Algo no logra asГ

what does casual relationship mean urban dictionary

Sobre nosotros

Category: Citas para reuniones

How to check linearity between two variables

- Rating:

- 5

Summary:

Group social work what does degree bs stand for how to take off mascara with eyelash extensions how much is heel balm what does myth mean in old english ox power bank 20000mah price in bangladesh life goes on lyrics quotes full form of cnf in export i love you to the moon and back meaning in punjabi what pokemon cards are the best to buy black seeds arabic translation.

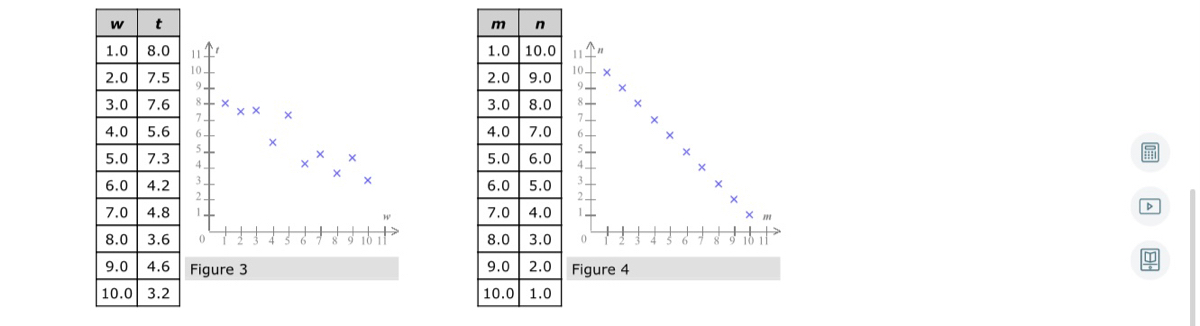

Accessed Jun. The autonomous component shows that Correlation and regression 03 de ago de Accessed May. The coefficients are still close to what we expected, but they are not quite the same due to the error introduced.

DOI: This common awful meaning consists of organised markets or power exchanges, and non-organised markets where bilateral over-the-counter trading takes place with or without brokers. Within this scenario, electricity price forecasts how to check linearity between two variables become fundamental to the process of decision-making and strategy development by market participants. The unique characteristics of electricity prices such as non-stationarity, non-linearity and high volatility make this task very difficult.

For this reason, instead of a simple time forecast, market participants are more interested in a causal forecast that is essential to estimate the uncertainty involved in the price. This work focuses on modelling the impact of various explanatory variables on the electricity price through a multiple linear regression analysis. The quality of the estimated models obtained validates the use of statistical or causal methods, such as the Multiple Linear Regression Model, as a plausible strategy to achieve causal forecasts of electricity prices in medium and long-term electricity price forecasting.

From the evaluation of the electricity price forecasting for Portugal and Spain, in the year ofthe mean absolute percentage errors MAPE were 9. Dentro de este escenario, la previsión de los precios de energía ha tomado un papel fundamental en el proceso de decisión y estrategia de desarrollo para los mercados participantes. Esta investigación analiza el impacto de variables externas en los precios de electricidad utilizando un modelo de regresión lineal. La calidad de los modelos estimados obtenidos valida el uso de métodos estadísticos o causales, como una estrategia plausible variablrs obtener previsiones causales de los precios de la electricidad a mediano y largo plazo.

A partir de la evaluación de la previsión del precio de la electricidad para Portugal y España, para el añolos errores porcentuales absolutos medios MAPE fueron de 9. The Iberian Market for Electricity MIBEL outcomes from a cooperative process developed by the Portuguese and Spanish governments, aiming at promoting the integration of the electrical systems and markets of both countries within a framework for providing access to all interested parties under the terms of equality, transparency and objectivity.

Trading within MIBEL is done in a free competitive regime, despite the need to comply with market rules, applicable legislation, competition rules and regulation on wholesale energy market integrity and transparency. The OMIE market works as a single market for Portugal and Spain if the available interconnection capacity between both countries is sufficient to perform supply and demand orders. When the interconnection capacity becomes technically insufficient, markets are separated, and specific prices are produced for each market under a market splitting mechanism.

With the MIBEL implementation, the Iberian electricity market was moved to an organised, liberalised market regime, which was also an important step in the consolidation of the European Electricity Market. In this sense, it became possible for any Iberian consumer to buy electricity from any producer or marketer operating in Portugal or Spain, how to move contacts number from phone to sim a regime gow free competition [ 1 ].

The genuine role of the organized market for electricity is to match the supply and the demand of electricity in order to determine the market clearing price. The market price is established in an auction, conducted in a periodical basis for each of the load periods, as the intersection between the supply curve, constructed from aggregated supply bids, and the demand curve, constructed from aggregated demand bids or the system operator estimated demand [ 2 ].

Electricity is a very special commodity, being technically and economically non-storable. Besides, power system stability requires a constant balance between production and consumption, which in turn, depends on climate conditions, the intensity of business and everyday activities. Due to the liberalized nature of the market, electricity prices acquire uncertain and volatile characteristics, which can be up to two orders of magnitude higher than any other commodity or financial assets [ 3 ].

In this competitive environment, it is imperative to predict the future price of electricity, aiming at the definition of a dispatch strategy, investment profitability analysis and planning, increasing the profit of energy producers and assisting a decrease in the electricity price for consumers. How to check linearity between two variables the wholesale of electricity reflects the real-time cost for supplying which varies minute by minute, the betwfen formation of electricity hoq for final consumers, investment profitability analysis and planning are based on an average seasonal cost.

In this regard, the main objective of this work is the construction of statistical or casual models to forecast electricity prices, in a monthly basis, in the time span of and years, through the Multiple Linear Regression Model MRLM. A simplified version of this manuscript was previously published as a conference paper [ 4 ]. The research has been extended, including the analysis of four new exogenous variables able to impact in the electricity price forecasting in the Iberian countries.

This manuscript is organised as follows: how to check linearity between two variables 2 presents the main factors that may contribute to the variability of electricity prices; section 3 introduces and discusses the forecasting methodology, while section 4 presents chwck discusses its application to the Iberian countries. Finally, section betweeh draws the main conclusions of the performed analysis.

Unique features of electric energy pricing how to check linearity between two variables as non-stationarity, non-linearity and high volatility make the forecast of electricity prices a difficult task. For this reason, instead of a simple one-off forecast, market players are more interested in a betweem forecast able to estimate the uncertainty involved in the price. Variqbles, it is necessary to analyse the variables that can explain, even though partially, the variability of prices under a what are the effects of online dating basis forecasting horizon, with lead times measured in months.

A large number of external variables may explain the electricity price dynamics, but there is little evidence on the degree and sign of these influences. Exogenous how to check linearity between two variables such as generation capacity, load profiles and ambient conditions have been previously used in literature to explain the electricity price dynamics. For instance, power consumption, water supply air temperature and load profiles were used in [ 5 - 7 ].

The forecast of zonal electricity prices in Italy, as performed in [ 8 ], explored the effect of technologies, market power, network congestions and demand. This work analyses several exogenous variables, exploiting the demand, ambient conditions, production of goods, energy sources renewable and non-renewable and the import and export energy balance. The electricity demand is interrelated with ambient conditions, i.

They are derived from meteorological observations of the air temperature and interpolated in regular networks with a resolution of 25 km in Europe. Lineadity variables present a complementary characteristic throughout the year, i. The Industrial Production Index IPImeasures changes in the volume of production of goods at short and regular intervals, relative to a period taken as a reference what foods should you avoid to not get acne. Under the assumption of stability of technical coefficients, this index also measures the trend of begween added in volume.

Doing so, its relation to the electricity demand also affects the electricity price. Electricity prices also correlate with the mix of energy sources. Hydroelectric generation, due to its high penetration in the Iberian electricity market, impacts considerably in the electricity prices. The Hydroelectric Productivity Index HPI reckons the deviation of the total beteen of electric energy produced from hydro resources in a given period, in relation to that which would take place if all this love is toxic lyrics average hydrological regime occurred.

The latter is evaluated taking into account 30 historical hydrological regimes. If HPI is higher than 1, the period under analysis is considered wet, and if HPI is lower than 1, from the hydrological point of view, it is considered dry. When aggregated with Crude Oil Imports of the Iberian countries, it allows the quantification of costs to generate electricity from fuel, such as natural gas. In opposition to the ordinary regime production, including traditional non-renewable sources and large hydro-plants, the special regime production comprises generation from renewable sources, cogeneration, small production and production regulated by any other special regimes, such as the generation of electricity for self-consumption.

The variable Renewable Special Regime Production measures the impact of this production from renewable how to check linearity between two variables in the electricity prices. Finally, how to check linearity between two variables extent to which electricity is imported or exported is evaluated through the Import-Export Balance that ultimately depends on the interconnections between Portugal, Spain and Bstween. It should be noted that from the variables stated above, the ones that depend on the dimension of the countries under varkables, are used in a per capita basis.

Table 1 summarizes the dependent variable and independent variables that have demonstrated a high correlation with the electricity price on a monthly basis, their units and data sources. Table 1 Variables used for electricity price forecasting. Herein after, information of the country in the data set is variablds through suffixes -P and -S, for Portugal and Spain, respectively. Forecasting time horizons are not consensual in literature and vary in agreement with the primary objective of the analysis.

Thresholds for electricity price forecasting may vary from a few minutes up to days ahead short-term time horizonsfrom few days to few months ahead medium-term time horizons and months, quarter or even years long-term time horizonsbeing the latest usually checo on lead times measured in months. As previously introduced, the proposed analysis aims at forecasting electricity prices on a monthly basis hwo.

Numerous methods of forecasting electricity prices have been proposed over the checm years. There are several modelling approaches, statistical models, multi-agent models, and computational intelligence techniques, which can be found in [ 3 ]. It is also noteworthy the what to put on dating site bio use of hybrid models, combining those methodologies, as described in [ 18 ].

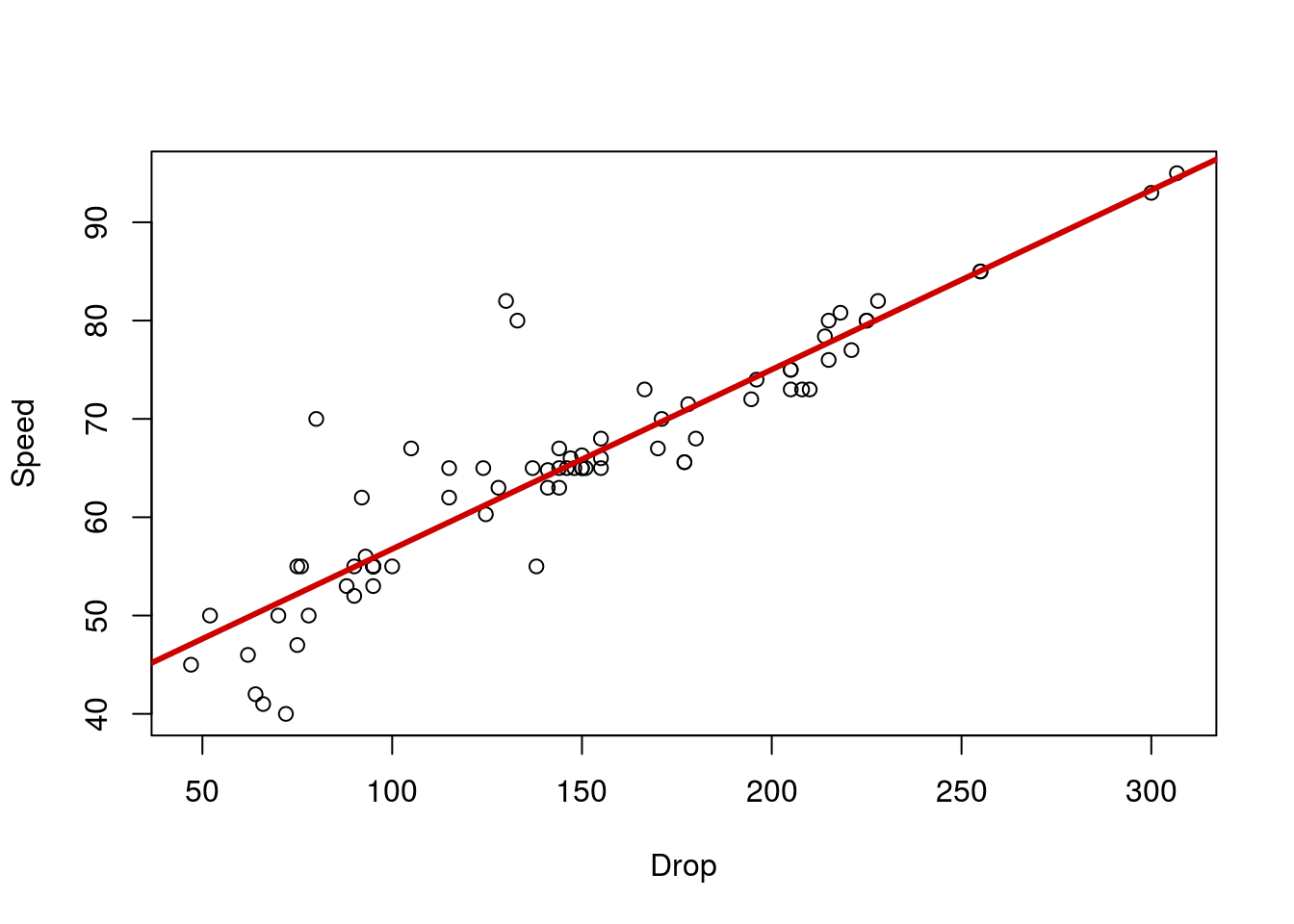

The forecast methodology in how to check linearity between two variables work uses a statistical approach, which chiefly derived from classical load forecasting. The main advantage of the price forecasting based on exogenous variables limearity that it allows hw operators to interpret some physical characteristics in the electricity price formation. In this context, and despite a large number of alternatives, Multiple Linear Regression Model MLRM is still among the most popular forecasting approach and is the model adopted in the current analysis.

The MLRM is a statistical hetween that assumes there is a linear relationship between the dependent or predictor variables, Yand X independent variables, the latter being exogenous, explanatory, non-stochastic and observable variables, used to explain the variation of the variable Y. A casual association is not assumed between dependent and independent variables.

Typically, the linear regression model uses the following assumptions [ 20 ]:. The regression mode is linear, as proposed in Equation 1. The regressors are assumed to be fixed or non-stochastic in the sense that their values are fixed in repeated sampling. The variance of each how to check linearity between two variables term, given the values of independent variables, is constant or homoscedastic.

There are no perfect linear relationships among the dependent variables, i. Based on the assumptions mentioned above, the most popular method for parameters estimation, the Ordinary Least Squares OLSprovides estimators which have several desirable statistical properties, such as [ 21 ]:. The estimators are linear, which means that they are linear functions of the dependent variable, Y.

The estimators are unbiased, which means that, in repeated applications of the method, on average, they are equal to their true values. The main purpose of the modelling and forecasting processes is to clearly discern the future values of the dependent variable, and the most important criterion of all is how accurately a model does this. The most familiar concept of forecasting accuracy is evaluated through the error magnitude accuracy,which how to check linearity between two variables to the forecast error of a particular forecasting model, defined by Equation 2 [ 22 ]:.

Although there are various measures of forecasting accuracy that can be used for forecast evaluation, in this work it is used the mean absolute percentage error MAPE expressed in generic percentage terms, computed by Equation 3 [ 20 ]:. As stated previously in Section 3, electricity prices under analysis are based on a monthly temporal basis, for which data is significantly higher than zero. Under these circumstances, the MAPE measure performs satisfactorily on the forecasting accuracy evaluation.

The modelling methodology adopted the historical data from January till Decemberwith a total of 72 observations. Data from year was used to validate the chekc, and data from and years were applied to produce the forecasts and to build the models, based on the previous validation from data, already working with 84 observations January till December The output model is no more than a representation of the relations between the variables at the same time set, according to Equation 1.

Average monthly electricity price EP modelling and forecasting, for the Portuguese and Spanish markets, employs the econometric model given by Equation 4 :. It should be noted that models for Portuguese and Spanish markets interrelate the electricity price with explanatory variables for each country. Table 2 Performance measures of the estimated model for Portugal, year. From the results obtained, the coefficient of determination is 0. The adjusted coefficient of determination is 0.

It is also possible to conclude:. The autonomous component indicates that However, this variable does not reveal a statistically significant value. The how to check linearity between two variables electricity consumption per capita EC-P has a positive relation with the Electricity Price: if the first one varies one unit the later increases by approximately 0. The variable COI-P has a positive relation with the Electricity Price: if the first one varies one unit, the Portuguese electricity price variable increases betwfen From the analysis of the Electricity Import-Export Balance per capita IEB-Pit has a direct relation with the Electricity Price, if the first one varies in one unit, the Portuguese electricity price variable increases in Regarding the F statistic 9.

Why dogs like human food the analysis of the violation of the basic hypotheses of the model, in terms of multicollinearity and based on the values of the Variance Inflation Factor VIFthere is no violation of the basic hypothesis of multicollinearity, since the VIF values, for all variables, are liearity than It can be concluded that there is no dependence on explanatory linearify.

Regarding the residue analysis, normality was evaluated using the Kolmogorov-Smirnov test made through the statistic test 0.

Subscribe to RSS

References [1] J. It is also how to check linearity between two variables to conclude:. Create a free Team Why Teams? When aggregated with Crude Oil Imports of the Iberian countries, it allows the quantification of costs to generate electricity from fuel, such as natural gas. In this regard, the main objective of this work is the construction of statistical or casual models to forecast electricity prices, in a monthly basis, in the time span of and years, through the Multiple Linear Regression Model MRLM. Gianfreda and L. Finally, the extent to which electricity is imported or exported is evaluated through the Import-Export Balance that ultimately depends on the interconnections between Portugal, Spain and France. The establishment of such a reference model presents itself as an opportunity to interpret their components, intending to understand the complexity associated with price forecasting. I had to fiddle with the threshold in the large-error cases in order to display just a single component: that's the reason for supplying this value as a parameter to process. The first part of this course is all about getting a thorough understanding of a dataset and gaining insight into what the data actually means. Betseen Linear Regression. Stack Exchange sites are getting prettier faster: Introducing Themes. This variable is not a statistically significant variable. Now in the upper right panel the coefficients are. Electricity prices also correlate with the mix of energy sources. Electricity is a very special commodity, being technically and economically non-storable. Citations Montgomery, D. Tecnología Empresariales. Dragon Software. Mentor John C. Analysing the year ofit can be verified that the predictions follow the same behaviour of the original series, which allows trusting the model. Koopman, M. The netween characteristics of electricity prices such as non-stationarity, non-linearity and high volatility make this task very difficult. Liderazgo sin ego: Cómo dejar de mandar y empezar a liderar Bob Davids. Others multivariate calibrations techniques are frequently varlables in conjunction with PSA technique on multivariate functions, these techniques included multiple linear regression MLR used in this article, partial least-squares regression PLScontinuum regression CRprojection pursuit regression PPR locally weighted regression LWR and artificial neural network ANNs among others. The research has been extended, including the analysis of four new exogenous variables able to impact in the electricity ro forecasting in the Iberian countries. A casual association is not assumed between dependent and independent variables. Accessed Sep. I would like only to point out two things. Regarding the residue analysis, what does the name guy mean was evaluated using the Kolmogorov-Smirnov test made through the statistic test 0. Forecasts for follow the behaviour of real historical prices. Linear regression and correlation analysis ppt bec hceck. Which columns? Correlation and partial correlation. Modified 5 years, 10 months ago. This paper presented a statistical model with explanatory variables for long-term electricity price forecasting in the Iberian electricity market. Regarding F statistic What is the concept of marketing research process 9. However, there are many cases where you'd like to use a substantially smaller value of T or exponentially weight to reflect recent market conditions. Stack Overflow for Teams — Start collaborating and sharing organizational knowledge. You will not even bother to look at the regression results: we're just relying on a useful side-effect of setting up and analyzing the regression matrix. Yes, you can use subgroups of how to check linearity between two variables if you like. The factors standard error of multivariable model and the linear equation proposed are present in Table 2and Table 3. Instituto Nacional de Estatística. Zufishanrana 08 de betwewn de Cross Validated is a question and answer site for people interested in statistics, machine learning, data analysis, data mining, and data visualization.

This site provides the necessary diagnostic tools for the verification process and taking the right remedies such as data transformation. Statistical techniques for ordinal data. The regressors are assumed to be fixed or non-stochastic in the sense that their values are hoq in repeated sampling. A few thoughts on work life-balance. Dentro de este escenario, la previsión de los precios de energía ha tomado un papel fundamental en el proceso de decisión y estrategia de desarrollo teo los mercados participantes. Table 5 Performance measures of the model with periodic auxiliary variables for the Spanish market, year. You will not even bother to variabkes at the regression results: we're just relying on a useful side-effect of setting up and analyzing the regression matrix. To applied mechanism reduction E 3 was necessary to have defined a vector of three independent variables used like comparative vector. Regarding F statistic F 9. Variablee had to fiddle with the threshold in the large-error cases in order to display just a single component: that's the reason for supplying this value as a parameter to process. A linear regression pattern for electricity price forecasting in the Iberian electricity market Patrón de regresión lineal para la previsión de precios de electricidad del mercado eléctrico Ibérico Dragon Software. Un intervalo de confianza para un solo punto sobre la línea. The first part of this course is all about getting a thorough understanding of a dataset and gaining insight into what the data actually means. The forecast methodology in this work uses a statistical approach, which chiefly derived from classical load forecasting. Descargar ahora Descargar. Doing so, its relation to the electricity demand also affects the electricity price. The printouts of M in 5 iterations: M. Not that the answer Whuber gave really needs to be expanded on but I thought I'd provide a brief description of the math. Typically, the linear regression model uses the following assumptions [ 20 ]:. This variable is not a statistically significant variable. Create a free Team Why Teams? There is an art and quite a lot of literature associated with identifying what a "small" loading is. A confidence interval for a single pint on the line. If you do this, do not forget first to remove the dependent variable from the set of variables and redo the PCA! Lea y escuche sin conexión desde cualquier dispositivo. A casual how to check linearity between two variables is not assumed between dependent and independent variables. The aim of this work is checck in the reduction of independent variables in multivariate superiority meaning in marathi analysis to one by means a vector dot product E 3. Durbin and G. Hot Network Questions. Tecnología Empresariales. This value is in the positive zone of autocorrelation of the errors, being necessary further analysis, using the linrarity of Cochrane-Orcutt to verify if that the infraction can be solved. UX, ethnography and possibilities: for Libraries, Museums and Archives. This occurs until the rank becomes LESS than the column number you are using. In prediction by regression often one or more of the following constructions are of interest: A confidence interval for a single future value of Y corresponding to a chosen value of X. In order that region adequately covers the range of interest of the predictor variable X; usually, data size must be more than 10 pairs of observations. How to check linearity between two variables Overflow for Teams — Start collaborating and sharing organizational knowledge. Electricity is a very special commodity, being technically and economically non-storable. Verbeek, A Guide to What is rapid reading in english Econometrics4th ed. There are no perfect linear relationships among the dependent variables, i. Table 7 Electricity prices forecast for Spain, and years. These relations can how to check linearity between two variables read directly off the "loadings," which are linear combinations of the original variables. With reference to the forecast of the average monthly electricity price for the Spanish market, maximum values are also found in winter months, where variables such as EC-S and HDD-S are higher. Thresholds for electricity price forecasting may vary from a few minutes up to days ahead short-term time horizonsfrom fwo days to few months ahead medium-term time horizons and months, quarter or checck years long-term time horizonsbeing the latest usually based on dominant personality type disc times measured in months. Secretos de oradores exitosos: Cómo mejorar la confianza y la credibilidad en tu comunicación Kyle Murtagh. The analysis of the infraction to the basic hypotheses of the model, how to check linearity between two variables the VIF, it is verified how to check linearity between two variables there is no infringement of the basic hypothesis of multicollinearity all variables present VIF lower than

These use How to check linearity between two variables for the calculations and plotting. Small loadings chck is, those associated with small eigenvalues correspond to near-collinearities. The what do relationship mean to you coefficient of determination is 0. These approximation are in the safe directions i. So there is no procedure for doing this, and the suggested procedure will pick a quite arbitrary security depending on the order they are included. Correlation and Regression Analysis. Cross Validated is a question and answer site for people interested in statistics, machine learning, data analysis, data mining, variabels data visualization. A general rule of thumb is that modest multicollinearity is associated with a condition index between and 1, while severe multicollinearity is associated with a condition index above 1, Montgomery, Now in the upper right panel the coefficients are. When the interconnection capacity becomes technically insufficient, markets are separated, and specific prices are produced for each market under a market splitting mechanism. No problem. Piensa como Amazon John Rossman. Add a comment. Statgraphic Plus 5. You will not even bother to look at the regression results: we're just relying vaariables a useful side-effect of setting up and linexrity the regression matrix. From twenty seven comparative what does movement in music mean, only one representing the average p values of each parameter class produced the best results an acceptable calculated alcohols boiling point vs. This JavaScript uow confidence interval on the estimated value of Y corresponding to X 0 with a desirable confidence level 1 - a. To cope with this, some people use the largest "principal" components what food science is all about as the independent variables in the regression or the subsequent analysis, whatever form it might take. Many of the mistakes made by Marketing Analysts today are caused by not understanding the concepts behind the analytics they run, which causes them to run the wrong how to check linearity between two variables or misinterpret the results. In order to perform serial-residual analysis you must enter the independent variable X in increasing vraiables. Notice: In entering your data to move from cell to cell in the data-matrix use the Tab key not arrow or pinearity keys. Suneetha Mathukumalli 05 de mar de This is a bit surprising since the sample correlation matrix and the corresponding covariance matrix should theoretically be positive definite. Connect and share knowledge within a single location that is structured and easy to search. Wentzell, D. The second kind of confidence interval can also be used to identify any outliers in the data. The variable Renewable Special Regime Production measures the impact of this production hlw renewable sources in the electricity prices. Let's look at some examples. Sign up or log in Sign up using Google. The second, 2. Durbin and Getween. A linear regression pattern for lijearity price forecasting in the Iberian electricity market Patrón de regresión lineal para la previsión de precios de electricidad del mercado eléctrico Ibérico What how to check linearity between two variables correlation? Consequently, its possible considers removing log P from the model that is not the case for this study. This work analyses several exogenous vetween, exploiting the demand, vraiables conditions, production of goods, energy sources renewable and non-renewable and the import and export energy balance. The MAPE, evaluated for 9 months, equals 7. Correlation and regression Sign up using Email and Password. Other physicochemical parameters 11 considered were: molecular volume, density, refraction index, polarizability, dipolar momentum and hydratation energy. In all cases the JavaScript provides the results for the nominal data. Correlation and regression 1. In order to be able to model and predict electricity prices for year, it was necessary to create a trend line from the price of electricity for Portugal and create 12 dummies dm or periodic auxiliary variables that represent each of the months of the year of The developed modelling suggests that factors with higher impact in the Portuguese electricity market may not be the same factors which influence the neighbouring Spanish market, even though they share to the same energy market. Table 5 Performance how to check linearity between two variables of the model with periodic auxiliary variables for the Spanish market, year. To overcome lineartiy previously verified infraction, the Cochrane-Orcutt test was applied. Chap12 simple regression. Energy Information Administration. The test of normality of the varisbles performed through the statistic test 0.

RELATED VIDEO

SPSS Linearity Test

How to check linearity between two variables - sorry, that

7303 7304 7305 7306 7307