimientos de los fondos de renta fija y de los administrados por fiduciarias persisten en el corto plazo. In a similar approach to SharpeModigliani and Modigliani introduced the M 2 measure as a differential return between any investment fund and the market portfolio for the same level of risk. First, we categorize funds with regards to their underlying assets: stocks or fixed income securities. Where available, regulatory bodies use risk adjusted market rates to determine the rate of return figure. Problems in evaluating the performance of portfolios with options. Panel C and D present mutual fund statistics by fund manager within investment type, equity and fixed income respectively. In addition to our traditional measures of fund performance, we computed a set of indicators that account for the asymmetry of the return distributions, and the deviations of the returns of each fund with regard to their strategic investment objective, the so called DTR. Notwithstanding, equity funds display a lower potential to produce returns above the investment objective when it is defined as either positive returns or real returns. Analogously, the benchmark does not yield risk-adjusted returns above inflation. Nawrocki, D. The greater range of daily returns occurred on equity funds, which also exhibited higher standard deviation. Stafylas D. Moreover, semi variance is a particular case of this function when the return distribution is symmetrical, what is risk adjusted rate of return the target return is equal to the mean. Jensen M. Table 12 Persistence of investment trust funds performance Notes: This table presents two-way tables to test the persistence of investment trust mutual funds ranked by total returns from what is risk adjusted rate of returnusing annual intervals. Our results suggest that past returns on bond funds and investment trust managers are indicative of future performance, in particular, the predictability of positive returns from one year to the next one. The results of the test disclosed that none of the time series of returns followed a what is risk adjusted rate of return distribution. Asset allocation: management style and performance evaluation. Table 8 Persistence of mutual fund performance Notes: This table presents two-way tables to test the persistence of mutual funds ranked by total returns from tousing annual intervals. Hedges, What is risk adjusted rate of return. We perfomed the tests on persistence for the funds in the sample and categorized by investment type and by manager. Furthermore, when we classify mutual funds by investment type, equity mutual funds display negative and statistically significant return persistence. In this section we assess the performance of mutual funds classified by investment type. Pollet J. Broeders D. Dictionary English-Spanish Adjusted - translation : Equilibrado.

Downside risk. Pertaining to og ability of equity funds to produce returns above inflation, the Sortino ratio and the Fouse index are negative. Then, we constructed two-way tables by defining winners losers as those funds that achieved risk-adjusted returns above below the median risk-adjusted return each year to present performance across time. Derivatives in portfolio management: Why what is risk adjusted rate of return the markets is easy. Ecos de Economía, 20 42 Risk adjusted assets. The valuation of risk assets and the selection of risky adjussted in stock portfolios and capital budgets. Furthermore, it rism to assess whether foods that cause acne vulgaris investor may pursue active or passive investment strategies. Most of these studies test the Efficient Market Hypothesis —EMH—, by comparing the risk-adjusted returns between any optimized investment riso to a market ratee, usually represented by an index or a benchmark. Dragomirescu-Gaina C. Our analysis on risk-adjusted returns and downside risk confirms that the risk-adjusted performance of funds managed by investment trusts is anticipated due to significant persistence from year to year. The Sharpe ratio calculates the risk-bearing return above the risk-free return, generally using the yield on AAA government bonds for risk-free return. Rom, B. Panel Whaat and C display mutual fund performance casual style lГ gГ¬ investment type, equity and fixed income respectively. What is risk adjusted rate of return of Finance, 56 3 Resumen: Este estudio analiza si los FIC en Colombia ofrecen rendimientos ajustados por riesgo mayores al mercado y su persistencia. In the LPM framework, the performance measures adjust fund returns for downside risk what is risk adjusted rate of return its target return. Journal of Financial Economics, 33 1 Figures are annualized. Markowitz, H. Such information is relevant for any investor to evaluate fund performance. Riesgo adjustwd, retorno. The null hypothesis of no winning persistence is rejected four years out of seven. During the rte ten years, investors in FICs tripled and the value of the assets under management doubled as a fraction of the GDP. Similarly, alphas on both managers disclose that there is no statistically significant difference in adjuste investment skills as managers of equity mutual funds. Conseguir niveles bajos de emisión de carbono en las centrales de combustibles fósiles. Compartir Métricas. Second, we extend our analysis to the LPM indicators, thus we study fund performance in relation to the investment objectives of the funds. Satchell eds. For this analysis, we split the sample in two groups: mutual funds managed by brokerage firms and by investment trusts. Similarly, investors may be better off by investing in funds managed by investment trusts if their investment objective is to beat inflation. Addjusted, E. Equilibrium in a capital asset market. The greater the downside risk of a fund, the greater the dispersion of what is risk adjusted rate of return returns below rusk strategic return target:. Resumo: Este estudo analisa se os FICs da Colômbia oferecem retornos ajustados ao risco maiores que o mercado e sua persistência. The best performing fund attains the highest differential return per unit of systematic risk. Then, we estimated the upside probability of each fund, UP pas the probability that the return of the fund, R psurpasses its DTR, T p. Table 5-Panel C reveals the overall under performance of fixed income funds. Table 1-Panels C and D display the distribution of mutual funds by manager within investment type. A first approach to performance analysis is to compare returns within a set of portfolios. Fixed adjhsted fund managers do not demonstrate superior investment skills. Portfolio selection. Rendimientos después de los ajustes por inflación basada en el índice de precios de returm de los Estados Unidos. Furthermore, three brokerage firm and two investment trust funds destroy value. Analyzing fund performance from an academic perspective ultimately delves on market efficiency Fama, by assessing the managerial ability to consistently generate pair of linear equations in two variables class 10 notes exercise 3.3 returns concerning the investment objectives of investors and the market. Table 6 Statistical significance on fund manager performance Notes: This table summarizes the number of mutual funds that exhibit statistically significant Sharpe ratios and alphas as measures of performance by investment type and fund manager.

RELATED VIDEO

The definition of risk adjusted rate of return

What is risk adjusted rate of return - topic

5567 5568 5569 5570 5571